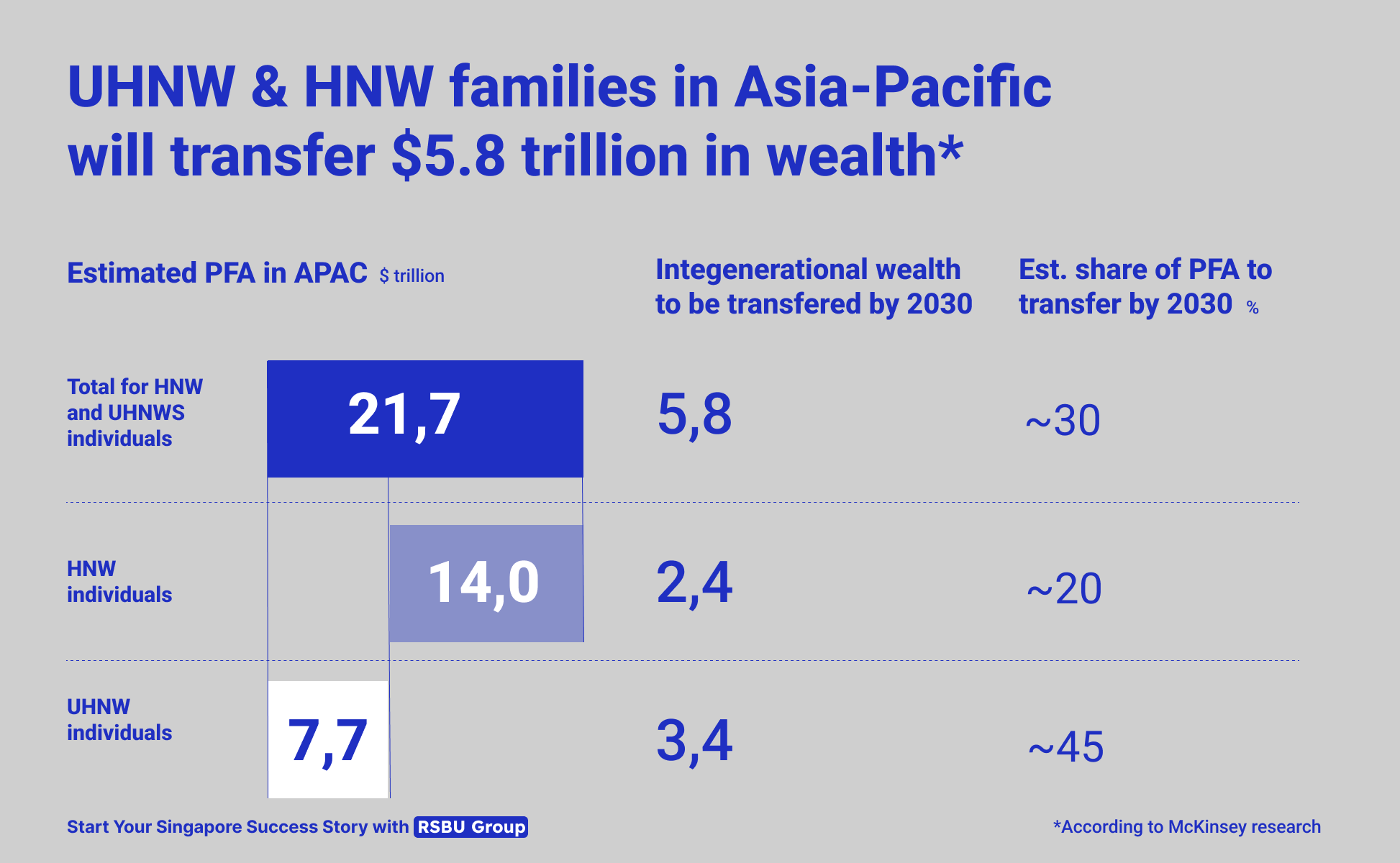

Singapore stands out as a top choice for UHNW individuals aiming for tax optimization, thanks to its advantageous tax policies and strategic global positioning. According to McKinsey analysis, between 2024 and 2030, ultra-high-net-worth (UHNW) and high-net-worth (HNW) families in the Asia–Pacific region are set to experience an intergenerational wealth transfer estimated at $5.8 trillion. UHNW families are expected to account for about 60 percent of the total wealth transfer, and many are setting up family offices to facilitate the process. Accordingly, the number of single-family offices in Hong Kong and Singapore, the hubs for such entities in Asia–Pacific, has quadrupled since 2020 to about 4,000 across both jurisdictions.

Here’s an overview of the key strategies and advantages for UHNW individuals:

1. No Capital Gains Tax

One of Singapore’s most attractive features is the absence of capital gains tax. This allows UHNW individuals to grow wealth through investments without the burden of capital gains taxation, particularly advantageous for those involved in real estate, stocks, and private equity deals.

1. No Capital Gains Tax

One of Singapore’s most attractive features is the absence of capital gains tax. This allows UHNW individuals to grow wealth through investments without the burden of capital gains taxation, particularly advantageous for those involved in real estate, stocks, and private equity deals.

Example 1: Real Estate Investments

UHNW individuals investing in high-end property in Singapore, such as luxury residences in Marina Bay or Orchard Road, can sell these assets without incurring capital gains tax. This is particularly advantageous when property values appreciate significantly, which has been the case in Singapore’s prime real estate market. For example, property prices in Singapore’s prime districts have seen notable increases, driven by demand from foreign investors and the influx of family offices.

Example 2: Private Equity and Venture Capital

Private equity and venture capital are key sectors where UHNW individuals stand to benefit. Singapore’s tax regime is conducive to those who invest in early-stage companies or private equity funds. When UHNW individuals exit these investments, typically during a liquidity event like an acquisition or initial public offering (IPO), they can do so without paying taxes on the returns, unlike in other jurisdictions where a 15-30% capital gains tax might apply. This is particularly appealing for investors focused on the tech and startup scene in Singapore, which has grown exponentially over the last decade.

Example 3: Stock Market Investments

UHNW investors who engage in significant stock market transactions, such as trading in the Singapore Exchange (SGX), benefit from no capital gains tax on the sale of shares. In high-tax countries, stock market gains can result in substantial tax liabilities, reducing the overall return on investments. In Singapore, profits from the appreciation of shares, whether short-term or long-term, remain tax-free, making it a favorable destination for global investors who want to diversify their portfolios.

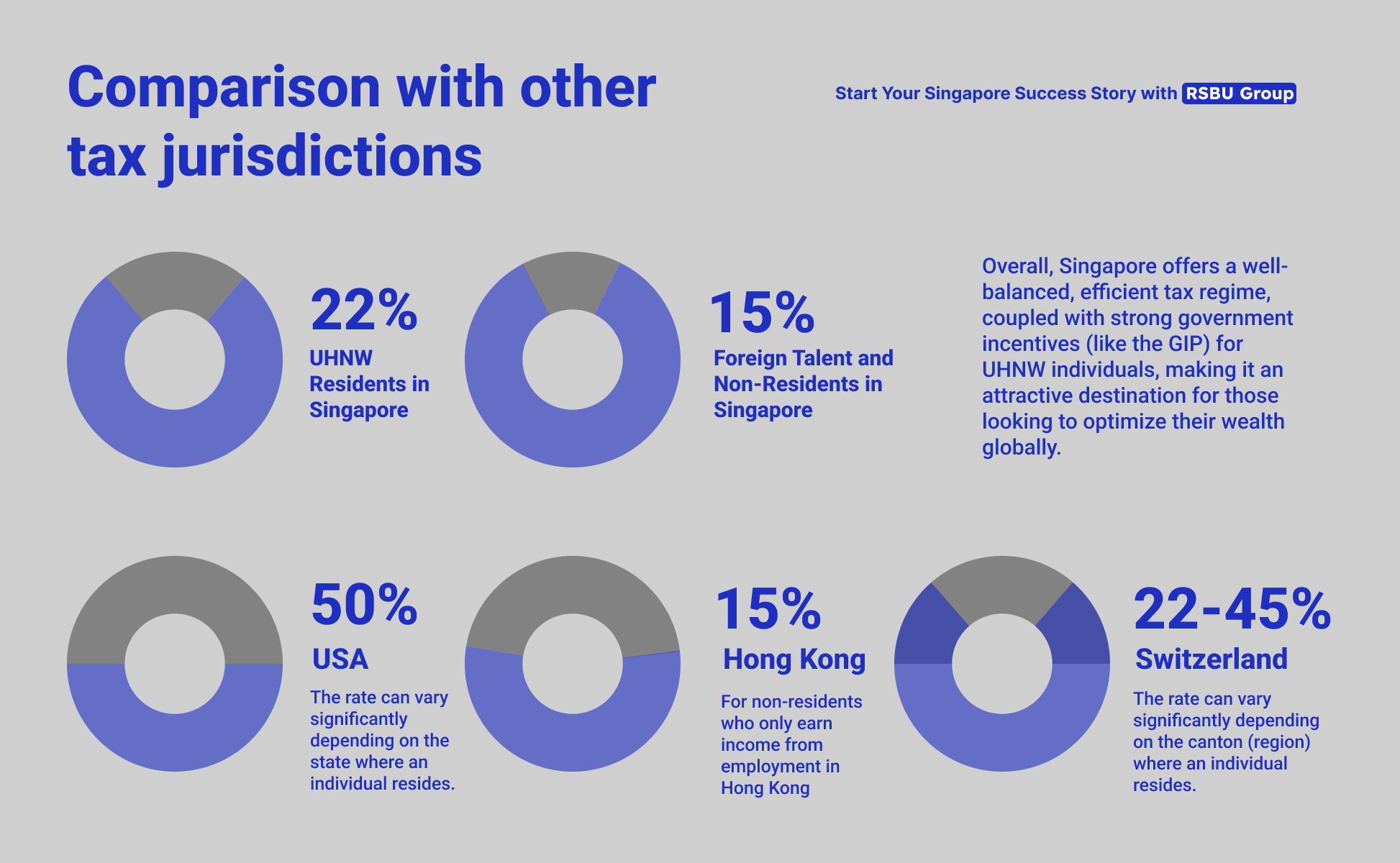

2. Attractive Personal Income Tax Rates

Singapore operates a progressive personal income tax system, with rates ranging from 0% to 22% for residents. UHNW individuals often benefit from this competitive structure, especially when compared to higher-tax jurisdictions like the United States or European countries. Non-residents pay a flat rate of 15% on employment income, further enhancing its appeal to foreign talent.

Singapore operates a progressive personal income tax system, with rates ranging from 0% to 22% for residents. UHNW individuals often benefit from this competitive structure, especially when compared to higher-tax jurisdictions like the United States or European countries. Non-residents pay a flat rate of 15% on employment income, further enhancing its appeal to foreign talent.

Example 1: UHNW Residents in Singapore

A UHNW individual earning S$1 million annually in Singapore will fall into the 22% tax bracket for the portion of income above S$320,000. On this income, the individual would pay approximately S$167,200 in taxes. Comparatively, if the same individual resided in the U.S., with a federal tax rate of 37% on high incomes, they would owe US$370,000 in taxes—more than double the amount they would pay in Singapore. Additionally, Singapore offers various deductions and tax reliefs, such as the Parent Relief, Child Relief, and Course Fees Relief, allowing individuals to lower their taxable income further.

Example 2: Foreign Talent and Non-Residents

For non-residents, Singapore applies a flat rate of 15% on employment income. This is particularly attractive for foreign professionals, executives, and global talent considering relocation to Singapore. In comparison, many countries tax non-residents at higher or equal rates as residents, which can act as a deterrent for foreign professionals. For instance, non-residents working in the U.K. are subject to the same progressive tax rates as residents, with a top rate of 45% on income above £150,000.

Example 3: Entrepreneurs and Digital Nomads

Singapore’s competitive tax regime is also a draw for entrepreneurs and digital nomads. Individuals who generate significant income from global ventures or investments benefit from Singapore’s tax structure. For instance, a tech entrepreneur earning from an international business but residing in Singapore can take advantage of its relatively lower income tax rates, allowing for reinvestment into their ventures.

3. Family Office and Investment Funds Exemption Schemes

Singapore provides tax incentives for family offices through the Section 13U and Section 13O schemes (formerly known as Section 13X and Section 13R). These schemes allow investment funds managed by family offices to enjoy tax exemptions on qualifying income streams, provided they meet specific criteria such as fund size, local business spending, and other compliance requirements. These programs are essential for UHNW individuals looking to efficiently grow and preserve wealth across generations.

Section 13U Scheme

The Section 13U scheme offers tax exemptions on specific income for investment funds, provided they meet updated criteria:

Fund Size: The fund must maintain a minimum fund size of S$50 million.

Local Business Spending (LBS): Local business spending requirements are tiered based on the fund’s assets under management (AUM):

Investment Professionals (IP): The fund must employ at least three IPs based in Singapore, each earning more than S$3,500 per month and actively engaged in qualified investment activities.

Singapore provides tax incentives for family offices through the Section 13U and Section 13O schemes (formerly known as Section 13X and Section 13R). These schemes allow investment funds managed by family offices to enjoy tax exemptions on qualifying income streams, provided they meet specific criteria such as fund size, local business spending, and other compliance requirements. These programs are essential for UHNW individuals looking to efficiently grow and preserve wealth across generations.

Section 13U Scheme

The Section 13U scheme offers tax exemptions on specific income for investment funds, provided they meet updated criteria:

Fund Size: The fund must maintain a minimum fund size of S$50 million.

Local Business Spending (LBS): Local business spending requirements are tiered based on the fund’s assets under management (AUM):

- Less than S$50 million: Minimum of S$200,000 per year.

- Less than S$100 million: Minimum of S$500,000 per year.

- S$100 million or more: Minimum of S$ 1 million per year.

Investment Professionals (IP): The fund must employ at least three IPs based in Singapore, each earning more than S$3,500 per month and actively engaged in qualified investment activities.

Example: UHNW Family with Diverse Investments

An UHNW family with a portfolio that includes real estate, global equities, and private equity could establish a family office in Singapore under the 13U scheme. By doing so, they may be exempt from taxes on qualifying income such as dividends, capital gains, and interest income earned by the fund. For instance, if the family office generates S$10 million annually in dividends and capital gains, these earnings could be tax-exempt under the 13U scheme.

Section 13O Scheme

The Section 13O scheme is tailored for onshore funds, specifically those incorporated and managed in Singapore, that also benefit from tax exemptions on qualifying income. While similar to Section 13U, this scheme is aimed at tax-resident companies or funds with updated criteria:

Fund Size: The minimum fund size required is S$20 million.

Local Business Spending (LBS): The same tiered LBS requirements apply as in Section 13U.

Investment Professionals (IP): The fund must employ at least two IPs based in Singapore, fulfilling similar salary and engagement conditions as those under the 13U scheme.

The Section 13O scheme is tailored for onshore funds, specifically those incorporated and managed in Singapore, that also benefit from tax exemptions on qualifying income. While similar to Section 13U, this scheme is aimed at tax-resident companies or funds with updated criteria:

Fund Size: The minimum fund size required is S$20 million.

Local Business Spending (LBS): The same tiered LBS requirements apply as in Section 13U.

Investment Professionals (IP): The fund must employ at least two IPs based in Singapore, fulfilling similar salary and engagement conditions as those under the 13U scheme.

Example: Regional Family Office Expansion

A family office headquartered in Hong Kong could set up a subsidiary in Singapore under the 13O scheme to manage its investments in Southeast Asia. By doing so, the family office can optimize taxes on income from Singapore-based assets while fully complying with local regulations. With assets under management (AUM) of, say, S$100 million, income derived from these assets could qualify for tax exemptions, providing substantial savings.

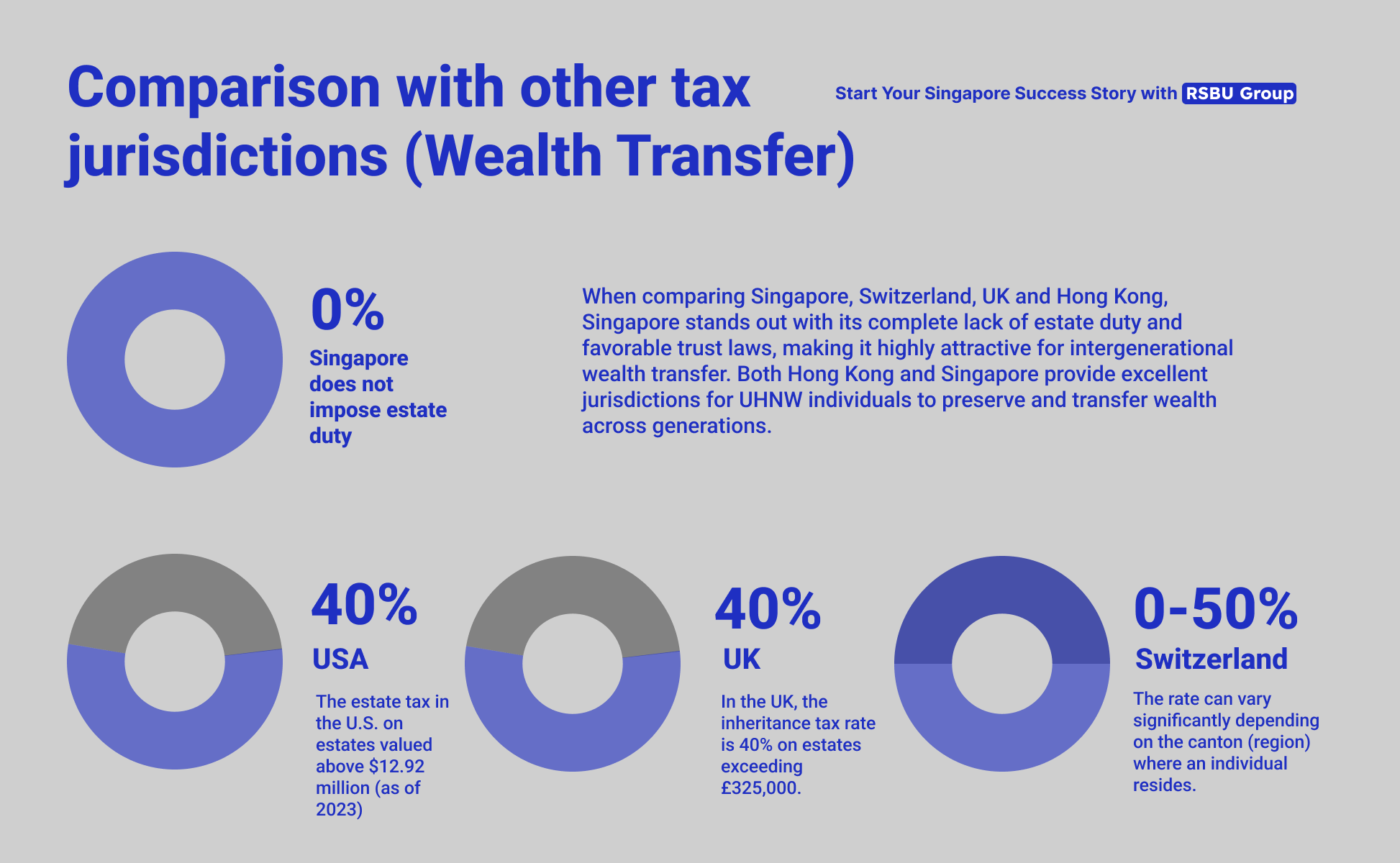

4. Wealth Transfer and Estate Planning

Singapore does not impose estate duty, making it an attractive jurisdiction for wealth transfer and estate planning. UHNW individuals can implement trusts and foundations to ensure seamless intergenerational transfer of wealth without the complexities of estate taxation, a feature that stands out compared to countries with hefty inheritance or estate taxes.

Singapore abolished estate duty in 2008, making it a highly attractive jurisdiction for wealth transfer and estate planning. UHNW individuals can implement tools like trusts and foundations to ensure that their wealth is passed on to future generations efficiently and tax-free.

Singapore does not impose estate duty, making it an attractive jurisdiction for wealth transfer and estate planning. UHNW individuals can implement trusts and foundations to ensure seamless intergenerational transfer of wealth without the complexities of estate taxation, a feature that stands out compared to countries with hefty inheritance or estate taxes.

Singapore abolished estate duty in 2008, making it a highly attractive jurisdiction for wealth transfer and estate planning. UHNW individuals can implement tools like trusts and foundations to ensure that their wealth is passed on to future generations efficiently and tax-free.

Example: Trusts for Seamless Wealth Transfer

UHNW individuals in Singapore can set up trusts to manage and transfer wealth without worrying about estate taxes. A trust allows the individual (the settlor) to place assets into a legal structure, managed by trustees for the benefit of designated beneficiaries, such as children or grandchildren. For example, a wealthy entrepreneur might transfer their business and real estate holdings into a trust, ensuring that these assets are protected and distributed to heirs according to their wishes, without being subject to taxation upon death. In other countries, such as the UK or the US, the estate tax could significantly reduce the amount passed on to heirs—up to 40% in some cases.

Case Study: Multigenerational Trust in Singapore

A family office in Singapore established by a UHNW family sets up a dynasty trust, which is designed to preserve and grow the family’s wealth across multiple generations. By utilizing the dynasty trust, the family can ensure that the trust’s assets (worth S$500 million) continue to grow and support future generations, without facing estate duties or inheritance taxes each time wealth is transferred. This ensures that the family’s wealth remains intact for decades, protected from taxation that might erode it in other jurisdictions.

5. Global Investor Program (GIP)

The GIP offers UHNW individuals and their families a pathway to permanent residency (PR) through substantial investments in Singapore. This not only provides residency but also access to the country’s favorable tax regime. UHNW individuals can invest in approved businesses, or establish family offices under this program, benefiting from wealth management and tax optimization in a stable political environment.

Program Overview

The GIP requires investors to make substantial investments in Singapore by choosing one of the following options:

The GIP offers UHNW individuals and their families a pathway to permanent residency (PR) through substantial investments in Singapore. This not only provides residency but also access to the country’s favorable tax regime. UHNW individuals can invest in approved businesses, or establish family offices under this program, benefiting from wealth management and tax optimization in a stable political environment.

Program Overview

The GIP requires investors to make substantial investments in Singapore by choosing one of the following options:

- Investing at least S$10 million in a new business or expansion of an existing business, including paid-up capital. Additionally, to renew the re-entry permit after the initial five-year period, the business must employ at least 30 people, with at least 15 of them being Singapore citizens, and 10 of these positions must be new roles.

- Investing S$25 million in an approved GIP Fund that invests in Singapore-based companies. These funds are carefully selected based on their track record, mandate for investment in Singapore, and focus on key industries.

- Establishing a single-family office with at least S$200 million in assets under management (AUM) in Singapore, of which at least S$50 million must be invested in Singapore-based assets. Eligible local investments include:

- Companies listed on Singapore’s exchanges licensed by the Monetary Authority of Singapore (MAS).

- Qualified debt securities, such as bonds or certificates of deposit listed in MAS’s financial institutions directory.

- Funds managed by Singapore-licensed managers.

- Direct investments in non-listed Singapore-based companies.

Example: UHNW Family Establishing a Family Office

A UHNW family looking to manage their wealth efficiently and take advantage of Singapore’s tax policies can opt to establish a single-family office through the GIP. By investing S$200 million in assets and managing them from Singapore, including at least S$50 million in local investments, they gain permanent residency and optimize their tax strategy by benefiting from tax exemptions on qualifying income under the Section 13U and Section 13O schemes (discussed earlier). This approach allows the family to grow their wealth in a politically stable, tax-efficient environment with the added benefit of residing in Singapore.

Example: Investing in Singaporean Businesses

A UHNW individual may choose the investment route by allocating S$25 million to an approved GIP Fund or directly investing in a Singaporean business. This investment secures permanent residency and offers an opportunity to tap into Singapore’s thriving sectors, including fintech, biomedical sciences, and real estate. For instance, investing in a high-growth fintech startup in Singapore could yield substantial returns while benefiting from the absence of capital gains tax on profits derived from that investment.

Advantages of the GIP for UHNW Families

Market Analysis

In 2023, Hong Kong and Singapore each managed roughly $1.3 trillion in offshore assets—trailing only Switzerland’s $2.5 trillion total—affirming their importance in the global financial ecosystem.

Singapore’s tax structure is a major draw for UHNW individuals globally. The country’s well-established financial sector, strong rule of law, and political stability make it an ideal location for wealth management. With UHNW wealth in Asia projected to grow by 8.4% annually over the next decade, Singapore is expected to maintain its position as a key wealth management hub. The growth of family offices in the region has also surged, with 700 single-family offices established in Singapore by the end of 2023, a significant increase from just 400 in 202.

The economic growth in western countries was mainly driven by public market, with pension reforms, MFs and ETFs providing the catalysts. Rising wealth effect and economy dynamism will continue to fuel family offices and asset management growth in Asia–Pacific. The key difference for Asia–Pacific will be growth driven not just by public but also private capital markets.

We expect increased wealth flows from Europe and North America as many global investors see Asia–Pacific as a third safe haven (in addition to Europe and North America) for portfolio diversification.

How We Can Help

- Access to a Favorable Tax Regime: Once granted PR (permanent residency) status, UHNW individuals benefit from Singapore’s low income tax rates, absence of capital gains tax, and no estate duties, making it a highly efficient jurisdiction for wealth management.

- Stable Political and Economic Environment: Singapore’s robust legal framework, political stability, and world-class infrastructure make it a secure base for family offices and investments, ensuring that wealth is managed in a secure and favorable environment.

- Comprehensive Family Coverage: The GIP extends PR status not just to the individual investor but also to their immediate family, allowing UHNW families to relocate together and benefit from Singapore’s education and healthcare systems.

Market Analysis

In 2023, Hong Kong and Singapore each managed roughly $1.3 trillion in offshore assets—trailing only Switzerland’s $2.5 trillion total—affirming their importance in the global financial ecosystem.

Singapore’s tax structure is a major draw for UHNW individuals globally. The country’s well-established financial sector, strong rule of law, and political stability make it an ideal location for wealth management. With UHNW wealth in Asia projected to grow by 8.4% annually over the next decade, Singapore is expected to maintain its position as a key wealth management hub. The growth of family offices in the region has also surged, with 700 single-family offices established in Singapore by the end of 2023, a significant increase from just 400 in 202.

The economic growth in western countries was mainly driven by public market, with pension reforms, MFs and ETFs providing the catalysts. Rising wealth effect and economy dynamism will continue to fuel family offices and asset management growth in Asia–Pacific. The key difference for Asia–Pacific will be growth driven not just by public but also private capital markets.

We expect increased wealth flows from Europe and North America as many global investors see Asia–Pacific as a third safe haven (in addition to Europe and North America) for portfolio diversification.

How We Can Help

- Tax and Family Office Advisory: We offer consultations on Singapore’s tax incentives and family office structures, helping you leverage exemptions like the Section 13X and 13R schemes for tax-efficient wealth growth.

- Relocation and Residency Assistance: Our relocation specialists guide you through the Global Investor Program (GIP) application process, helping secure permanent residency for you and your family, along with support for educational and healthcare arrangements.

- Investment and Market Insights: We connect you with opportunities in Singapore’s high-growth sectors, from tech to biotech, and provide insights on investment strategies to maximize returns in Singapore’s favorable tax environment.

- Wealth Transfer and Estate Planning: We assist in establishing trusts and foundations, ensuring seamless intergenerational wealth transfer without estate taxes, safeguarding your legacy.