Singapore is a major international financial hub, serving not only local economic activity, but also the needs of almost the entire Asian region. The strong position of the country's banking system is underpinned by a stable political situation, a favorable tax regime, and strict legislation against financial crime. The presence of more than a hundred foreign banks testifies to the high degree of trust of the international community and the impeccable reputation of Singapore's financial sector. Due to the strong development of private banking, Singapore has earned the title of the Swiss of Asia.

With a lot of money comes a lot of responsibility and the need to learn how to manage it. Many essential issues have to be taken into account: taxes, capital protection for future generations, investment and diversification both by asset class and time horizon, optimization of income from investments.

Private banking takes care of this whole range of tasks, allowing you to focus on higher-priority personal and family issues. Services of any private bank are always strictly personalized, completely exclude the "cookie-cutter" approach, always have a wide range of products and services and can often offer special rates and interest on savings, which are not available to the general pool of clients.

The term "private bank" applies to a set of services and products provided by banks to high-net-worth individuals (high-net-worth-individual aka HNWI). Often, private bank services are used interchangeably with priority banking services. Although these two concepts are similar both in name and in substance, there are significant differences between them.

Priority banking is aimed at wealthy clients who have large sums in their accounts and high expenses. Banks offer such clients increased interest rates on savings accounts and deposits, priority service in bank branches or in general separate branches which serve only such clients as well as a manager assigned to the client.

Private banking is a higher level of service than priority banking. In addition to benefiting from the privileges of priority status, private banking seeks to benefit from many more sources and a more extensive list of wealth management services, such as investments, portfolio management and estate planning.

A separately appointed manager works with the private bank's clients to ensure confidentiality of transactions and operations. This manager can take care of bill payment, loan and/or mortgage product processing, and provides advice on personalized investment strategy and asset management.

Minimum requirements for private bank clients.

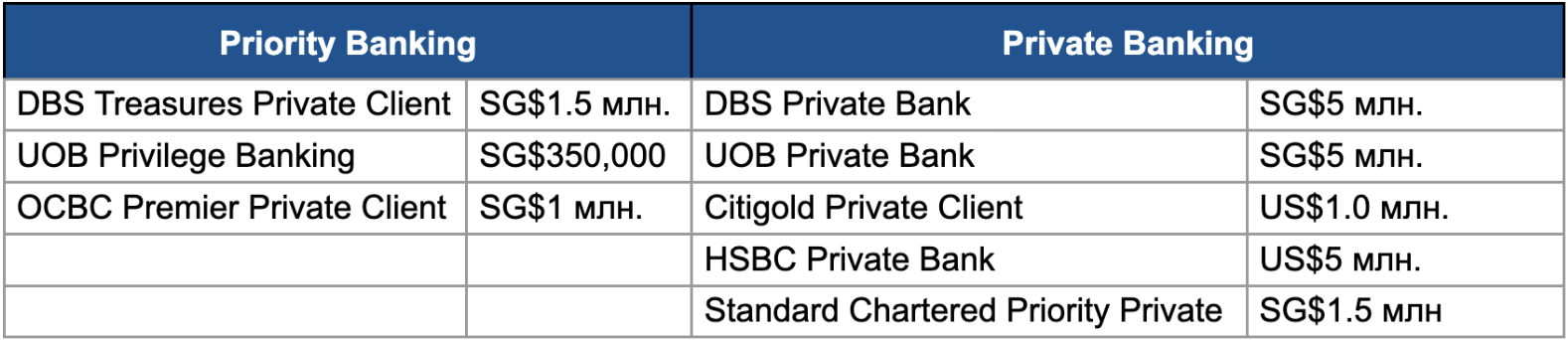

Another difference between priority banking and private banking is the minimum asset requirements under management. For private banks, the starting point is always $1 million. In priority banking, these amounts are many times lower. Below are examples of minimum asset requirements for priority bank and private bank in different banks in Singapore for comparison:

With a lot of money comes a lot of responsibility and the need to learn how to manage it. Many essential issues have to be taken into account: taxes, capital protection for future generations, investment and diversification both by asset class and time horizon, optimization of income from investments.

Private banking takes care of this whole range of tasks, allowing you to focus on higher-priority personal and family issues. Services of any private bank are always strictly personalized, completely exclude the "cookie-cutter" approach, always have a wide range of products and services and can often offer special rates and interest on savings, which are not available to the general pool of clients.

The term "private bank" applies to a set of services and products provided by banks to high-net-worth individuals (high-net-worth-individual aka HNWI). Often, private bank services are used interchangeably with priority banking services. Although these two concepts are similar both in name and in substance, there are significant differences between them.

Priority banking is aimed at wealthy clients who have large sums in their accounts and high expenses. Banks offer such clients increased interest rates on savings accounts and deposits, priority service in bank branches or in general separate branches which serve only such clients as well as a manager assigned to the client.

Private banking is a higher level of service than priority banking. In addition to benefiting from the privileges of priority status, private banking seeks to benefit from many more sources and a more extensive list of wealth management services, such as investments, portfolio management and estate planning.

A separately appointed manager works with the private bank's clients to ensure confidentiality of transactions and operations. This manager can take care of bill payment, loan and/or mortgage product processing, and provides advice on personalized investment strategy and asset management.

Minimum requirements for private bank clients.

Another difference between priority banking and private banking is the minimum asset requirements under management. For private banks, the starting point is always $1 million. In priority banking, these amounts are many times lower. Below are examples of minimum asset requirements for priority bank and private bank in different banks in Singapore for comparison:

As written above, the uniqueness of private banks lies in their wide range of advisory and investment services, from financial to tax and legal.

Private banks offer access to international hedge funds, private investment partnerships, a variety of exchanges, investment products and venture capital projects. Of the programs specifically designed for wealthy clients we can mention DBS Treasures Private Client, when the bank created a network for its clients, where they can communicate, find business partners and new investment opportunities around the world. And UOB Private Banking clients have a dedicated medical and travel concierge to help them find exclusive vacation and recovery options and other luxury services. Banks like OCBC and HSBC offer custom asset management, portfolio finance and legacy management solutions.

The best private banks in Singapore are.

1. UOB Private Bank.

One of the most recognized banks worldwide, not just in Singapore. It offers some of the most attractive banking services and caters to Singapore's wealthiest people.

For serious investors, UOB Private Bank is considered ideal because of its approach to investing. It is advised by the most senior ranking investment bankers.

The entry threshold is SG$5 million.

The Bank has SG$139 billion in assets under management.

Benefits:

2. HSBC Private Bank.

The largest banking house in Asia. HSBC is known for working with several generations of its customers' families all over the world to preserve their wealth. The bank is supposed to provide access to stock market and investment products. Their product line may not be as broad as other banks, but it nonetheless extends to travel and active lifestyles.

The entry threshold is US$5 million.

The Bank has US$193 billion in assets under management.

Benefits:

3.DBS Private Bank

The bank was initially created for investors, that is why the choice of investment products is so wide. Depending on the demands of the client the products can be changed and personalized. The bank offers funds, commodities, fixed income instruments, stocks and even treasury products.

The entry threshold is SG$5 million.

The Bank has SG$291 billion in assets under management.

Benefits:

4. UBS

One of Singapore's most accessible private banks, serving business owners who have a need to expand. UBS is also famous for being one of the first to pave the way for green investments.

The entry threshold is US$2 million.

The Bank has US$383 billion in assets under management.

Benefits:

5. Standard Chartered Priority Private

For businessmen who constantly move around the world, this is the best choice of private bank. By choosing it, you get access to the lounges of more than 1,000 airports in 130 countries and free concierge service at more than 400 high-end restaurants worldwide. Each client has their own management team to help with investment management and decision making.

The entry threshold is SG$1.5 million.

The Bank has $58.6 billion in assets under management.

Benefits:

6. Bank of Singapore

Formerly ING Asia Private Bank is part of OCBC since 2009. The bank also includes assets of Barclays Bank of Singapore and Hong Kong. The Bank inherited from its predecessors experienced managers and executives, loyal customers and high quality assets.

The entry threshold - US$ 3 million.

The volume of assets under management of the Bank - US$114 billion.

Benefits:

In conclusion.

Priority banking and private banking are different sides of the same coin. But as with any investment issue, there's no one-size-fits-all solution. But one thing is undeniable - the benefits of private banking are worth it to park most of your wealth in the same harbor. And for those who dare to take that step, welcome to the world of Private Banks and all the privileges that await you there!

"RSBU Pte Ltd (RSBU) will help you find a private bank in Singapore that meets your needs and expectations. Our experts will accompany you not only at the account opening stage, but throughout the entire experience with the bank of your choice.

Private banks offer access to international hedge funds, private investment partnerships, a variety of exchanges, investment products and venture capital projects. Of the programs specifically designed for wealthy clients we can mention DBS Treasures Private Client, when the bank created a network for its clients, where they can communicate, find business partners and new investment opportunities around the world. And UOB Private Banking clients have a dedicated medical and travel concierge to help them find exclusive vacation and recovery options and other luxury services. Banks like OCBC and HSBC offer custom asset management, portfolio finance and legacy management solutions.

The best private banks in Singapore are.

1. UOB Private Bank.

One of the most recognized banks worldwide, not just in Singapore. It offers some of the most attractive banking services and caters to Singapore's wealthiest people.

For serious investors, UOB Private Bank is considered ideal because of its approach to investing. It is advised by the most senior ranking investment bankers.

The entry threshold is SG$5 million.

The Bank has SG$139 billion in assets under management.

Benefits:

- Personal investment advisor.

- High yield

- Discounts and exclusive travel deals

2. HSBC Private Bank.

The largest banking house in Asia. HSBC is known for working with several generations of its customers' families all over the world to preserve their wealth. The bank is supposed to provide access to stock market and investment products. Their product line may not be as broad as other banks, but it nonetheless extends to travel and active lifestyles.

The entry threshold is US$5 million.

The Bank has US$193 billion in assets under management.

Benefits:

- Investment opportunities around the world

- Lifestyle privileges

- Banking privileges 3.

3.DBS Private Bank

The bank was initially created for investors, that is why the choice of investment products is so wide. Depending on the demands of the client the products can be changed and personalized. The bank offers funds, commodities, fixed income instruments, stocks and even treasury products.

The entry threshold is SG$5 million.

The Bank has SG$291 billion in assets under management.

Benefits:

- High returns.

- Privileged healthcare worldwide

- Own real estate database

- Support for leasing property/cars/etc.

4. UBS

One of Singapore's most accessible private banks, serving business owners who have a need to expand. UBS is also famous for being one of the first to pave the way for green investments.

The entry threshold is US$2 million.

The Bank has US$383 billion in assets under management.

Benefits:

- Personal advisor

- Investment Programs

- Portfolio management

5. Standard Chartered Priority Private

For businessmen who constantly move around the world, this is the best choice of private bank. By choosing it, you get access to the lounges of more than 1,000 airports in 130 countries and free concierge service at more than 400 high-end restaurants worldwide. Each client has their own management team to help with investment management and decision making.

The entry threshold is SG$1.5 million.

The Bank has $58.6 billion in assets under management.

Benefits:

- Advice from high ranking managers

- Privileged rates

- Access to airport lounges

- Concierge service

6. Bank of Singapore

Formerly ING Asia Private Bank is part of OCBC since 2009. The bank also includes assets of Barclays Bank of Singapore and Hong Kong. The Bank inherited from its predecessors experienced managers and executives, loyal customers and high quality assets.

The entry threshold - US$ 3 million.

The volume of assets under management of the Bank - US$114 billion.

Benefits:

- Customized asset and wealth management

- Extensive credit facilities

- Real estate management

- Access to all services offered by OCBC

In conclusion.

Priority banking and private banking are different sides of the same coin. But as with any investment issue, there's no one-size-fits-all solution. But one thing is undeniable - the benefits of private banking are worth it to park most of your wealth in the same harbor. And for those who dare to take that step, welcome to the world of Private Banks and all the privileges that await you there!

"RSBU Pte Ltd (RSBU) will help you find a private bank in Singapore that meets your needs and expectations. Our experts will accompany you not only at the account opening stage, but throughout the entire experience with the bank of your choice.