Expanding internationally requires Singaporean companies to navigate diverse banking and regulatory requirements. While global standards like Know Your Customer (KYC) apply, each jurisdiction has unique rules. This guide outlines key preparations and compliance steps to streamline opening bank accounts abroad while staying aligned with Singapore's financial reporting obligations.

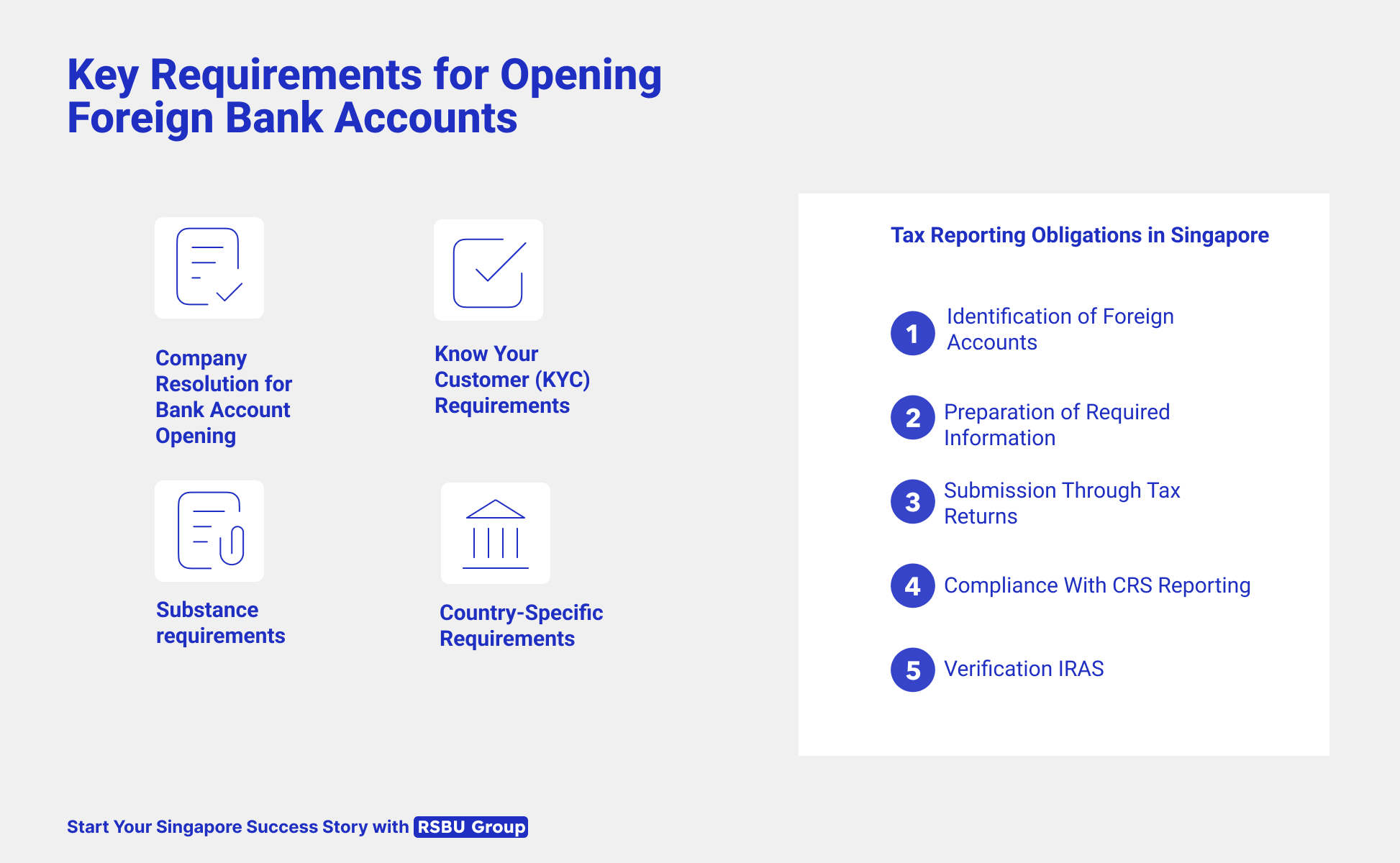

Key Requirements for Opening Foreign Bank Accounts

1.Company resolution for bank account opening

A formal company resolution is mandatory for opening a foreign bank account. This resolution must include details about the bank, the type of account, and the individuals authorized to operate it. In Singapore, this process is governed by the Companies Act (Cap. 50) and ensures proper corporate governance and accountability.

2.Know Your Customer (KYC) & Legal Documents requirements

KYC is a universal banking standard designed to comply with international anti-money laundering (AML) and counter-terrorism financing (CFT) regulations. Regardless of the jurisdiction, banks may require:

1.Company resolution for bank account opening

A formal company resolution is mandatory for opening a foreign bank account. This resolution must include details about the bank, the type of account, and the individuals authorized to operate it. In Singapore, this process is governed by the Companies Act (Cap. 50) and ensures proper corporate governance and accountability.

2.Know Your Customer (KYC) & Legal Documents requirements

KYC is a universal banking standard designed to comply with international anti-money laundering (AML) and counter-terrorism financing (CFT) regulations. Regardless of the jurisdiction, banks may require:

Corporate Legal Documents

Identification Documents for Key Individuals

Financial and Operational Documents

KYC and AML Compliance Documents

- Certificate of Incorporation: Proof of the company’s registration.

- Memorandum and Articles of Association: Documents defining the company’s structure and purpose.

- Board Resolution for Bank Account Opening: Formal approval from the board of directors to open the account.

- Register of Directors and Shareholders: Details of the company’s management and ownership.

- Licenses (if applicable): Industry-specific licenses required for operation.

Identification Documents for Key Individuals

- Passports or ID cards: For directors, shareholders, and beneficial owners.

- Proof of address: Such as utility bills or bank statements showing the current address.

Financial and Operational Documents

- Business Plan: A detailed outline of the company’s activities, revenue sources, and expected transactions.

- Financial Statements: Recent financial reports if the company is already operational.

- Contracts with Clients or Suppliers: To demonstrate real economic activity.

KYC and AML Compliance Documents

- Bank’s KYC form: A standard form provided by the bank to be completed by the company.

- Source of Funds Declaration: Explanation of the capital’s origin and anticipated account deposits.

- Beneficial Ownership Documents: Transparency about the ultimate owners of the company.

Additional Jurisdiction-Specific Documents

United States:

- Form W-8BEN-E: This form is used by foreign entities to certify their status for U.S. tax withholding purposes. It helps in claiming reduced withholding rates under applicable tax treaties.

European Union:

- Anti-Money Laundering Directive (AMLD/AMLD6): The EU has implemented several AML directives to combat money laundering and terrorist financing. These directives require entities to conduct thorough customer due diligence, maintain records, and report suspicious activities.

United Kingdom:

- Certificate of Good Standing: This document verifies that a company is legally registered and compliant with statutory requirements.

- Confirmation Statement: An annual submission that provides up-to-date information about the company’s directors, shareholders, and registered office.

Hong Kong:

- Business Registration Certificate: Mandatory for all businesses operating in Hong Kong, this certificate confirms the company’s legal status.

- Audited Financial Statements: Banks may request recent audited financials to assess the company’s financial health.

Offshore Jurisdictions (e.g., Cayman Islands, British Virgin Islands):

- Economic Substance Declaration: These jurisdictions require entities to demonstrate substantial economic presence to comply with international tax transparency standards, particularly the OECD’s Base Erosion and Profit Shifting (BEPS) initiative.

- Certificate of Incumbency: A document that lists current directors and officers, confirming the company’s active status. This is often requested to validate the legitimacy of the company’s structure.

Switzerland:

- Proof of Source of Funds: Enhanced due diligence requires detailed documentation of the origins of funds to ensure compliance with Switzerland’s stringent anti-money laundering (AML) obligations.

- Reference Letters: Some Swiss banks may ask for references from other financial institutions or business partners, particularly for high-net-worth individuals (HNWIs) or large corporate accounts.

China:

- Foreign Enterprise Approval Certificate: Required for foreign companies conducting business in China, this certificate confirms government approval for their operations. Requirements may vary depending on the province or industry.

- Tax Clearance Certificate:Confirms that the company has no outstanding tax obligations in China. This is particularly relevant for companies closing accounts or transferring operations.

3.Substance requirements

Under BEPS 2.0, all major countries worldwide now require companies to demonstrate real economic substance to ensure entities are not merely shell companies created for tax optimization purposes. These stricter requirements apply across jurisdictions and are aimed at ensuring alignment with international tax transparency and fairness principles.

Key Criteria for Economic Substance:

Example: A Singaporean company opening an account in Luxembourg must show that it has an active office, local directors, and ongoing business activities to meet these substance requirements. Additionally, under BEPS 2.0, this includes compliance with minimum global tax thresholds and evidence of genuine commercial operations.

Under BEPS 2.0, all major countries worldwide now require companies to demonstrate real economic substance to ensure entities are not merely shell companies created for tax optimization purposes. These stricter requirements apply across jurisdictions and are aimed at ensuring alignment with international tax transparency and fairness principles.

Key Criteria for Economic Substance:

- Office and Personnel: Companies must provide proof of a physical office and employ local staff actively performing key business functions. The scale of personnel should correspond to the company's level of business activity in the jurisdiction.

- Operational Activity: Demonstrate active operations by presenting contracts, invoices, and business transactions that substantiate ongoing and significant commercial activity in the jurisdiction.

- Governance: Evidence that board meetings and key decision-making occur within the jurisdiction of incorporation is essential. Local directors should be involved in the strategic and operational management of the company.

Example: A Singaporean company opening an account in Luxembourg must show that it has an active office, local directors, and ongoing business activities to meet these substance requirements. Additionally, under BEPS 2.0, this includes compliance with minimum global tax thresholds and evidence of genuine commercial operations.

Tax Reporting Obligations & Regulatory Requirements

When Singaporean companies expand internationally and open bank accounts abroad, they must meet stringent tax reporting and compliance requirements both locally and globally. These obligations ensure proper taxation, adherence to international transparency standards, and alignment with Singapore’s regulatory framework.

Key Tax Reporting Requirements

1. Reporting Foreign Bank Accounts to IRAS

Singaporean companies must report all foreign bank accounts to the Inland Revenue Authority of Singapore (IRAS) as part of their annual tax filing obligations. This includes detailing income earned from these accounts, even if the income is not remitted to Singapore.

2. Compliance with the Common Reporting Standard (CRS)

The CRS, a global initiative to combat tax evasion, mandates the automatic exchange of financial information between jurisdictions. Financial institutions in participating countries share account details, such as balances and transactions, with local tax authorities, which then forward the data to IRAS. Companies must ensure the information provided to their foreign banks aligns with what is reported to IRAS to avoid discrepancies.

Key Tax Reporting Requirements

1. Reporting Foreign Bank Accounts to IRAS

Singaporean companies must report all foreign bank accounts to the Inland Revenue Authority of Singapore (IRAS) as part of their annual tax filing obligations. This includes detailing income earned from these accounts, even if the income is not remitted to Singapore.

2. Compliance with the Common Reporting Standard (CRS)

The CRS, a global initiative to combat tax evasion, mandates the automatic exchange of financial information between jurisdictions. Financial institutions in participating countries share account details, such as balances and transactions, with local tax authorities, which then forward the data to IRAS. Companies must ensure the information provided to their foreign banks aligns with what is reported to IRAS to avoid discrepancies.

Steps for Compliance in Singapore

1. Identify Foreign Bank Accounts

Singaporean companies must first identify all foreign accounts under their name, including corporate accounts and accounts where they are the beneficial owner.

2. Prepare Required Information

Compile detailed records for each foreign account, including:

3. Include Foreign Account Details in Tax Returns

During the corporate tax return filing, companies must disclose foreign accounts in the relevant sections. IRAS requires reporting of all income derived from these accounts, ensuring transparency and proper tax treatment.

4. Maintain Consistency in CRS Reporting

Under CRS, foreign financial institutions report account information to local authorities, who share it with IRAS. Singaporean companies must ensure consistency between their tax filings and CRS data to avoid penalties or audits.

5. Verification and Record-Keeping

IRAS may review submissions for accuracy and consistency. Companies are encouraged to maintain clear, organized records of all foreign account activities to support compliance and facilitate audits if required.

Failure to comply with Singapore’s tax reporting obligations for foreign accounts can result in severe penalties, including fines and audits. By understanding the reporting process, adhering to CRS requirements, leveraging DTA provisions, and maintaining accurate records, Singaporean companies can ensure smooth international banking operations while fulfilling their regulatory responsibilities.

1. Identify Foreign Bank Accounts

Singaporean companies must first identify all foreign accounts under their name, including corporate accounts and accounts where they are the beneficial owner.

2. Prepare Required Information

Compile detailed records for each foreign account, including:

- Account holder’s name and address.

- Account number and financial institution details.

- Account balances, income, and transaction summaries.

3. Include Foreign Account Details in Tax Returns

During the corporate tax return filing, companies must disclose foreign accounts in the relevant sections. IRAS requires reporting of all income derived from these accounts, ensuring transparency and proper tax treatment.

4. Maintain Consistency in CRS Reporting

Under CRS, foreign financial institutions report account information to local authorities, who share it with IRAS. Singaporean companies must ensure consistency between their tax filings and CRS data to avoid penalties or audits.

5. Verification and Record-Keeping

IRAS may review submissions for accuracy and consistency. Companies are encouraged to maintain clear, organized records of all foreign account activities to support compliance and facilitate audits if required.

Failure to comply with Singapore’s tax reporting obligations for foreign accounts can result in severe penalties, including fines and audits. By understanding the reporting process, adhering to CRS requirements, leveraging DTA provisions, and maintaining accurate records, Singaporean companies can ensure smooth international banking operations while fulfilling their regulatory responsibilities.

Tax Considerations for Foreign Accounts

When Singaporean companies hold foreign bank accounts, the taxation of income generated from these accounts is subject to both Singapore’s tax laws and the local tax regulations of the jurisdiction where the account is held. Understanding how these incomes are taxed under both frameworks is essential for ensuring compliance and optimizing tax liabilities.

1. Taxation Under Singapore’s Laws

Singapore operates a territorial tax system, which means:

2. Taxation in the Local Jurisdiction

Income earned in the jurisdiction where the foreign bank account is located (e.g., interest, dividends, or gains):

3. Double Taxation Implications

Double taxation can arise when income from a foreign bank account is taxed in both the local jurisdiction and Singapore. To address this:

○ Benefit from reduced withholding tax rates in the foreign jurisdiction.

NB! The information provided in this article is for general informational purposes only and does not constitute legal advice. While we strive to ensure the content is accurate and up-to-date, it should not be relied upon as a substitute for professional consultation. For personalized advice or assistance with legal matters, please contact our specialists directly.

When Singaporean companies hold foreign bank accounts, the taxation of income generated from these accounts is subject to both Singapore’s tax laws and the local tax regulations of the jurisdiction where the account is held. Understanding how these incomes are taxed under both frameworks is essential for ensuring compliance and optimizing tax liabilities.

1. Taxation Under Singapore’s Laws

Singapore operates a territorial tax system, which means:

- Foreign-sourced income is taxed in Singapore only when it is remitted into Singapore or deemed received in Singapore.

- Certain types of foreign income, such as dividends, branch profits, and service income, may qualify for exemptions under specific conditions (e.g., the income has already been taxed in a qualifying foreign jurisdiction).

- If income from a foreign account is remitted to Singapore, it will be subject to corporate income tax at the prevailing rate, unless exemptions under the Foreign-Sourced Income Exemption (FSIE) scheme apply.

2. Taxation in the Local Jurisdiction

Income earned in the jurisdiction where the foreign bank account is located (e.g., interest, dividends, or gains):

- May be subject to withholding taxes or other local taxes, depending on the country’s tax laws.

- Typically, the local bank or financial institution will deduct taxes at source (e.g., on interest income).

3. Double Taxation Implications

Double taxation can arise when income from a foreign bank account is taxed in both the local jurisdiction and Singapore. To address this:

- Singapore has Double Tax Agreements (DTAs) with 98 jurisdictions. Under these agreements, companies may:

○ Benefit from reduced withholding tax rates in the foreign jurisdiction.

- If a DTA is not in place, companies may rely on unilateral tax relief, allowing a tax credit for foreign taxes paid, subject to specific conditions.

NB! The information provided in this article is for general informational purposes only and does not constitute legal advice. While we strive to ensure the content is accurate and up-to-date, it should not be relied upon as a substitute for professional consultation. For personalized advice or assistance with legal matters, please contact our specialists directly.

How We Can Help

Navigating the intricate landscape of compliance, legal, and tax requirements both in Singapore and abroad can be daunting, especially when dealing with foreign income, cross-border financial activities, and international regulations. Our team of experts is equipped to provide comprehensive support in the following areas:

With our guidance, you can focus on expanding your business internationally while we handle the complexities of tax compliance.

Navigating the intricate landscape of compliance, legal, and tax requirements both in Singapore and abroad can be daunting, especially when dealing with foreign income, cross-border financial activities, and international regulations. Our team of experts is equipped to provide comprehensive support in the following areas:

- Regulatory Compliance:Ensure your business adheres to all reporting and regulatory obligations under Singaporean law, as well as local requirements in the jurisdictions where your foreign accounts are held.

- Legal Guidance:Assist in structuring your international operations to comply with legal frameworks in both Singapore and foreign countries, minimizing risks and ensuring seamless global operations.

- Tax Planning and Optimization: We help structure your foreign income to maximize tax efficiency under Singapore’s Double Tax Agreements (DTAs).

- DTA Compliance Review: Our specialists ensure your financial activities align with the terms of relevant DTAs, reducing the risk of double taxation.

- Filing and Reporting Assistance: We manage the preparation and submission of your tax returns, ensuring accurate reporting of foreign income.

- Strategic Advice: We offer tailored advice on how to leverage Singapore’s tax exemptions and incentives to grow your business.

With our guidance, you can focus on expanding your business internationally while we handle the complexities of tax compliance.