The Asia-Pacific region is experiencing a significant rise in family offices. This growth is fueled by several fundamental economic factors. Firstly, the region has become a global hub for wealth creation, driven by rapid economic expansion in countries like China, India, and Southeast Asia. Secondly, ultra-high-net-worth individuals (UHNWIs) are increasingly looking for sophisticated structures to manage and preserve their wealth. Singapore, in particular, stands out as a preferred destination due to its stable political environment, robust legal framework, and attractive tax incentives for family offices. Read more about the advantages of Family offices in Singapore.

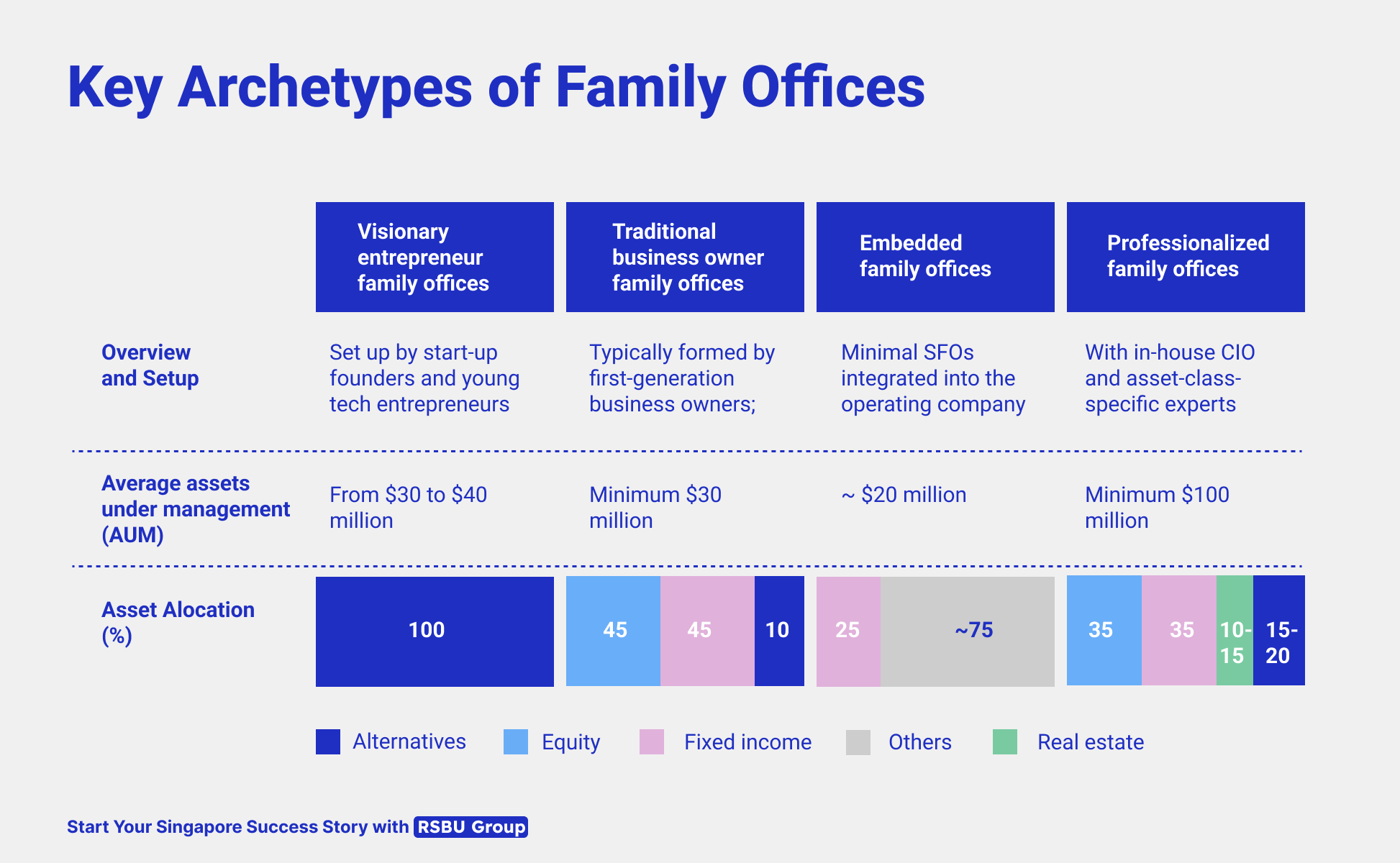

To begin, let’s understand the purpose of family offices and the opportunities they provide for wealthy and ultra-wealthy individuals. Global family offices can be categorized into four main archetypes, each with distinct needs and preferences. In summary, they are as follows:

Visionary Entrepreneur Family Offices: Created by tech entrepreneurs post-exit, these offices focus on high-risk, high-reward investments in start-ups, leveraging industry connections and service providers to find the next unicorn.

Traditional Business Owner Family Offices: Established by first-generation business owners, they prefer low-risk investments and rely on banks, MFOs, and informal advice over formalized strategies.

Embedded Family Offices: Integrated into existing businesses, these offices favor passive investments in sectors complementary to the core business, with capital managed by the operating company.

Professionalized Family Offices: Sophisticated setups with in-house CIOs, managing larger Assets under management (AUM) with clear strategies for wealth preservation (5–6% returns) or growth (up to 15%). They dominate in terms of AUM but face competition from emerging archetypes.

To begin, let’s understand the purpose of family offices and the opportunities they provide for wealthy and ultra-wealthy individuals. Global family offices can be categorized into four main archetypes, each with distinct needs and preferences. In summary, they are as follows:

Visionary Entrepreneur Family Offices: Created by tech entrepreneurs post-exit, these offices focus on high-risk, high-reward investments in start-ups, leveraging industry connections and service providers to find the next unicorn.

Traditional Business Owner Family Offices: Established by first-generation business owners, they prefer low-risk investments and rely on banks, MFOs, and informal advice over formalized strategies.

Embedded Family Offices: Integrated into existing businesses, these offices favor passive investments in sectors complementary to the core business, with capital managed by the operating company.

Professionalized Family Offices: Sophisticated setups with in-house CIOs, managing larger Assets under management (AUM) with clear strategies for wealth preservation (5–6% returns) or growth (up to 15%). They dominate in terms of AUM but face competition from emerging archetypes.

Key Differences Between SFO and MFO

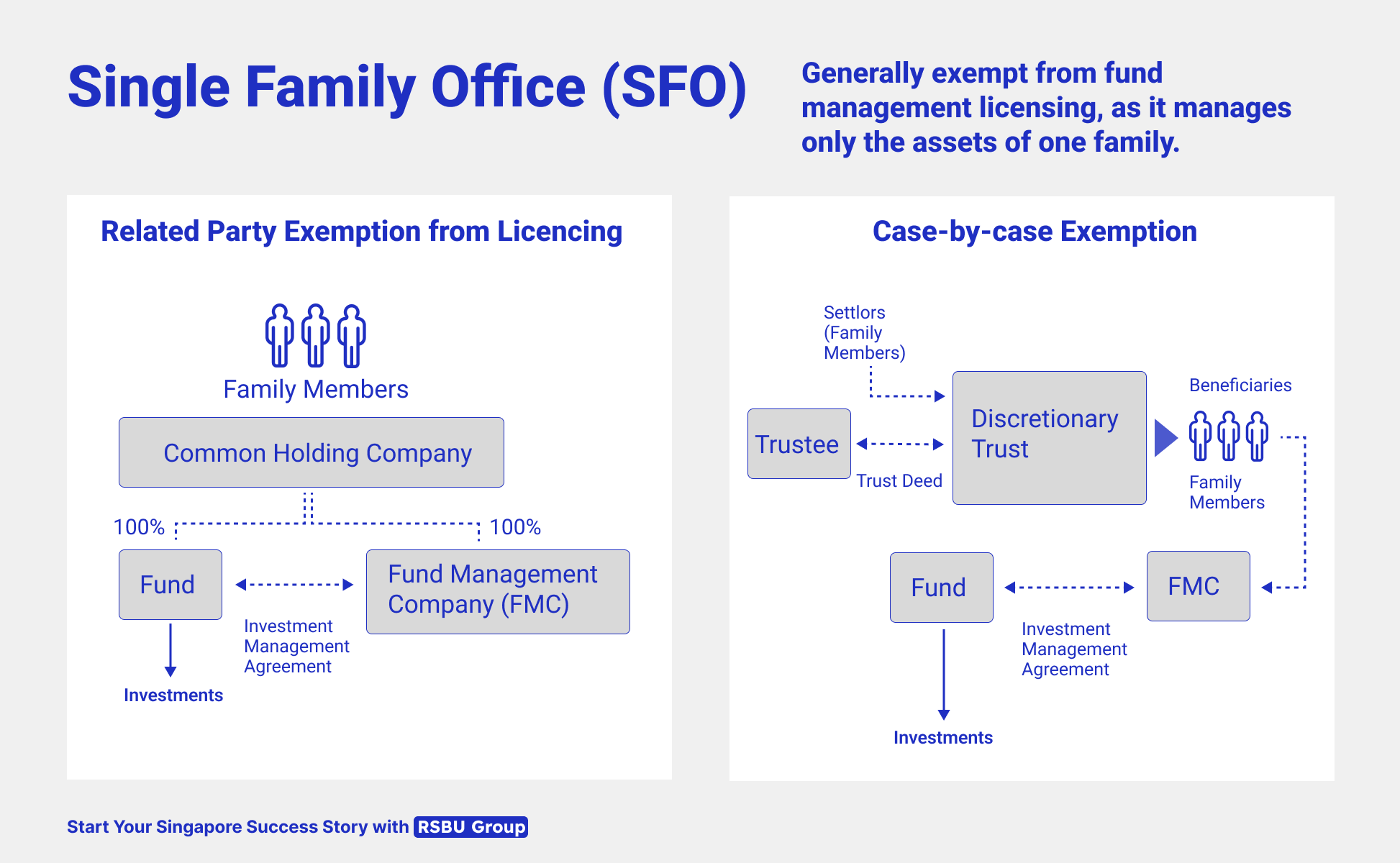

There are two main options for managing your wealth: Single Family Office (SFO) and Multi-Family Office (MFO). SFOs are tailored exclusively to one family’s needs, providing a highly customized approach to wealth and asset management. In contrast, MFOs serve multiple families, offering shared resources and a cost-effective solution for those seeking professional management without the high costs of running a dedicated office.

Capital Requirements

Licensing and Regulation

There are two main options for managing your wealth: Single Family Office (SFO) and Multi-Family Office (MFO). SFOs are tailored exclusively to one family’s needs, providing a highly customized approach to wealth and asset management. In contrast, MFOs serve multiple families, offering shared resources and a cost-effective solution for those seeking professional management without the high costs of running a dedicated office.

Capital Requirements

- SFO: Requires a significant amount of wealth (typically $30-50 million or more) to justify the operational costs, as it is customized for a single family’s needs.

- MFO: Designed for families with more modest wealth (starting from $5–10 million), as costs are shared among multiple clients. However, MFOs are typically large organizations managing substantial combined wealth, often reaching billions of dollars. While their shared-cost structure makes them advantageous for smaller fortunes, there are rare instances where families or groups of closely connected families create bespoke MFOs to manage their assets collectively.

Licensing and Regulation

- SFO: Generally exempt from fund management licensing, as it manages only the assets of one family (It is not MAS’ intention to license or regulate SFOs).

- MFO: Must obtain fund management licenses in jurisdictions like Singapore, as it manages assets for multiple families and operates as a professional service provider.

Scope of Services

Cost Efficiency

Singapore Tax & Incentive Schemes

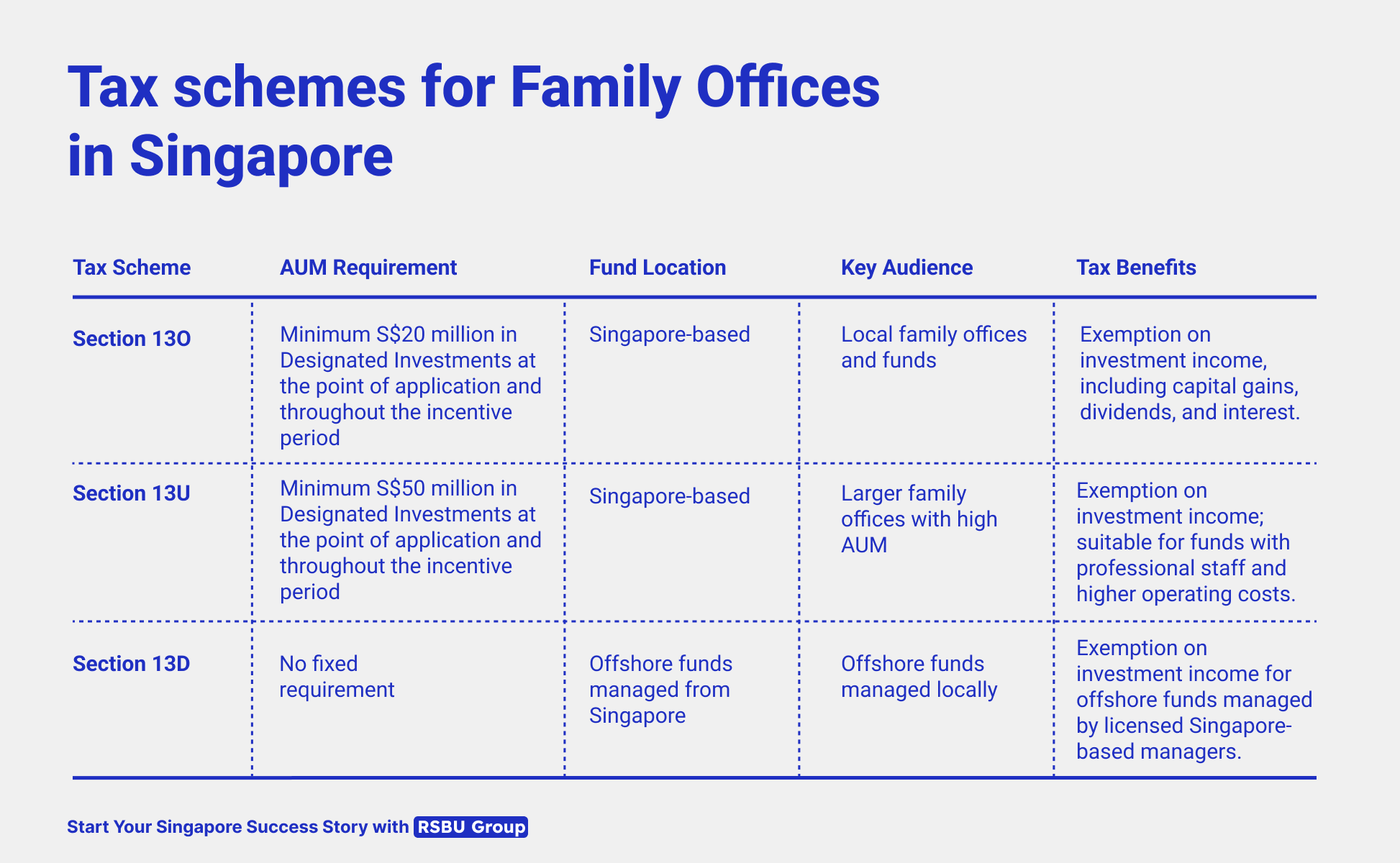

In Singapore, there are three key tax schemes commonly utilized by family offices or funds, depending on their structure and operations: Section 13O (formerly 13R), Section 13U (formerly 13X), and Section 13D. These schemes offer tax exemptions on qualifying investment income, with specific requirements for fund size, location, and management. Each scheme caters to different types of family office setups, ranging from locally registered funds to offshore funds managed from Singapore.

- SFO: Tailors its services to the family’s specific needs, which can include investment management, tax planning, asset structuring, lifestyle management, philanthropy, and concierge services.

- MFO: Offers a comprehensive and standardized range of services, including investment advisory, asset management, lifestyle services, and family governance, leveraging economies of scale.

Cost Efficiency

- SFO: High operational and administrative costs, suitable for families with substantial wealth to sustain bespoke management.

- MFO: More economical for families with smaller wealth by sharing costs and accessing a broad range of expertise without the need for a dedicated in-house team.

Singapore Tax & Incentive Schemes

In Singapore, there are three key tax schemes commonly utilized by family offices or funds, depending on their structure and operations: Section 13O (formerly 13R), Section 13U (formerly 13X), and Section 13D. These schemes offer tax exemptions on qualifying investment income, with specific requirements for fund size, location, and management. Each scheme caters to different types of family office setups, ranging from locally registered funds to offshore funds managed from Singapore.

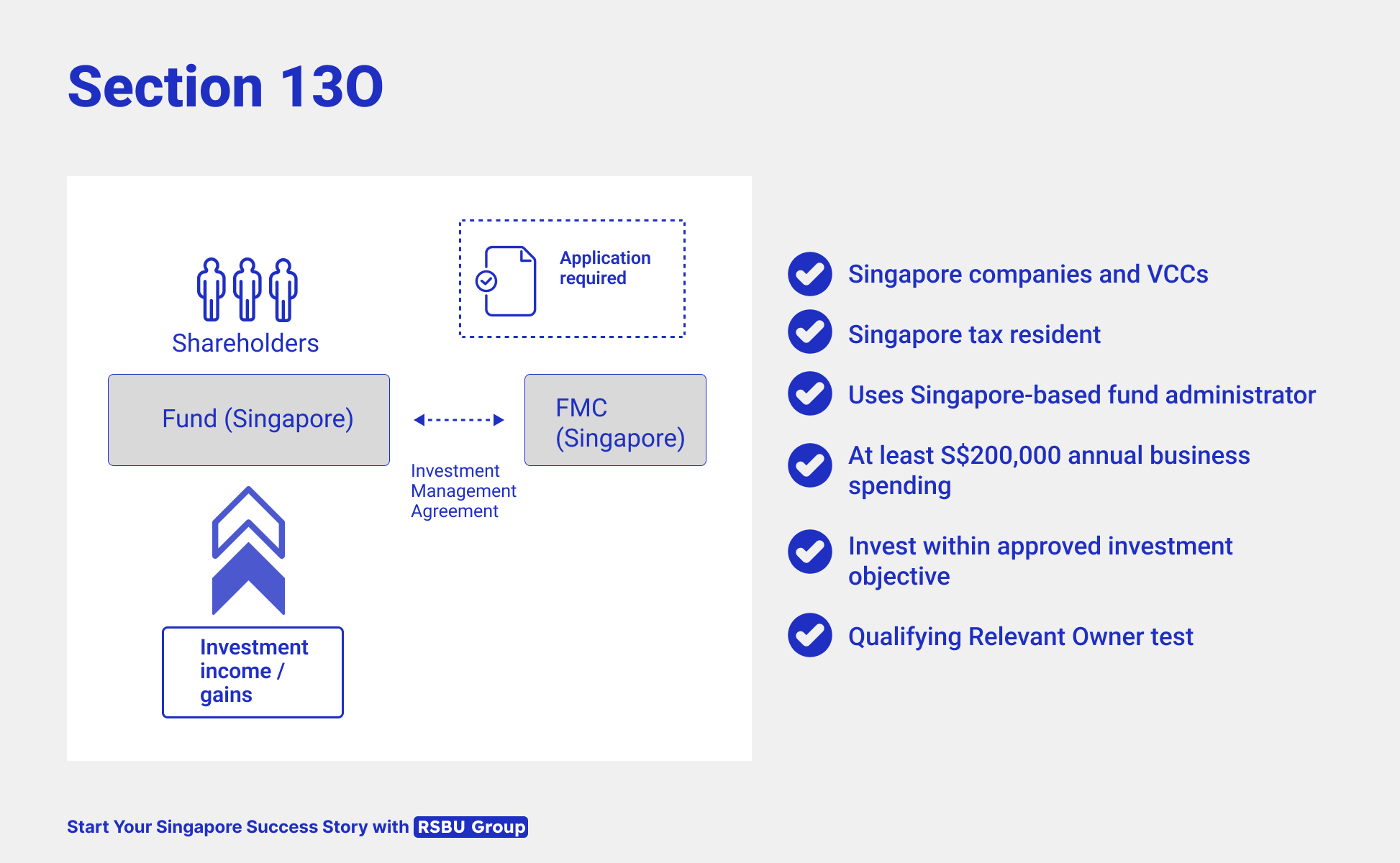

Section 13O: Tailored for Locally Incorporated Funds

Section 13O is a tax incentive designed for Singapore-based Single Family Offices (SFOs) managing the wealth of a single family. It is ideal for funds focused on local investments and seeking operational and tax efficiency within a compliant structure.

The scheme requires an initial SGD 20 million at the point of application, with no grace period for increasing AUM. It supports a broad range of investment activities, including equities, bonds, private equity, and real estate, making it a flexible choice for families with diverse investment portfolios. Section 13O is perfect for families establishing a localized structure to manage and grow their wealth in Singapore.

To qualify, the fund must:

Section 13O is a tax incentive designed for Singapore-based Single Family Offices (SFOs) managing the wealth of a single family. It is ideal for funds focused on local investments and seeking operational and tax efficiency within a compliant structure.

The scheme requires an initial SGD 20 million at the point of application, with no grace period for increasing AUM. It supports a broad range of investment activities, including equities, bonds, private equity, and real estate, making it a flexible choice for families with diverse investment portfolios. Section 13O is perfect for families establishing a localized structure to manage and grow their wealth in Singapore.

To qualify, the fund must:

- Incur a minimum annual business spending of SGD 200,000 locally and employ at least two professionals, of whom at least one is not a family member of the beneficial owners, at the point of application and throughout the incentive period.

- Have a private banking account with a MAS-licensed financial institution at the point of application and throughout the incentive period.

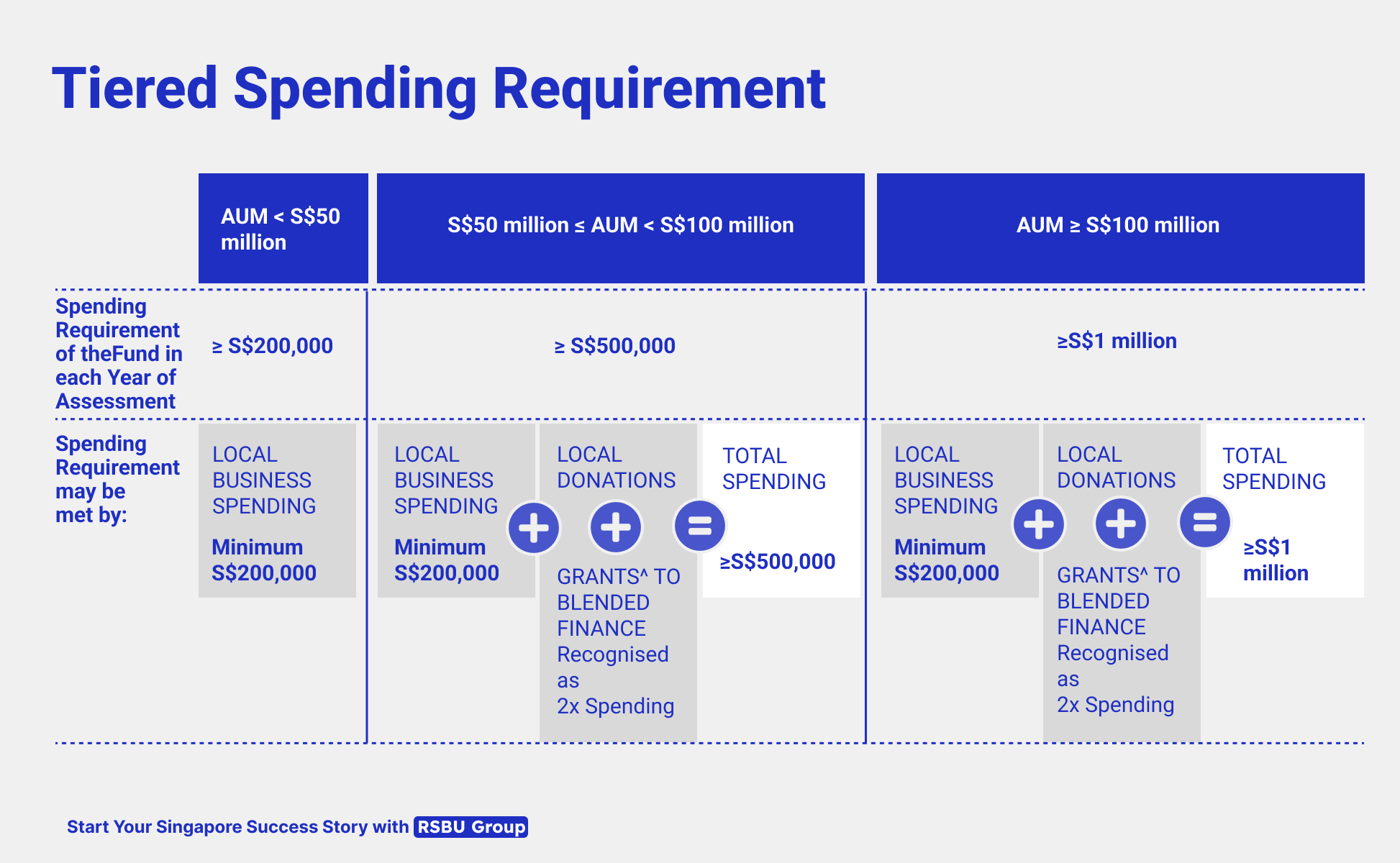

- Additionally, comply with the Tiered Spending Requirement, ensuring that minimum local business spending is met. This includes the allowance for donations and grants to be counted as eligible spending (effective from 5 July 2023).

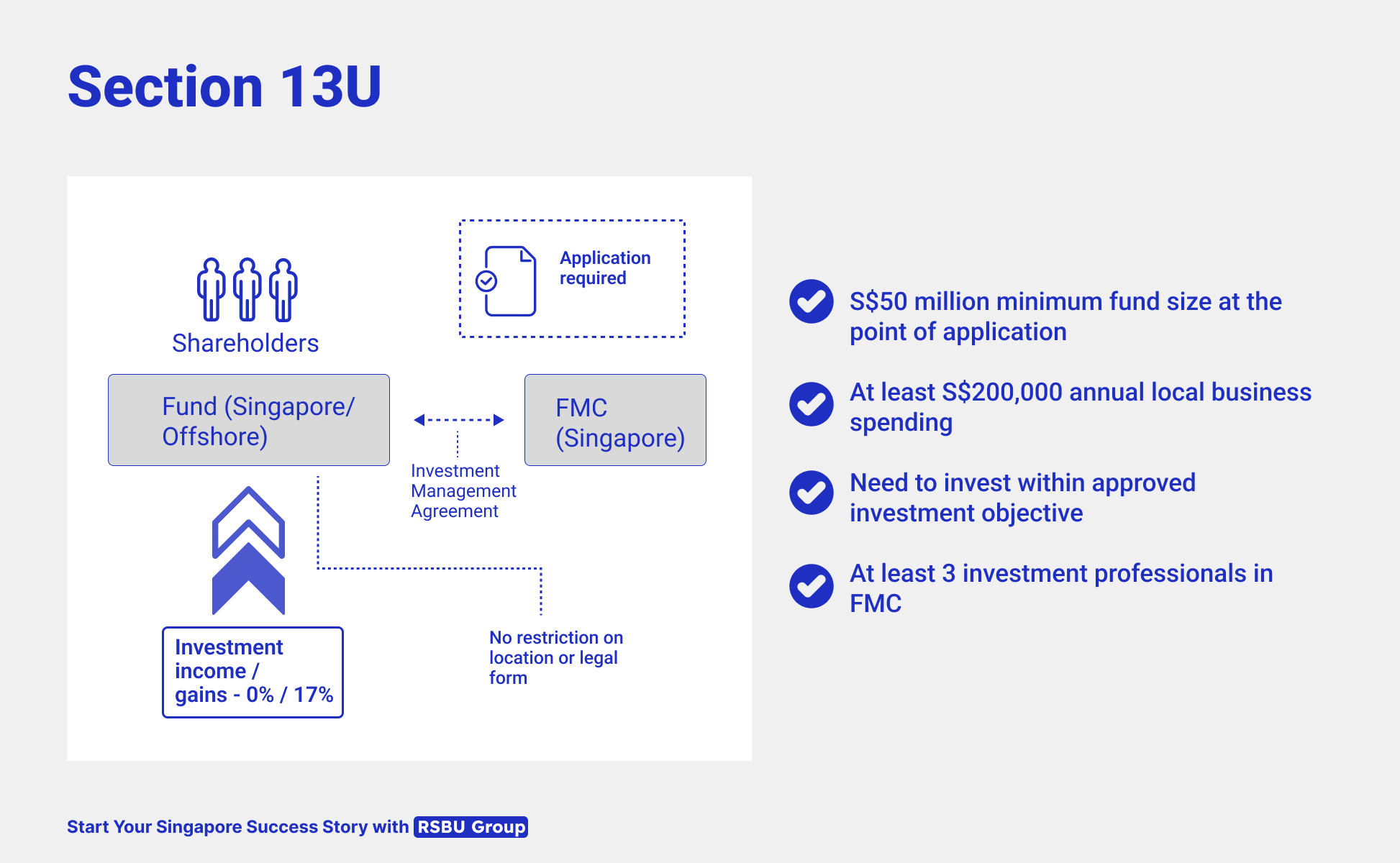

Section 13U: Designed for High-Value Funds

Section 13U is a tax incentive targeted at large-scale family offices and investment funds with significant assets under management (AUM). It is particularly suited for Single Family Offices (SFOs) and Multi-Family Offices (MFOs) managing AUM of at least SGD 50 million.

This scheme is ideal for family offices with a global investment outlook, as it accommodates a wide range of asset classes, including equities, bonds, private equity, venture capital, and alternative investments.

Section 13U provides tax exemptions on income generated from qualifying investments, making it an excellent option for wealthy families or funds seeking to manage substantial portfolios under a flexible and tax-efficient structure. It is best suited for those looking to establish a highly professionalized family office setup with larger operational resources.

To qualify, the fund must:

Section 13U is a tax incentive targeted at large-scale family offices and investment funds with significant assets under management (AUM). It is particularly suited for Single Family Offices (SFOs) and Multi-Family Offices (MFOs) managing AUM of at least SGD 50 million.

This scheme is ideal for family offices with a global investment outlook, as it accommodates a wide range of asset classes, including equities, bonds, private equity, venture capital, and alternative investments.

Section 13U provides tax exemptions on income generated from qualifying investments, making it an excellent option for wealthy families or funds seeking to manage substantial portfolios under a flexible and tax-efficient structure. It is best suited for those looking to establish a highly professionalized family office setup with larger operational resources.

To qualify, the fund must:

- Incur a minimum annual business spending of SGD 200,000 locally.

- Employ at least three professionals, of whom at least one is not a family member of the beneficial owners, at the point of application and throughout the incentive period.

- Comply with the Tiered Spending Requirement, ensuring that minimum local business spending is met. This includes the allowance for donations and grants to be counted as eligible spending (effective from 5 July 2023).

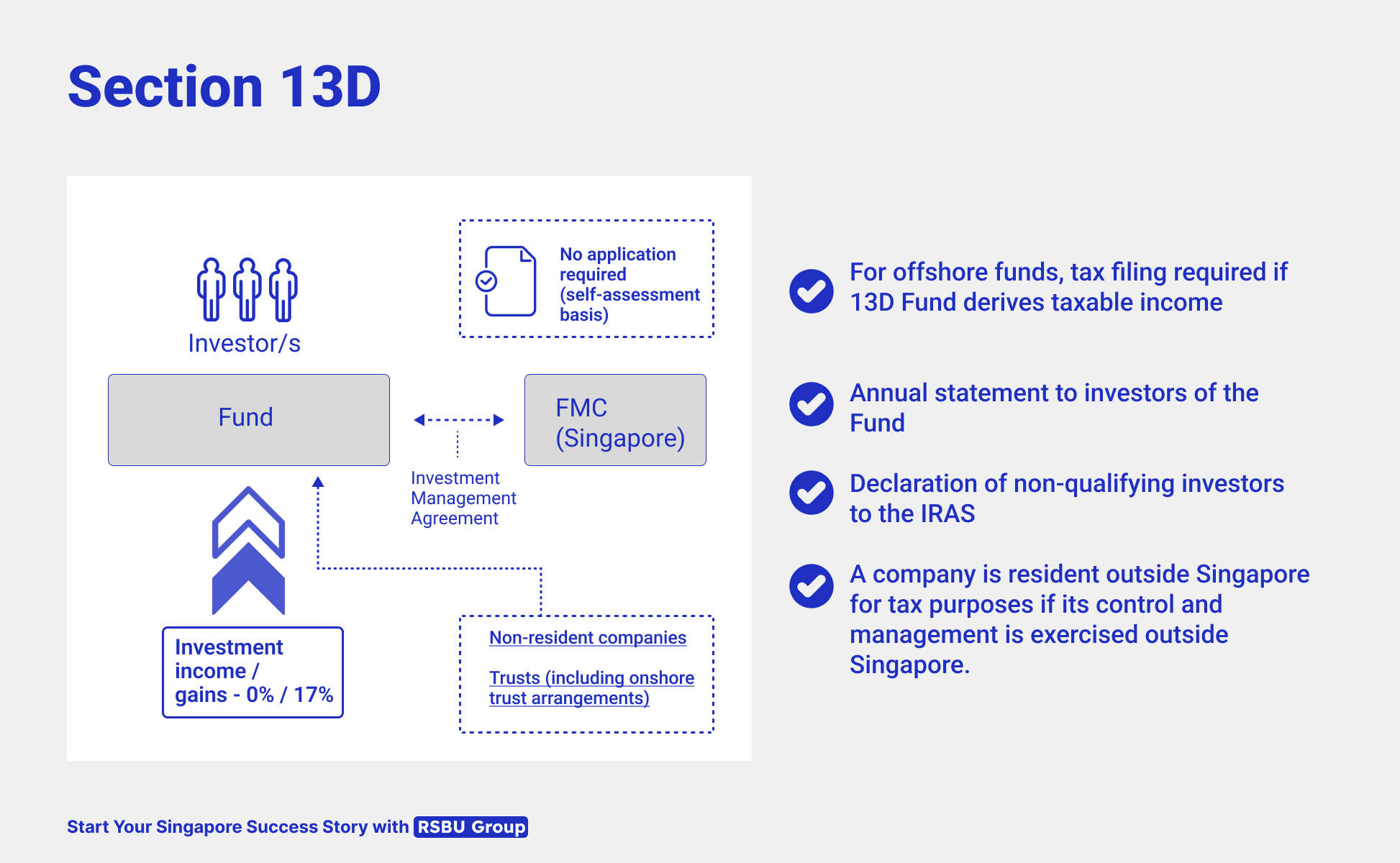

Section 13D: Сustomized for Offshore Funds

Section 13D is a tax incentive designed for offshore funds managed from Singapore. This scheme is ideal for funds that are incorporated outside Singapore and primarily cater to foreign investors, including family offices managing international wealth.

Key features of Section 13D:

Eligibility: The fund must be an offshore entity and not considered a tax resident of Singapore. It should not be fully owned by Singapore residents.

Management: The fund must be managed by a Singapore-based fund management company (FMC) holding the necessary license or exemption.

Investment Scope: Applies to a broad range of investments, including equities, bonds, private equity, and alternative assets.

Tax Benefits: Section 13D provides tax exemptions on qualifying income earned by the offshore fund, such as dividends, capital gains, and interest, if managed by a licensed fund manager in Singapore.

Section 13D is a tax incentive designed for offshore funds managed from Singapore. This scheme is ideal for funds that are incorporated outside Singapore and primarily cater to foreign investors, including family offices managing international wealth.

Key features of Section 13D:

Eligibility: The fund must be an offshore entity and not considered a tax resident of Singapore. It should not be fully owned by Singapore residents.

Management: The fund must be managed by a Singapore-based fund management company (FMC) holding the necessary license or exemption.

Investment Scope: Applies to a broad range of investments, including equities, bonds, private equity, and alternative assets.

Tax Benefits: Section 13D provides tax exemptions on qualifying income earned by the offshore fund, such as dividends, capital gains, and interest, if managed by a licensed fund manager in Singapore.

How to Set Up a Family Office: A Comprehensive Roadmap

Setting up a family office, whether it is a Single Family Office (SFO) or a Multi-Family Office (MFO), requires careful planning and execution. Here is a general roadmap that applies across different tax schemes (Section 13O, 13U, 13D) and types of family offices.

1. Define Objectives and Structure

2. Determine the Tax Scheme

3. Incorporate the Entity

4. Appoint Key Professionals

5. Establish Governance Framework

6. Open Bank and Custody Accounts

7. Develop an Investment Strategy

8. Comply with Regulatory and Tax Requirements

9. Establish Operational Processes

10. Develop a Long-Term Strategy

NB! The information provided in this article is for general informational purposes only and does not constitute legal advice. While we strive to ensure the content is accurate and up-to-date, it should not be relied upon as a substitute for professional consultation. For personalized advice or assistance with legal matters, please contact our specialists directly.

Setting up a family office, whether it is a Single Family Office (SFO) or a Multi-Family Office (MFO), requires careful planning and execution. Here is a general roadmap that applies across different tax schemes (Section 13O, 13U, 13D) and types of family offices.

1. Define Objectives and Structure

- Clarify the family’s goals: wealth preservation, investment growth, philanthropy, or lifestyle management.

- Decide on the type of office: SFO for exclusive management or MFO for shared resources.

- Select the appropriate legal structure (e.g., company, trust, or Variable Capital Company).

2. Determine the Tax Scheme

- Choose between Section 13O, 13U, or 13D based on AUM size, fund location, and investment objectives.

- Assess eligibility for tax incentives and required commitments.

3. Incorporate the Entity

- Register the family office or fund with Singapore’s Accounting and Corporate Regulatory Authority (ACRA).

- Ensure compliance with local regulations, including the appointment of directors.

4. Appoint Key Professionals

- Hire investment professionals and other staff required for day-to-day operations.

- For SFOs, this typically includes financial advisors and administrative personnel. For MFOs, more specialized roles like CIOs may be necessary.

5. Establish Governance Framework

- Develop clear policies for investment, risk management, and decision-making processes.

- Define reporting structures and roles within the office.

6. Open Bank and Custody Accounts

- Set up local or international banking facilities to manage funds.

- Secure custody solutions for the safekeeping of investments.

7. Develop an Investment Strategy

- Create a diversified investment plan aligned with the family’s objectives.

- Include asset allocation strategies covering equities, bonds, private equity, and other alternative investments.

8. Comply with Regulatory and Tax Requirements

- For SFOs: Ensure compliance with MAS requirements for tax schemes like Section 13O or 13U.

- For MFOs: Obtain the necessary licenses (e.g., RFMC or LFMC).

- Keep detailed documentation to meet self-assessment or reporting requirements.

9. Establish Operational Processes

- Set up accounting, reporting, and compliance systems.

- Define processes for regular reporting to stakeholders and tax authorities (e.g., IRAS).

10. Develop a Long-Term Strategy

- Define a clear roadmap for the family office’s growth, focusing on wealth preservation, legacy planning, or philanthropic goals.

- Establish an investment strategy aligned with the family’s objectives, including diversification across asset classes and regions.

- Plan for adapting to future opportunities, such as evolving market conditions or changes in family needs.

NB! The information provided in this article is for general informational purposes only and does not constitute legal advice. While we strive to ensure the content is accurate and up-to-date, it should not be relied upon as a substitute for professional consultation. For personalized advice or assistance with legal matters, please contact our specialists directly.

RSBU Group Expertise

We have extensive experience in providing legal and financial support in Singapore for over 13 years. From choosing the right tax scheme (Section 13O, 13U, or 13D) to structuring investments and ensuring compliance with Singapore’s regulations, our team provides end-to-end support. We assist with operational setup, hiring professionals, and developing long-term strategies for wealth preservation and growth. Whether you need help with establishing a Single Family Office (SFO) or scaling a Multi-Family Office (MFO), we offer the expertise and resources to make the process seamless and efficient.

We have extensive experience in providing legal and financial support in Singapore for over 13 years. From choosing the right tax scheme (Section 13O, 13U, or 13D) to structuring investments and ensuring compliance with Singapore’s regulations, our team provides end-to-end support. We assist with operational setup, hiring professionals, and developing long-term strategies for wealth preservation and growth. Whether you need help with establishing a Single Family Office (SFO) or scaling a Multi-Family Office (MFO), we offer the expertise and resources to make the process seamless and efficient.