Singapore’s private wealth sector is thriving, with its ultra-high-net-worth individual (UHNWI) population expected to grow by 9.7% from 2024 to 2028, according to Knight Frank. Driven by strong foreign demand, limited luxury property supply, and Singapore’s global reputation for stability and safety, the nation continues to solidify its position as Asia’s premier destination for wealth preservation and investment growth. The ‘NextGen effect’ is transforming family office strategies, as a tech-savvy and sustainability-driven generation takes the lead, driving an increase in startup investments, collaborative club deals, and impact-driven portfolios

Singapore’s private wealth management industry has established itself as a leading financial hub, celebrated for its stability, innovation, and regulatory excellence. As we enter the second half of the decade, the industry faces transformative trends driven by digitalization, sustainability, regulatory evolution, and changing client demands. Positioned strategically, Singapore is not merely adapting to these changes — it is proactively shaping the future standards of global wealth management, delivering substantial benefits to investors and businesses alike.Here’s an in-depth look at these emerging trends, supported by real data and market forecasts as of 2025.

Digital Transformation: The New Norm

The digital shift has become indispensable in private wealth management. A recent report by PwC highlights that 78% of wealth management firms in Singapore have significantly accelerated their digital investments since 2023. Notably, DBS Bank has implemented AI-driven advisory platforms, enhancing portfolio management accuracy by 30% and reducing operational costs by 25% since early 2024.

Digital advisory solutions, such as robo-advisors, have also seen dramatic growth. Endowus, a prominent Singapore-based digital wealth platform, now manages assets exceeding SGD 4 billion, representing a 45% annual growth rate since 2023.

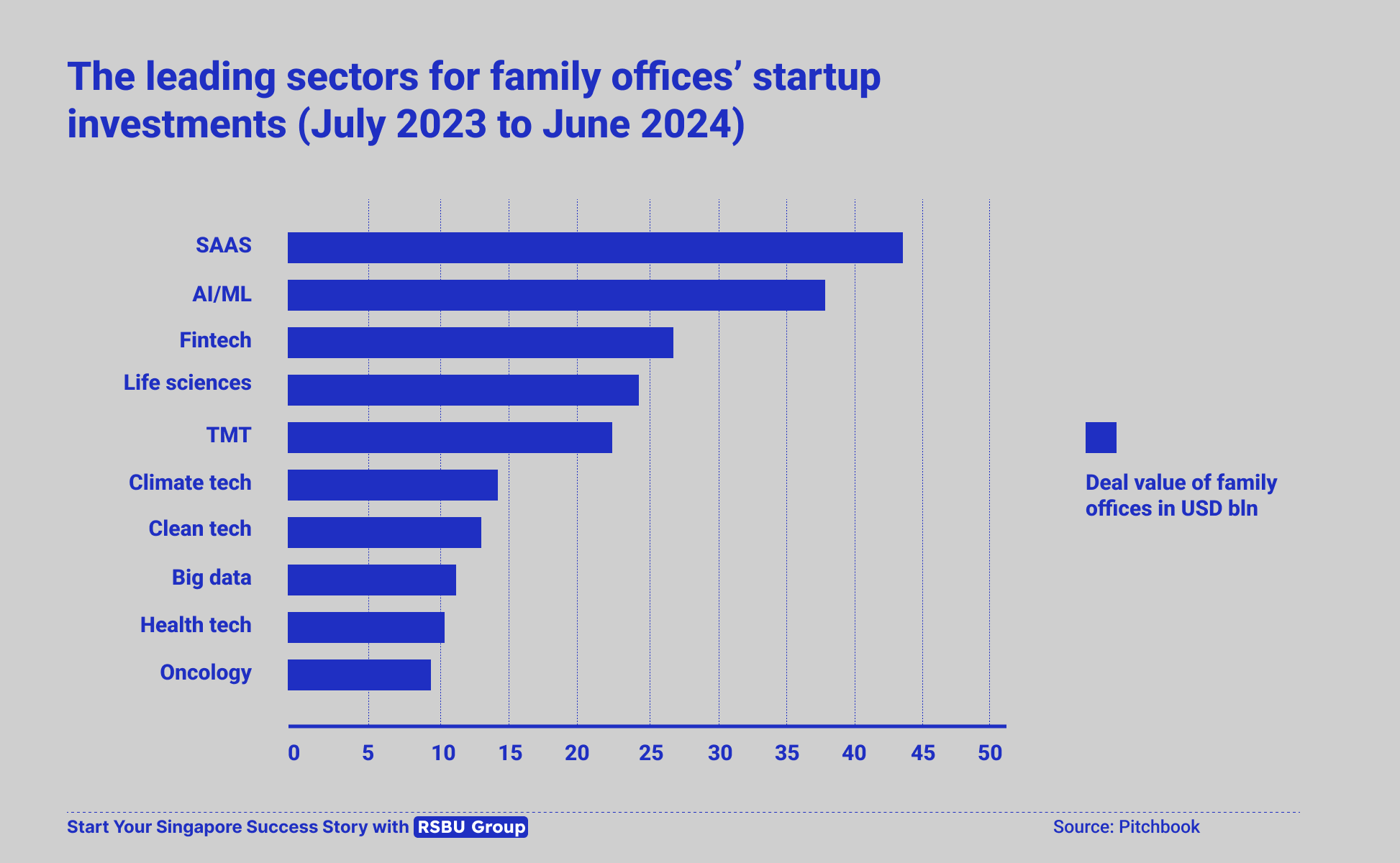

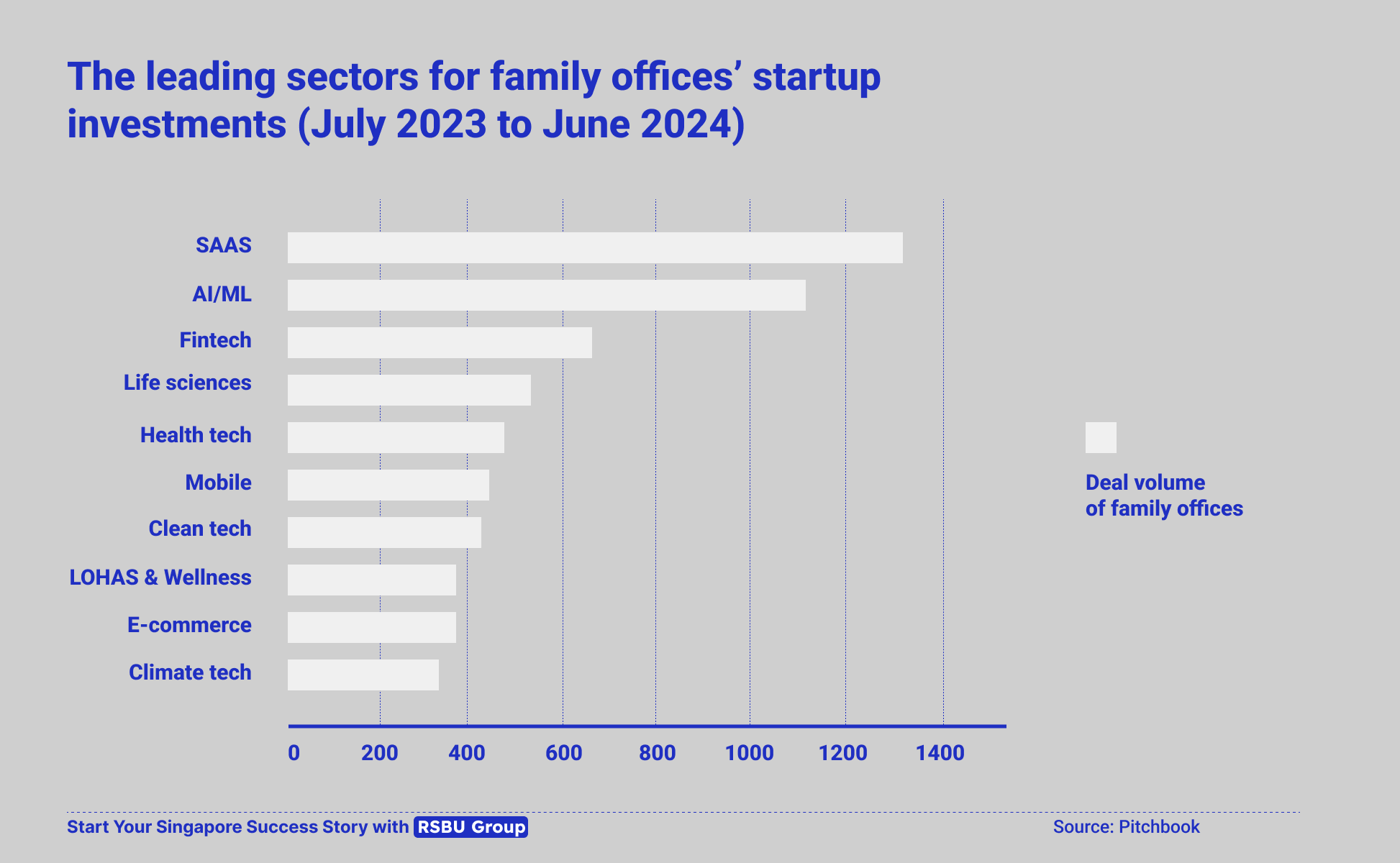

Interesting fact – software and services globally dominate family office direct investments, leading in both total deal value and share of overall deal value. Over the past year, startup investments have been heavily focused on software-as-a-service (SaaS) and artificial intelligence/machine learning (AI/ML), which ranked highest in both deal volume and value. FinTech and life sciences followed in these metrics.

The digitization trend creates more accessible, sophisticated investment platforms, enabling UHNW investors to benefit from precise, personalized advisory services and highly tailored investment strategies. Enhanced digital solutions facilitate quicker decisions, greater portfolio diversification, and improved risk management capabilities.

ESG and Sustainable Investing: Leading the Charge

Sustainability and ESG investments have rapidly gained momentum. As per the Monetary Authority of Singapore (MAS), ESG-related investments in Singapore have surged to SGD 45 billion by 2025, doubling in just two years. MAS has set ambitious targets for Singapore to become Asia’s green finance hub by 2030, attracting international funds specifically targeting sustainability.

Banks such as OCBC and UOB have launched dedicated ESG funds, with combined assets under management (AUM) growing 60% year-over-year since 2024. These strategic shifts underline Singapore’s commitment to sustainable financial leadership.

The increasing prominence of ESG investing opens significant avenues for UHNW investors interested in aligning portfolios with sustainable values and securing long-term growth. Businesses focusing on sustainability criteria not only attract greater capital inflows but also gain a competitive edge in a progressively ESG-conscious global market.

Evolving Regulatory Frameworks

Singapore’s robust regulatory environment remains one of its key competitive advantages, continuously evolving to address emerging financial crime threats and investor concerns. Recent significant updates include stricter Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) policies implemented by the Monetary Authority of Singapore (MAS), reflecting global best practices and local security needs. According to Deloitte, these regulatory enhancements have led to increased compliance costs for wealth management firms, estimated at an additional SGD 120 million annually across the sector.

Strengthened Anti-Money Laundering (AML) Framework

In August 2024, Singapore enacted the Anti-Money Laundering and Other Matters Act 2024, designed to strengthen law enforcement agencies’ powers against money laundering offenses. The new legislation significantly lowers the evidentiary threshold required for prosecuting such crimes, especially in complex cases involving cross-border financial transactions, thereby reinforcing investor confidence in Singapore’s financial security measures.

Enhanced Regulatory Oversight and Enforcement

Further reinforcing oversight, the Financial Institutions (Miscellaneous Amendments) Act 2024 expanded MAS’s regulatory powers across banking, insurance, and capital markets sectors. Under this amendment, MAS can issue prohibition orders, enhance compliance enforcement, and take swift action against regulatory breaches, contributing to a safer investment climate.

Inter-Agency Collaboration and Data Sharing

In a notable innovation to combat financial crimes, Singapore introduced the Collaborative Sharing of Money Laundering/Terrorism Financing Information & Cases (COSMIC) platform. This initiative fosters real-time information sharing among financial institutions, improving early detection and swift preventive actions against illicit financial activities, positioning Singapore as a leader in regulatory technology and compliance innovation.

Upcoming Regulatory Developments (2025)

In 2025, MAS proposed further AML/CFT regulation amendments, effective from mid-year, including broader proliferation financing risk assessments, enhanced due diligence for trusts and related entities, and stringent requirements for timely reporting of suspicious transactions. Additionally, a consultation on allowing retail investor access to private market investments aims to widen investment opportunities while ensuring strong investor protection.

Implications for UHNWIs and Financial Institutions

These regulatory advancements significantly boost Singapore’s standing as a secure, transparent, and compliant global financial hub. Ultra-high-net-worth individuals (UHNWIs) can confidently invest, assured of their wealth being managed under stringent governance and advanced compliance frameworks. Financial institutions, though facing higher immediate compliance costs, gain long-term benefits through clearer guidelines, increased operational reliability, and enhanced global credibility. Ultimately, these measures strengthen Singapore’s competitive position against other prominent wealth management hubs such as Hong Kong and Dubai.

Singapore’s stringent regulatory framework assures investors of safety and transparency, mitigating financial crime risks and enhancing reputation management. Investors and businesses operating within Singapore’s robust compliance landscape benefit from reduced operational risks and greater international credibility.

Surge of Family Offices and Multi-Generational Wealth

Family offices continue to be a cornerstone of Singapore’s private wealth management. MAS data shows Singapore hosted approximately 1,400 family offices in 2022, rising sharply to over 2,500 by the end of 2024. This reflects a clear preference among ultra-high-net-worth individuals (UHNWIs) for Singapore’s political stability, tax incentives, and world-class financial infrastructure.

Family offices now demand comprehensive services beyond traditional asset management. For instance, Citibank Singapore expanded its family office services to include structured legacy planning, philanthropic advisory, and specialized next-generation educational programs, seeing a 40% increase in client engagement since their launch in 2024.

Software and services dominate family office direct investments, leading in both total deal value and share of overall deal value. Over the past year, startup investments have been heavily focused on software-as-a-service (SaaS) and artificial intelligence/machine learning (AI/ML), which ranked highest in both deal volume and value. FinTech and life sciences followed in these metrics.

The rise of family offices and multi-generational wealth services significantly benefits UHNW families, providing specialized legacy planning, sophisticated asset structuring, philanthropic solutions, and education tailored to intergenerational wealth transfer.

Singapore’s private wealth management industry has established itself as a leading financial hub, celebrated for its stability, innovation, and regulatory excellence. As we enter the second half of the decade, the industry faces transformative trends driven by digitalization, sustainability, regulatory evolution, and changing client demands. Positioned strategically, Singapore is not merely adapting to these changes — it is proactively shaping the future standards of global wealth management, delivering substantial benefits to investors and businesses alike.Here’s an in-depth look at these emerging trends, supported by real data and market forecasts as of 2025.

Digital Transformation: The New Norm

The digital shift has become indispensable in private wealth management. A recent report by PwC highlights that 78% of wealth management firms in Singapore have significantly accelerated their digital investments since 2023. Notably, DBS Bank has implemented AI-driven advisory platforms, enhancing portfolio management accuracy by 30% and reducing operational costs by 25% since early 2024.

Digital advisory solutions, such as robo-advisors, have also seen dramatic growth. Endowus, a prominent Singapore-based digital wealth platform, now manages assets exceeding SGD 4 billion, representing a 45% annual growth rate since 2023.

Interesting fact – software and services globally dominate family office direct investments, leading in both total deal value and share of overall deal value. Over the past year, startup investments have been heavily focused on software-as-a-service (SaaS) and artificial intelligence/machine learning (AI/ML), which ranked highest in both deal volume and value. FinTech and life sciences followed in these metrics.

The digitization trend creates more accessible, sophisticated investment platforms, enabling UHNW investors to benefit from precise, personalized advisory services and highly tailored investment strategies. Enhanced digital solutions facilitate quicker decisions, greater portfolio diversification, and improved risk management capabilities.

ESG and Sustainable Investing: Leading the Charge

Sustainability and ESG investments have rapidly gained momentum. As per the Monetary Authority of Singapore (MAS), ESG-related investments in Singapore have surged to SGD 45 billion by 2025, doubling in just two years. MAS has set ambitious targets for Singapore to become Asia’s green finance hub by 2030, attracting international funds specifically targeting sustainability.

Banks such as OCBC and UOB have launched dedicated ESG funds, with combined assets under management (AUM) growing 60% year-over-year since 2024. These strategic shifts underline Singapore’s commitment to sustainable financial leadership.

The increasing prominence of ESG investing opens significant avenues for UHNW investors interested in aligning portfolios with sustainable values and securing long-term growth. Businesses focusing on sustainability criteria not only attract greater capital inflows but also gain a competitive edge in a progressively ESG-conscious global market.

Evolving Regulatory Frameworks

Singapore’s robust regulatory environment remains one of its key competitive advantages, continuously evolving to address emerging financial crime threats and investor concerns. Recent significant updates include stricter Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) policies implemented by the Monetary Authority of Singapore (MAS), reflecting global best practices and local security needs. According to Deloitte, these regulatory enhancements have led to increased compliance costs for wealth management firms, estimated at an additional SGD 120 million annually across the sector.

Strengthened Anti-Money Laundering (AML) Framework

In August 2024, Singapore enacted the Anti-Money Laundering and Other Matters Act 2024, designed to strengthen law enforcement agencies’ powers against money laundering offenses. The new legislation significantly lowers the evidentiary threshold required for prosecuting such crimes, especially in complex cases involving cross-border financial transactions, thereby reinforcing investor confidence in Singapore’s financial security measures.

Enhanced Regulatory Oversight and Enforcement

Further reinforcing oversight, the Financial Institutions (Miscellaneous Amendments) Act 2024 expanded MAS’s regulatory powers across banking, insurance, and capital markets sectors. Under this amendment, MAS can issue prohibition orders, enhance compliance enforcement, and take swift action against regulatory breaches, contributing to a safer investment climate.

Inter-Agency Collaboration and Data Sharing

In a notable innovation to combat financial crimes, Singapore introduced the Collaborative Sharing of Money Laundering/Terrorism Financing Information & Cases (COSMIC) platform. This initiative fosters real-time information sharing among financial institutions, improving early detection and swift preventive actions against illicit financial activities, positioning Singapore as a leader in regulatory technology and compliance innovation.

Upcoming Regulatory Developments (2025)

In 2025, MAS proposed further AML/CFT regulation amendments, effective from mid-year, including broader proliferation financing risk assessments, enhanced due diligence for trusts and related entities, and stringent requirements for timely reporting of suspicious transactions. Additionally, a consultation on allowing retail investor access to private market investments aims to widen investment opportunities while ensuring strong investor protection.

Implications for UHNWIs and Financial Institutions

These regulatory advancements significantly boost Singapore’s standing as a secure, transparent, and compliant global financial hub. Ultra-high-net-worth individuals (UHNWIs) can confidently invest, assured of their wealth being managed under stringent governance and advanced compliance frameworks. Financial institutions, though facing higher immediate compliance costs, gain long-term benefits through clearer guidelines, increased operational reliability, and enhanced global credibility. Ultimately, these measures strengthen Singapore’s competitive position against other prominent wealth management hubs such as Hong Kong and Dubai.

Singapore’s stringent regulatory framework assures investors of safety and transparency, mitigating financial crime risks and enhancing reputation management. Investors and businesses operating within Singapore’s robust compliance landscape benefit from reduced operational risks and greater international credibility.

Surge of Family Offices and Multi-Generational Wealth

Family offices continue to be a cornerstone of Singapore’s private wealth management. MAS data shows Singapore hosted approximately 1,400 family offices in 2022, rising sharply to over 2,500 by the end of 2024. This reflects a clear preference among ultra-high-net-worth individuals (UHNWIs) for Singapore’s political stability, tax incentives, and world-class financial infrastructure.

Family offices now demand comprehensive services beyond traditional asset management. For instance, Citibank Singapore expanded its family office services to include structured legacy planning, philanthropic advisory, and specialized next-generation educational programs, seeing a 40% increase in client engagement since their launch in 2024.

Software and services dominate family office direct investments, leading in both total deal value and share of overall deal value. Over the past year, startup investments have been heavily focused on software-as-a-service (SaaS) and artificial intelligence/machine learning (AI/ML), which ranked highest in both deal volume and value. FinTech and life sciences followed in these metrics.

The rise of family offices and multi-generational wealth services significantly benefits UHNW families, providing specialized legacy planning, sophisticated asset structuring, philanthropic solutions, and education tailored to intergenerational wealth transfer.

Talent Development: A Strategic Priority

The evolution of Singapore’s private wealth sector necessitates continuous talent development. Financial institutions are heavily investing in talent acquisition and training to cater to sophisticated client demands. A survey by Robert Walters in 2025 highlights a 25% increase in demand for professionals specializing in ESG investments, digital finance, and regulatory compliance compared to 2023.

The Singapore Institute of Banking and Finance (IBF) reported a record enrollment increase of 35% in specialized wealth management certifications between 2024 and 2025, underscoring industry commitment to maintaining a competitive talent pool.

The strategic investment in talent ensures UHNW investors and businesses receive world-class advice across complex investment landscapes. The availability of highly qualified professionals specializing in ESG, digital transformation, and regulatory compliance directly enhances the quality and effectiveness of financial advisory services.

Strategic International Collaborations

International partnerships are critical for expanding Singapore's global influence. Recent initiatives include the strategic partnership between SGX Group and London Stock Exchange in early 2025, enhancing Singapore’s visibility as a global wealth hub and facilitating cross-border investments and knowledge transfer. Additionally, the MAS has strengthened financial cooperation with major economies including the United States, Switzerland, and China, through mutual recognition agreements and joint regulatory frameworks designed to simplify cross-border investments and improve market access.

Further illustrating Singapore’s strategic approach, in 2025, the launch of the ASEAN Sustainable Finance Initiative—a partnership involving MAS, Bank Negara Malaysia, and Bank of Thailand—has significantly expanded opportunities for sustainable investments across Southeast Asia. Such alliances underscore Singapore's proactive role in shaping global wealth management standards and positioning itself as an indispensable node in international finance networks.

Strategic international collaborations provide UHNW investors and businesses expanded opportunities through enhanced global connectivity and market access. Partnerships with global financial institutions open doors for diversified international investments, beneficially positioning Singapore as a nexus for cross-border wealth management activities.

NB! The information provided in this article is for general informational purposes only and does not constitute legal advice. While we strive to ensure the content is accurate and up-to-date, it should not be relied upon as a substitute for professional consultation. For personalized advice or assistance with legal matters, please contact our specialists directly.

The evolution of Singapore’s private wealth sector necessitates continuous talent development. Financial institutions are heavily investing in talent acquisition and training to cater to sophisticated client demands. A survey by Robert Walters in 2025 highlights a 25% increase in demand for professionals specializing in ESG investments, digital finance, and regulatory compliance compared to 2023.

The Singapore Institute of Banking and Finance (IBF) reported a record enrollment increase of 35% in specialized wealth management certifications between 2024 and 2025, underscoring industry commitment to maintaining a competitive talent pool.

The strategic investment in talent ensures UHNW investors and businesses receive world-class advice across complex investment landscapes. The availability of highly qualified professionals specializing in ESG, digital transformation, and regulatory compliance directly enhances the quality and effectiveness of financial advisory services.

Strategic International Collaborations

International partnerships are critical for expanding Singapore's global influence. Recent initiatives include the strategic partnership between SGX Group and London Stock Exchange in early 2025, enhancing Singapore’s visibility as a global wealth hub and facilitating cross-border investments and knowledge transfer. Additionally, the MAS has strengthened financial cooperation with major economies including the United States, Switzerland, and China, through mutual recognition agreements and joint regulatory frameworks designed to simplify cross-border investments and improve market access.

Further illustrating Singapore’s strategic approach, in 2025, the launch of the ASEAN Sustainable Finance Initiative—a partnership involving MAS, Bank Negara Malaysia, and Bank of Thailand—has significantly expanded opportunities for sustainable investments across Southeast Asia. Such alliances underscore Singapore's proactive role in shaping global wealth management standards and positioning itself as an indispensable node in international finance networks.

Strategic international collaborations provide UHNW investors and businesses expanded opportunities through enhanced global connectivity and market access. Partnerships with global financial institutions open doors for diversified international investments, beneficially positioning Singapore as a nexus for cross-border wealth management activities.

NB! The information provided in this article is for general informational purposes only and does not constitute legal advice. While we strive to ensure the content is accurate and up-to-date, it should not be relied upon as a substitute for professional consultation. For personalized advice or assistance with legal matters, please contact our specialists directly.

How We Can Help

- Relocation and Residency Assistance: Our relocation specialists guide you through the Global Investor Program (GIP) application process, helping secure permanent residency for you and your family, along with support for educational and healthcare arrangements.

- Investment and Market Insights: We connect you with opportunities in Singapore’s high-growth sectors, from tech to biotech, and provide insights on investment strategies to maximize returns in Singapore’s favorable tax environment.

- Wealth Transfer and Estate Planning: We assist in establishing trusts and foundations, ensuring seamless intergenerational wealth transfer without estate taxes, safeguarding your legacy.