Singapore’s Growth Driven by Tech

The positive outlook is broad-based, with most clusters expecting improved business conditions in the first half of 2025. Within the manufacturing sector, the electronics cluster is the most optimistic, with a net weighted balance of 25 per cent of firms (Singapore Economic Development Board, 2025) predicting a better business environment in the next six months ending June 2025 compared to the fourth quarter of 2024. This optimism is largely driven by the semiconductors segment which anticipates robust growth in artificial intelligence (AI) applications to continue supporting chip demand, despite uncertainties surrounding US trade policy.

Singapore is set to achieve a projected economic growth rate of 2.8 per cent in 2025, in line with our estimated medium-term growth potential of 2 to 3 per cent. The DBS Bank economists forecast is underpinned by resilient external demand, at least in early 2025, driven by sectors like electronics, trade-related services, finance and information and communications technology (ICT).

A recent survey (Singapore Economic Development Board, 2025) indicates that a net weighted balance of 16% of manufacturers foresee improved business conditions in the first half of 2025 compared to the fourth quarter of 2024. This optimism is broad-based, with significant confidence observed in the electronics and transport engineering clusters.

The manufacturing sector, especially electronics, remains a key growth driver. Singapore’s strategic role in the global semiconductor supply chain positions it to benefit from rising demand for artificial intelligence (AI) technologies and consumer electronics. Global semiconductor sales are expected to grow by 11.2% in 2025, supporting Singapore’s electronics output and exports.

Johor-Singapore SEZ: Boosting Regional Growth

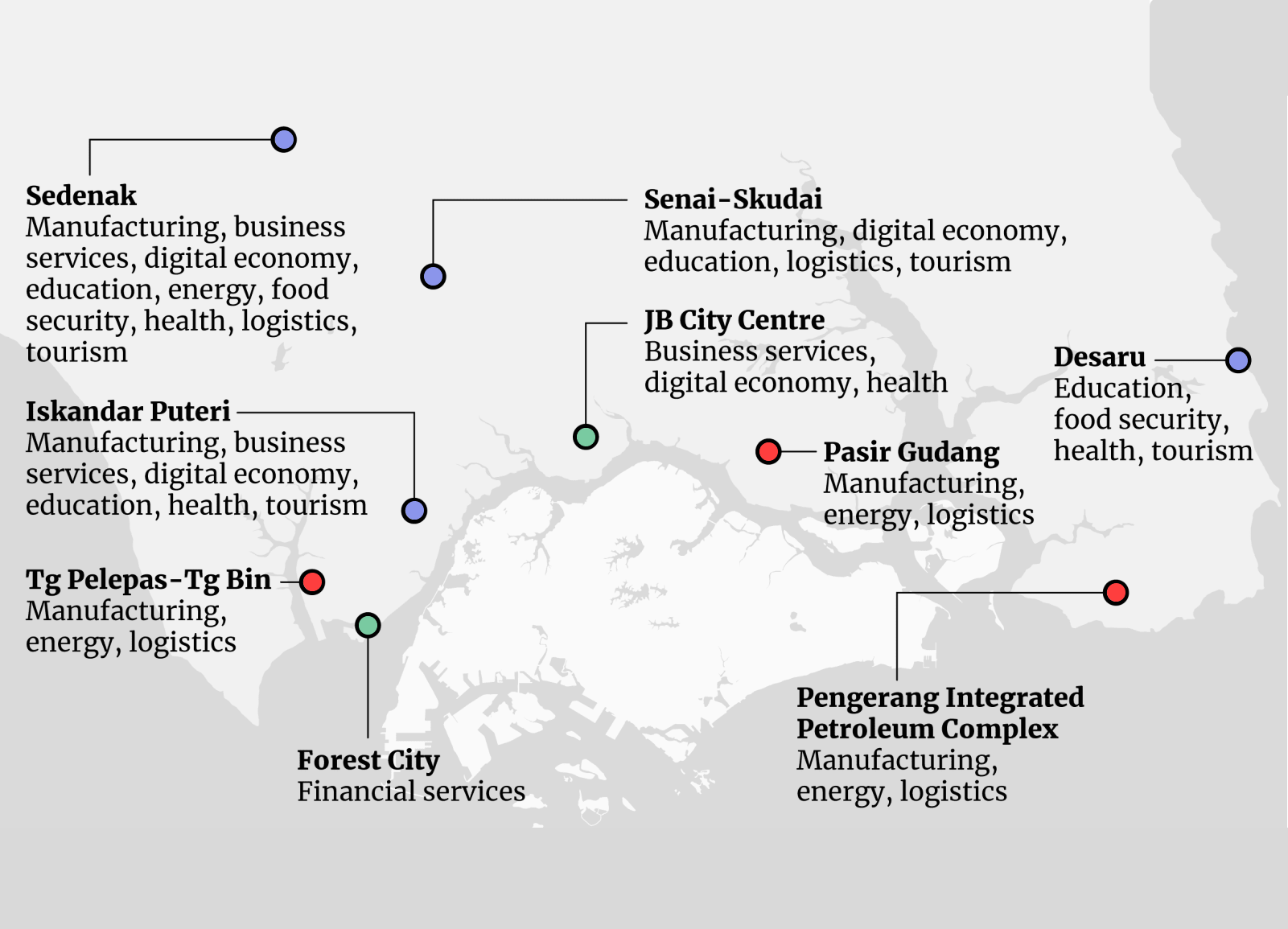

In January 2025, Malaysia and Singapore formalized the establishment of the Johor-Singapore Special Economic Zone (JS-SEZ) through a signed agreement. This initiative aims to attract high-value investments and facilitate the movement of goods and people between the two nations. The JS-SEZ is projected to contribute approximately US$28 billion annually to Malaysia’s gross domestic product over the next decade. Key sectors targeted for development include manufacturing, tourism, renewable energy, and logistics. The governments of both countries are committed to addressing challenges related to manpower, cross-border movement, and ease of doing business to ensure the SEZ’s success.

The Johor-Singapore Special Economic Zone (JS-SEZ) represents a significant opportunity to deepen regional collaboration and economic integration. Covering 3,571 sq km in southern Johor, the zone promises to combine Singapore’s strengths as a business and financial hub with Johor’s abundant land, labour and energy resources.

Industries such as data centres, electronics, renewable energy and tourism stand to benefit from this collaboration. Improved connectivity, particularly through the Johor Bahru-Singapore Rapid Transit System Link, which is expected to be ready by end-2026, will facilitate smoother movement of goods and people, further bolstering trade and investment.

Complementing the JS-SEZ’s internal infrastructure with broader development across Johor will be crucial. For example, while the 4km Johor-Singapore Rapid Transit System (RTS) is expected to become operational by end-2026, additional road, bus and rail connectivity to the RTS and more broadly, within the state of Johor will help improve prospects for the JS-SEZ.

The positive outlook is broad-based, with most clusters expecting improved business conditions in the first half of 2025. Within the manufacturing sector, the electronics cluster is the most optimistic, with a net weighted balance of 25 per cent of firms (Singapore Economic Development Board, 2025) predicting a better business environment in the next six months ending June 2025 compared to the fourth quarter of 2024. This optimism is largely driven by the semiconductors segment which anticipates robust growth in artificial intelligence (AI) applications to continue supporting chip demand, despite uncertainties surrounding US trade policy.

Singapore is set to achieve a projected economic growth rate of 2.8 per cent in 2025, in line with our estimated medium-term growth potential of 2 to 3 per cent. The DBS Bank economists forecast is underpinned by resilient external demand, at least in early 2025, driven by sectors like electronics, trade-related services, finance and information and communications technology (ICT).

A recent survey (Singapore Economic Development Board, 2025) indicates that a net weighted balance of 16% of manufacturers foresee improved business conditions in the first half of 2025 compared to the fourth quarter of 2024. This optimism is broad-based, with significant confidence observed in the electronics and transport engineering clusters.

The manufacturing sector, especially electronics, remains a key growth driver. Singapore’s strategic role in the global semiconductor supply chain positions it to benefit from rising demand for artificial intelligence (AI) technologies and consumer electronics. Global semiconductor sales are expected to grow by 11.2% in 2025, supporting Singapore’s electronics output and exports.

Johor-Singapore SEZ: Boosting Regional Growth

In January 2025, Malaysia and Singapore formalized the establishment of the Johor-Singapore Special Economic Zone (JS-SEZ) through a signed agreement. This initiative aims to attract high-value investments and facilitate the movement of goods and people between the two nations. The JS-SEZ is projected to contribute approximately US$28 billion annually to Malaysia’s gross domestic product over the next decade. Key sectors targeted for development include manufacturing, tourism, renewable energy, and logistics. The governments of both countries are committed to addressing challenges related to manpower, cross-border movement, and ease of doing business to ensure the SEZ’s success.

The Johor-Singapore Special Economic Zone (JS-SEZ) represents a significant opportunity to deepen regional collaboration and economic integration. Covering 3,571 sq km in southern Johor, the zone promises to combine Singapore’s strengths as a business and financial hub with Johor’s abundant land, labour and energy resources.

Industries such as data centres, electronics, renewable energy and tourism stand to benefit from this collaboration. Improved connectivity, particularly through the Johor Bahru-Singapore Rapid Transit System Link, which is expected to be ready by end-2026, will facilitate smoother movement of goods and people, further bolstering trade and investment.

Complementing the JS-SEZ’s internal infrastructure with broader development across Johor will be crucial. For example, while the 4km Johor-Singapore Rapid Transit System (RTS) is expected to become operational by end-2026, additional road, bus and rail connectivity to the RTS and more broadly, within the state of Johor will help improve prospects for the JS-SEZ.

Singapore Dollar Maintains Stability Amid Economic Shifts

The MAS is expected to maintain a vigilant approach to its exchange rate policy, and the next easing might be in the second half of 2025, after having loosened it in its January 2025 review.

The central bank slightly reduced the appreciation pace of the Singapore Dollar Nominal Effective Exchange Rate (S$NEER) policy band during its January 2025 review. The MAS forecasts core inflation to decline to 1 to 2 per cent in 2025, from 2.7 per cent in 2024, providing room for policy adjustment. Concurrently, growth uncertainties have risen due to possible shifts in global trade policies.

The Singdollar’s modest and gradual appreciation policy stance, coupled with Singapore’s robust economic fundamentals, ensures it remains a resilient currency amid global volatility. The central bank will monitor external factors, including US policies and global economic developments, which could influence its policy decisions.

Green Economy & Sustainability Investments

Singapore is strengthening its position as a regional leader in sustainability and the green economy. The government has set ambitious targets under the Singapore Green Plan 2030, focusing on clean energy, green finance, and carbon neutrality. Investments in renewable energy sources, such as solar power and hydrogen, are expanding, with Singapore aiming to increase its solar capacity to at least 2 gigawatt-peak (GWp) by 2030.

Green finance is also a key driver, with Singapore emerging as Asia’s top sustainable finance hub. The Monetary Authority of Singapore (MAS) is actively promoting green bonds and sustainability-linked loans, with over S$50 billion in green and sustainable bonds issued as of 2024. The city-state’s carbon exchange, Climate Impact X (CIX), is gaining traction as a key platform for global carbon credit trading.

Infrastructure and mobility are evolving with sustainability in mind. The government is investing in electric vehicle (EV) adoption, expanding charging infrastructure, and supporting green building initiatives. By 2030, Singapore aims to phase out internal combustion engine vehicles, accelerating the transition to cleaner transportation.

Access to high-quality Article 6 carbon credits is one of the viable decarbonisation pathways for companies, especially those in hard-to-abate sectors. Singapore takes a multi-pronged approach to drive the development of these carbon credits to help companies achieve their sustainability goals.

Earlier this year, Singapore introduced the invitation-only Singapore Carbon Market Alliance to connect prospective buyers in Singapore with leading international sellers and developers of high-quality Article 6 carbon credits.

Singapore’s strong policy framework and public-private partnerships position it as a leader in sustainable development, attracting global companies looking to align with ESG (Environmental, Social, and Governance) goals.

Trade and Logistics: Strengthening Singapore’s Global Hub Status

Singapore continues to solidify its position as a global trade and logistics hub, leveraging its strategic location and world-class infrastructure. The expansion of Tuas Port, set to be fully operational by 2040, will make it the world’s largest fully automated port, increasing cargo capacity and enhancing global supply chain resilience.

The aviation sector is also experiencing strong recovery, with Changi Airport’s Terminal 5 expected to be completed in the 2030s, reinforcing Singapore’s role as a major air transit hub. Additionally, the government’s investments in digital trade infrastructure, such as TradeTrust and the Networked Trade Platform (NTP), streamline cross-border transactions, boosting efficiency for businesses engaged in international trade.

With increasing global demand for efficient supply chain solutions, Singapore’s continued investment in logistics, digital trade, and transport infrastructure ensures its competitiveness in the evolving global economy.

Singapore: A Leading Global Hub for Family Offices and Investment Capital

Singapore is cementing its status as a premier destination for family offices and global investment capital, driven by its robust regulatory environment, economic stability, and investor-friendly policies. With over 1,650 single-family offices (SFOs) established by the end of 2024, the city-state continues to attract ultra-high-net-worth individuals (UHNWIs) seeking wealth preservation, asset diversification, and legacy planning.

Government incentives, including tax exemptions under the 13O and 13U schemes, alongside initiatives such as the Family Office Development Programme (FODP), are further strengthening Singapore’s position. Additionally, the Monetary Authority of Singapore (MAS) is actively fostering a sustainable investment ecosystem, encouraging family offices to align their portfolios with ESG (Environmental, Social, and Governance) goals.

Beyond family offices, private equity, venture capital, and sovereign wealth funds are increasingly choosing Singapore as a regional headquarters, leveraging its strategic location in Asia, financial expertise, and strong network of nearly 100 Double Taxation Agreements (DTAs). The city-state’s progressive stance on digital assets and sustainable finance further enhances its attractiveness as a leading global investment hub.

NB! The information provided in this article is for general informational purposes only and does not constitute legal advice. While we strive to ensure the content is accurate and up-to-date, it should not be relied upon as a substitute for professional consultation. For personalized advice or assistance with legal matters, please contact our specialists directly.

The MAS is expected to maintain a vigilant approach to its exchange rate policy, and the next easing might be in the second half of 2025, after having loosened it in its January 2025 review.

The central bank slightly reduced the appreciation pace of the Singapore Dollar Nominal Effective Exchange Rate (S$NEER) policy band during its January 2025 review. The MAS forecasts core inflation to decline to 1 to 2 per cent in 2025, from 2.7 per cent in 2024, providing room for policy adjustment. Concurrently, growth uncertainties have risen due to possible shifts in global trade policies.

The Singdollar’s modest and gradual appreciation policy stance, coupled with Singapore’s robust economic fundamentals, ensures it remains a resilient currency amid global volatility. The central bank will monitor external factors, including US policies and global economic developments, which could influence its policy decisions.

Green Economy & Sustainability Investments

Singapore is strengthening its position as a regional leader in sustainability and the green economy. The government has set ambitious targets under the Singapore Green Plan 2030, focusing on clean energy, green finance, and carbon neutrality. Investments in renewable energy sources, such as solar power and hydrogen, are expanding, with Singapore aiming to increase its solar capacity to at least 2 gigawatt-peak (GWp) by 2030.

Green finance is also a key driver, with Singapore emerging as Asia’s top sustainable finance hub. The Monetary Authority of Singapore (MAS) is actively promoting green bonds and sustainability-linked loans, with over S$50 billion in green and sustainable bonds issued as of 2024. The city-state’s carbon exchange, Climate Impact X (CIX), is gaining traction as a key platform for global carbon credit trading.

Infrastructure and mobility are evolving with sustainability in mind. The government is investing in electric vehicle (EV) adoption, expanding charging infrastructure, and supporting green building initiatives. By 2030, Singapore aims to phase out internal combustion engine vehicles, accelerating the transition to cleaner transportation.

Access to high-quality Article 6 carbon credits is one of the viable decarbonisation pathways for companies, especially those in hard-to-abate sectors. Singapore takes a multi-pronged approach to drive the development of these carbon credits to help companies achieve their sustainability goals.

Earlier this year, Singapore introduced the invitation-only Singapore Carbon Market Alliance to connect prospective buyers in Singapore with leading international sellers and developers of high-quality Article 6 carbon credits.

Singapore’s strong policy framework and public-private partnerships position it as a leader in sustainable development, attracting global companies looking to align with ESG (Environmental, Social, and Governance) goals.

Trade and Logistics: Strengthening Singapore’s Global Hub Status

Singapore continues to solidify its position as a global trade and logistics hub, leveraging its strategic location and world-class infrastructure. The expansion of Tuas Port, set to be fully operational by 2040, will make it the world’s largest fully automated port, increasing cargo capacity and enhancing global supply chain resilience.

The aviation sector is also experiencing strong recovery, with Changi Airport’s Terminal 5 expected to be completed in the 2030s, reinforcing Singapore’s role as a major air transit hub. Additionally, the government’s investments in digital trade infrastructure, such as TradeTrust and the Networked Trade Platform (NTP), streamline cross-border transactions, boosting efficiency for businesses engaged in international trade.

With increasing global demand for efficient supply chain solutions, Singapore’s continued investment in logistics, digital trade, and transport infrastructure ensures its competitiveness in the evolving global economy.

Singapore: A Leading Global Hub for Family Offices and Investment Capital

Singapore is cementing its status as a premier destination for family offices and global investment capital, driven by its robust regulatory environment, economic stability, and investor-friendly policies. With over 1,650 single-family offices (SFOs) established by the end of 2024, the city-state continues to attract ultra-high-net-worth individuals (UHNWIs) seeking wealth preservation, asset diversification, and legacy planning.

Government incentives, including tax exemptions under the 13O and 13U schemes, alongside initiatives such as the Family Office Development Programme (FODP), are further strengthening Singapore’s position. Additionally, the Monetary Authority of Singapore (MAS) is actively fostering a sustainable investment ecosystem, encouraging family offices to align their portfolios with ESG (Environmental, Social, and Governance) goals.

Beyond family offices, private equity, venture capital, and sovereign wealth funds are increasingly choosing Singapore as a regional headquarters, leveraging its strategic location in Asia, financial expertise, and strong network of nearly 100 Double Taxation Agreements (DTAs). The city-state’s progressive stance on digital assets and sustainable finance further enhances its attractiveness as a leading global investment hub.

NB! The information provided in this article is for general informational purposes only and does not constitute legal advice. While we strive to ensure the content is accurate and up-to-date, it should not be relied upon as a substitute for professional consultation. For personalized advice or assistance with legal matters, please contact our specialists directly.

How We Can Help

- Tax and Family Office Advisory: We offer consultations on Singapore’s tax incentives and family office structures, helping you leverage exemptions like the Section 13X and 13R schemes for tax-efficient wealth growth.

- Relocation and Residency Assistance: Our relocation specialists guide you through the Global Investor Program (GIP) application process, helping secure permanent residency for you and your family, along with support for educational and healthcare arrangements.

- Investment and Market Insights: We connect you with opportunities in Singapore’s high-growth sectors, from tech to biotech, and provide insights on investment strategies to maximize returns in Singapore’s favorable tax environment.

- Wealth Transfer and Estate Planning: We assist in establishing trusts and foundations, ensuring seamless intergenerational wealth transfer without estate taxes, safeguarding your legacy.