As Singapore continues to strengthen its status as a global private wealth hub, the use of trusts — particularly living trusts — has become an increasingly important part of the financial and estate planning toolkit. In a climate of rising geopolitical uncertainty, generational wealth transfers, and greater regulatory transparency, high-net-worth individuals (HNWIs), business owners, and expatriates are turning to Singapore’s robust trust framework to protect assets, manage succession, and ensure continuity.

This guide explores in detail what a living trust is, how it works under Singapore law, who it benefits, how to set one up, and what tax implications and compliance obligations are relevant as of 2025.

1. What Is a Living Trust?

A living trust, also called an inter vivos trust, is a legal arrangement in which a person (the settlor) transfers assets into a trust during their lifetime. The assets are managed by a trustee — either an individual or a licensed trust company — for the benefit of one or more beneficiaries.

The trust becomes active immediately upon funding and operates according to the trust deed — a legal document that defines how the assets should be held, invested, and distributed.

Unlike a testamentary trust (which takes effect after death), a living trust operates while the settlor is still alive. It can be revocable, allowing the settlor to modify or revoke it, or irrevocable, which offers stronger asset protection but cannot be amended once established.

2. Legal and Regulatory Framework in Singapore

Living trusts in Singapore are governed primarily by the Trustees Act (Cap. 337) and case law rooted in English common law traditions. While there is no mandatory registration requirement for private trusts in Singapore, those administered by licensed trust companies are regulated by the Monetary Authority of Singapore (MAS) under the Trust Companies Act.

Professional trustees must comply with anti-money laundering (AML) and counter-terrorism financing (CTF) obligations, know-your-client (KYC) due diligence, and other fiduciary duties. Singapore’s high regulatory standards are a key reason the jurisdiction is viewed globally as a safe and stable trust domicile.

3. Revocable vs Irrevocable Trusts: Which to Choose?

A revocable living trust allows the settlor to retain full control and make changes to the trust. This option is suitable for individuals who are not yet ready to relinquish control but wish to plan ahead for potential incapacity or streamline future asset distribution.

An irrevocable living trust, on the other hand, provides stronger legal protection. Once assets are transferred, the settlor no longer owns them and cannot modify the trust. Irrevocable trusts are often used for tax planning, creditor protection, and to ring-fence assets for future generations.

In Singapore, irrevocable trusts are generally preferred by HNWIs for family wealth preservation, particularly when structured with discretionary provisions that allow trustees flexibility in managing and distributing assets.

4. Common Use Cases for Living Trusts in Singapore

Family Succession Planning:

Affluent families use living trusts to pass assets to children or grandchildren over time, avoiding the delays and publicity of probate. For example, shares in a family-owned company can be held in trust with voting rights delegated to professional trustees or independent directors.

Asset Protection from Creditors or Litigation:

Properly constructed irrevocable trusts can shield assets from future legal claims, provided they are not set up with the intent to defraud. Business owners, especially those in high-risk industries, use trusts to separate personal and business assets.

Provision for Special Needs or Financial Immaturity:

Trusts can allocate assets in stages (e.g., at age 21, 30, etc.) or provide regular disbursements, ensuring responsible use. Special needs trusts can also ensure lifelong financial support for dependents without disqualifying them from public assistance.

Cross-border Families and Tax Neutrality:

Singapore trusts are particularly attractive to international families due to the absence of capital gains tax, estate duty, or wealth taxes. Assets across multiple jurisdictions can be consolidated under a single structure.

5. How to Set Up a Living Trust in Singapore

Setting up a trust involves careful planning and professional execution. The typical process includes:

6. Taxation of Trusts in Singapore

Singapore offers a clear and competitive tax environment for trusts:

7. Risks, Compliance, and Governance

While trusts offer flexibility and protection, risks include:

Mitigation involves clear legal drafting, use of professional licensed trustees, periodic trust reviews, and up-to-date reporting in line with MAS, IRAS, and international standards such as CRS and FATCA.

This guide explores in detail what a living trust is, how it works under Singapore law, who it benefits, how to set one up, and what tax implications and compliance obligations are relevant as of 2025.

1. What Is a Living Trust?

A living trust, also called an inter vivos trust, is a legal arrangement in which a person (the settlor) transfers assets into a trust during their lifetime. The assets are managed by a trustee — either an individual or a licensed trust company — for the benefit of one or more beneficiaries.

The trust becomes active immediately upon funding and operates according to the trust deed — a legal document that defines how the assets should be held, invested, and distributed.

Unlike a testamentary trust (which takes effect after death), a living trust operates while the settlor is still alive. It can be revocable, allowing the settlor to modify or revoke it, or irrevocable, which offers stronger asset protection but cannot be amended once established.

2. Legal and Regulatory Framework in Singapore

Living trusts in Singapore are governed primarily by the Trustees Act (Cap. 337) and case law rooted in English common law traditions. While there is no mandatory registration requirement for private trusts in Singapore, those administered by licensed trust companies are regulated by the Monetary Authority of Singapore (MAS) under the Trust Companies Act.

Professional trustees must comply with anti-money laundering (AML) and counter-terrorism financing (CTF) obligations, know-your-client (KYC) due diligence, and other fiduciary duties. Singapore’s high regulatory standards are a key reason the jurisdiction is viewed globally as a safe and stable trust domicile.

3. Revocable vs Irrevocable Trusts: Which to Choose?

A revocable living trust allows the settlor to retain full control and make changes to the trust. This option is suitable for individuals who are not yet ready to relinquish control but wish to plan ahead for potential incapacity or streamline future asset distribution.

An irrevocable living trust, on the other hand, provides stronger legal protection. Once assets are transferred, the settlor no longer owns them and cannot modify the trust. Irrevocable trusts are often used for tax planning, creditor protection, and to ring-fence assets for future generations.

In Singapore, irrevocable trusts are generally preferred by HNWIs for family wealth preservation, particularly when structured with discretionary provisions that allow trustees flexibility in managing and distributing assets.

4. Common Use Cases for Living Trusts in Singapore

Family Succession Planning:

Affluent families use living trusts to pass assets to children or grandchildren over time, avoiding the delays and publicity of probate. For example, shares in a family-owned company can be held in trust with voting rights delegated to professional trustees or independent directors.

Asset Protection from Creditors or Litigation:

Properly constructed irrevocable trusts can shield assets from future legal claims, provided they are not set up with the intent to defraud. Business owners, especially those in high-risk industries, use trusts to separate personal and business assets.

Provision for Special Needs or Financial Immaturity:

Trusts can allocate assets in stages (e.g., at age 21, 30, etc.) or provide regular disbursements, ensuring responsible use. Special needs trusts can also ensure lifelong financial support for dependents without disqualifying them from public assistance.

Cross-border Families and Tax Neutrality:

Singapore trusts are particularly attractive to international families due to the absence of capital gains tax, estate duty, or wealth taxes. Assets across multiple jurisdictions can be consolidated under a single structure.

5. How to Set Up a Living Trust in Singapore

Setting up a trust involves careful planning and professional execution. The typical process includes:

- Defining the Objectives — Is the goal succession, asset protection, charitable giving, or tax planning?

- Selecting the Trustee — Most HNW individuals opt for MAS-licensed professional trust companies to ensure independence and compliance.

- Drafting the Trust Deed — Legal counsel prepares a deed outlining powers, obligations, asset distribution rules, and successor provisions.

- Funding the Trust — Assets such as cash, property, shares, life insurance policies, or intellectual property are transferred to the trust.

- Ongoing Administration — Trustees manage investments, file accounts, and ensure compliance with Singapore’s regulatory framework.

6. Taxation of Trusts in Singapore

Singapore offers a clear and competitive tax environment for trusts:

- Trustee taxation: Trusts are taxed at a flat 17% rate on statutory income. However, trusts that distribute income to beneficiaries may be tax-transparent.

- Beneficiary taxation: Singapore-resident beneficiaries are taxed at their personal income tax rates. Non-resident beneficiaries are taxed via withholding at the trustee rate (unless exemptions apply).

- Capital gains and inheritance tax: There is no capital gains tax or estate duty in Singapore, making it an ideal jurisdiction for long-term wealth accumulation and intergenerational planning.

- Foreign-source income: May be exempt from Singapore tax under the foreign-sourced income exemption scheme (FSIE), provided certain conditions are met.

7. Risks, Compliance, and Governance

While trusts offer flexibility and protection, risks include:

- Improper structuring, leading to trust challenges or ineffective asset segregation

- Poor trustee selection, resulting in mismanagement or conflicts of interest

- Tax reporting failures, especially in cross-border structures, potentially leading to penalties

Mitigation involves clear legal drafting, use of professional licensed trustees, periodic trust reviews, and up-to-date reporting in line with MAS, IRAS, and international standards such as CRS and FATCA.

In 2025, the living trust remains one of the most powerful and flexible estate planning vehicles available in Singapore. With benefits ranging from probate avoidance and family governance to asset protection and global tax neutrality, living trusts are ideal for affluent individuals seeking control, continuity, and confidentiality.

However, success depends on precise structuring, proper execution, and ongoing compliance. Establishing a living trust is not simply a legal formality — it is a strategic financial decision that should align with broader estate, tax, and succession goals.

Professional advice from licensed trustees, legal counsel, and tax advisors is essential to navigate complexities and tailor the trust to your needs.

For families, entrepreneurs, and global investors alike, Singapore continues to offer a world-class jurisdiction for safeguarding wealth through living trusts.

However, success depends on precise structuring, proper execution, and ongoing compliance. Establishing a living trust is not simply a legal formality — it is a strategic financial decision that should align with broader estate, tax, and succession goals.

Professional advice from licensed trustees, legal counsel, and tax advisors is essential to navigate complexities and tailor the trust to your needs.

For families, entrepreneurs, and global investors alike, Singapore continues to offer a world-class jurisdiction for safeguarding wealth through living trusts.

FAQ

1. What is the difference between a living trust and a private trust?

A living trust is a type of private trust created during the settlor’s lifetime and becomes effective immediately upon funding. While all living trusts are private trusts, not all private trusts are living trusts — some are testamentary and take effect only upon death.

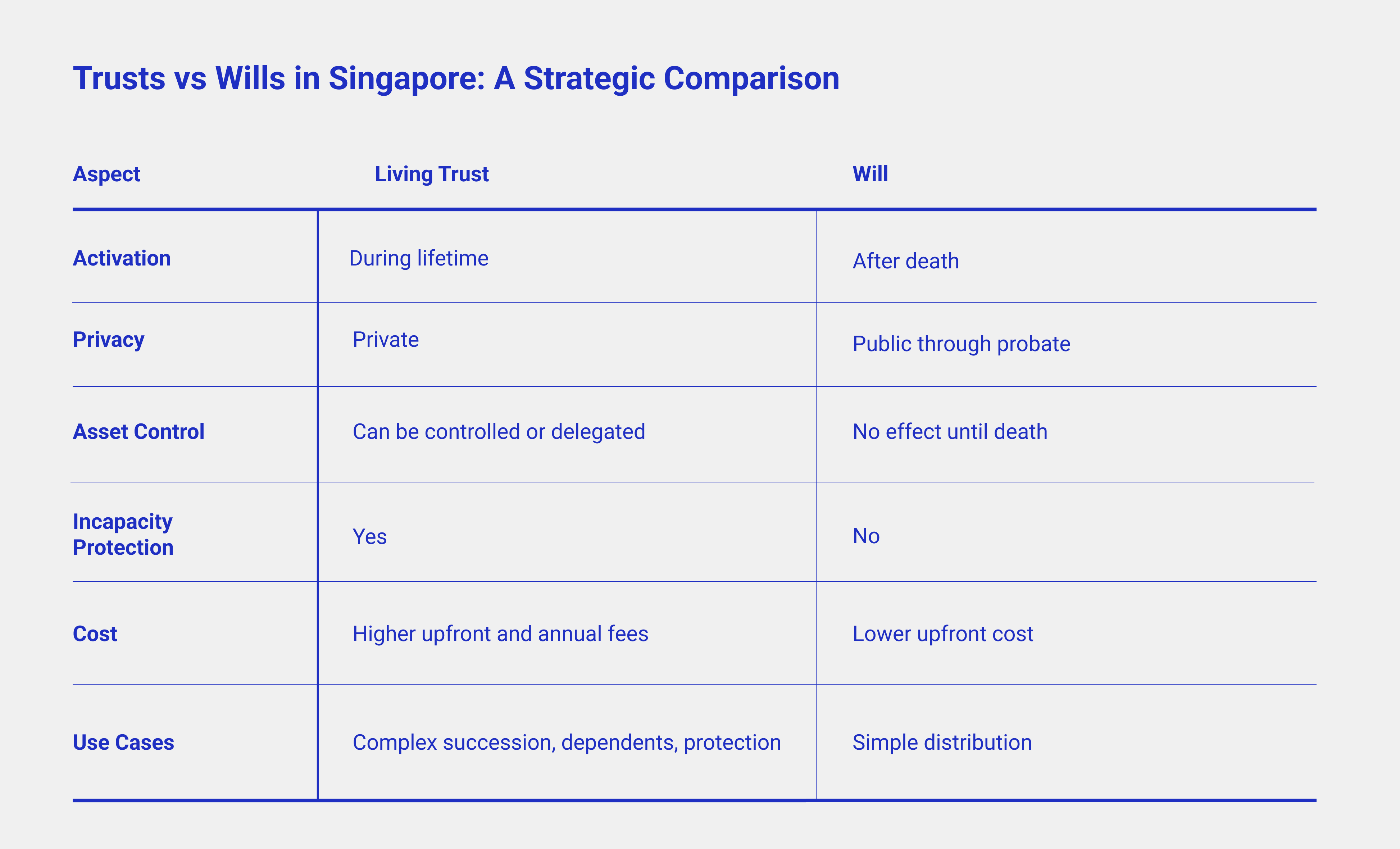

2. Is a living trust better than a will in Singapore?

That depends on your objectives. A will is simpler and more cost-effective for straightforward estates. However, a living trust provides greater flexibility, avoids probate, offers privacy, and ensures continuity in the event of incapacity — benefits particularly valuable for high-net-worth individuals and families with complex assets or cross-border holdings.

3. Can I be both the settlor and the trustee of my living trust?

Yes, in a revocable trust, the settlor can also serve as the initial trustee and retain full control. However, in irrevocable trusts (often used for asset protection or tax planning), it is advisable — and sometimes necessary — to appoint an independent trustee to preserve legal separation of assets.

4. How long does it take to set up a living trust in Singapore?

With standard assets and clear objectives, a living trust can typically be set up in 3 to 6 weeks. Complex structures involving multiple jurisdictions or regulatory considerations (e.g. FATCA/CRS compliance) may take longer.

5. What assets can I place into a living trust?

Almost any legal asset can be transferred into a trust, including:

- Bank deposits and investment portfolios

- Real estate (subject to conveyancing laws)

- Shares in private companies

- Insurance policies

- Intellectual property or digital assets

Note: Some assets, like CPF savings, cannot be placed in a trust under Singapore law.

6. Do I need to register my trust with the authorities?

Private trusts in Singapore do not require registration, and are not publicly disclosed. However, if administered by a licensed trust company, the trust is subject to MAS regulation and AML/KYC compliance.

7. What are the ongoing responsibilities of a trustee?

A trustee must act in the best interests of the beneficiaries, preserve and invest trust assets prudently, distribute according to the deed, maintain records, and comply with all regulatory and tax obligations. Professional trustees typically handle this on a fee basis.

8. What are the tax consequences for a Singapore trust in 2025?

Trusts are taxed at a flat rate of 17% on income retained by the trust. If income is distributed to beneficiaries, Singapore residents are taxed at their personal income tax rates, while non-residents may be taxed at the trustee level. Capital gains remain non-taxable in Singapore.

9. Can a foreigner set up a living trust in Singapore?

Yes. Foreign individuals frequently set up trusts in Singapore due to its strong legal framework, lack of estate duties, political stability, and professional trustee ecosystem. However, they should seek local legal and tax advice to ensure compliance with both Singaporean and home country laws.

10. What happens if the settlor becomes incapacitated?

In a living trust, especially a revocable trust, the trustee can continue managing assets without court intervention. This ensures continuity and avoids the need for a deputieship order under the Mental Capacity Act.

NB! The information provided in this article is for general informational purposes only and does not constitute legal advice. While we strive to ensure the content is accurate and up-to-date, it should not be relied upon as a substitute for professional consultation. For personalized advice or assistance with legal matters, please contact our specialists directly.

How We Can Help

- Relocation and Residency Assistance: Our relocation specialists guide you through the Global Investor Program (GIP) application process, helping secure permanent residency for you and your family, along with support for educational and healthcare arrangements.

- Investment and Market Insights: We connect you with opportunities in Singapore’s high-growth sectors, from tech to biotech, and provide insights on investment strategies to maximize returns in Singapore’s favorable tax environment.

- Wealth Transfer and Estate Planning: We assist in establishing trusts and foundations, ensuring seamless intergenerational wealth transfer without estate taxes, safeguarding your legacy.