What is a Trust and How Does It Work?

A trust is a legal structure that allows an individual, known as the settlor, to transfer assets to a trustee, who holds and manages them for the benefit of designated beneficiaries. The trustee is legally obligated to manage the assets according to the terms set by the settlor, ensuring that the wealth is preserved and distributed according to the settlor’s wishes.

Assets that can be placed in a trust include:

Example: A high-net-worth entrepreneur in Singapore sets up a trust to ensure his business assets are protected from legal claims and passed down efficiently to his children.

Why Do I Need to Create a Trust?

Trusts are widely used for estate planning, wealth preservation, and asset protection, especially by high-net-worth individuals and family offices. They provide long-term financial security and offer flexibility in managing wealth across generations.

Setting up a trust can provide numerous financial and strategic advantages, depending on your personal or business needs. Here are key reasons why establishing a trust might be beneficial:

How Trusts Can Benefit Families and Businesses

Trusts offer several benefits for individuals, families, and corporations. For families, trusts provide a structured approach to wealth transfer, reducing the risk of inheritance disputes and ensuring financial stability for future generations. They also allow for tax-efficient wealth preservation, especially for individuals with international assets.

For businesses, trusts serve as effective tools for managing corporate assets, protecting key investments, and ensuring smooth business continuity in case of unforeseen circumstances. Employee benefit trusts, for instance, are widely used by companies to manage stock options and pension schemes, providing financial security for employees while maintaining operational efficiency.

Another growing trend is the use of Singapore trusts for philanthropic giving. High-net-worth individuals and family offices increasingly set up charitable foundations through trusts, allowing them to contribute to meaningful social causes while benefiting from tax advantages.

Why Singapore is an Attractive Jurisdiction for Trusts

Singapore has established itself as a premier global financial center, making it one of the most sought-after jurisdictions for trust formation. Singapore provides a stable and reliable legal system based on common law principles, similar to those in the UK and Hong Kong. The country’s political stability, strong regulatory framework, and tax-friendly environment make it an ideal choice for individuals and businesses looking to safeguard their assets.

One of the key advantages of setting up a trust in Singapore is its legal and regulatory framework. The country enforces strict compliance and governance standards through the Monetary Authority of Singapore (MAS), which regulates licensed trust companies. This oversight ensures that trusts remain transparent and secure. Additionally, Singapore’s trust laws provide strong asset protection, ensuring that trust assets remain separate from a trustee’s personal estate and are safeguarded from potential legal claims or creditors.

Another reason why Singapore is an attractive destination for trusts is its tax benefits. Certain types of trusts enjoy tax exemptions on income derived from outside Singapore. Foreign trusts, for example, which are set up by non-resident settlors for non-resident beneficiaries, are exempt from tax on foreign-sourced income. Similarly, locally administered trusts managed by a licensed Singapore trust company can benefit from tax exemptions on non-trading income. Singapore also has no estate duty, capital gains tax, or inheritance tax, making it highly attractive for wealth structuring and succession planning.

Key Benefits of Setting Up a Trust in Singapore

Types of Trusts in Singapore and Their Uses

Trusts are widely used in Singapore for wealth protection, estate planning, tax efficiency, and corporate structuring. However, with multiple types of trusts available, choosing the right one depends on your specific financial goals, level of control, tax considerations, and legal flexibility.

In Singapore, trusts are categorized based on their purpose, distribution mechanisms, tax treatment, and the level of control retained by the settlor. These classifications often overlap, making it important to understand how each type functions.

A trust is a legal structure that allows an individual, known as the settlor, to transfer assets to a trustee, who holds and manages them for the benefit of designated beneficiaries. The trustee is legally obligated to manage the assets according to the terms set by the settlor, ensuring that the wealth is preserved and distributed according to the settlor’s wishes.

Assets that can be placed in a trust include:

- Cash

- Stocks and bonds

- Real estate

- Family businesses

- Intellectual property

- Art and collectibles

Example: A high-net-worth entrepreneur in Singapore sets up a trust to ensure his business assets are protected from legal claims and passed down efficiently to his children.

Why Do I Need to Create a Trust?

Trusts are widely used for estate planning, wealth preservation, and asset protection, especially by high-net-worth individuals and family offices. They provide long-term financial security and offer flexibility in managing wealth across generations.

Setting up a trust can provide numerous financial and strategic advantages, depending on your personal or business needs. Here are key reasons why establishing a trust might be beneficial:

- Asset Protection: Shields assets from legal claims, creditors, and disputes, ensuring long-term security.

- Wealth Preservation: Allows structured financial planning to maintain and grow wealth across generations.

- Tax Optimization: Helps reduce tax liabilities through strategic wealth distribution and tax-efficient structures.

- Succession Planning: Ensures smooth and controlled transfer of assets without lengthy probate processes.

- Privacy and Confidentiality: Unlike wills, trusts do not require public disclosure, keeping financial matters private.

- Business Continuity: Protects family businesses and key assets from ownership disputes or mismanagement.

- Philanthropy: Facilitates charitable giving and legacy planning through structured donations.

How Trusts Can Benefit Families and Businesses

Trusts offer several benefits for individuals, families, and corporations. For families, trusts provide a structured approach to wealth transfer, reducing the risk of inheritance disputes and ensuring financial stability for future generations. They also allow for tax-efficient wealth preservation, especially for individuals with international assets.

For businesses, trusts serve as effective tools for managing corporate assets, protecting key investments, and ensuring smooth business continuity in case of unforeseen circumstances. Employee benefit trusts, for instance, are widely used by companies to manage stock options and pension schemes, providing financial security for employees while maintaining operational efficiency.

Another growing trend is the use of Singapore trusts for philanthropic giving. High-net-worth individuals and family offices increasingly set up charitable foundations through trusts, allowing them to contribute to meaningful social causes while benefiting from tax advantages.

Why Singapore is an Attractive Jurisdiction for Trusts

Singapore has established itself as a premier global financial center, making it one of the most sought-after jurisdictions for trust formation. Singapore provides a stable and reliable legal system based on common law principles, similar to those in the UK and Hong Kong. The country’s political stability, strong regulatory framework, and tax-friendly environment make it an ideal choice for individuals and businesses looking to safeguard their assets.

One of the key advantages of setting up a trust in Singapore is its legal and regulatory framework. The country enforces strict compliance and governance standards through the Monetary Authority of Singapore (MAS), which regulates licensed trust companies. This oversight ensures that trusts remain transparent and secure. Additionally, Singapore’s trust laws provide strong asset protection, ensuring that trust assets remain separate from a trustee’s personal estate and are safeguarded from potential legal claims or creditors.

Another reason why Singapore is an attractive destination for trusts is its tax benefits. Certain types of trusts enjoy tax exemptions on income derived from outside Singapore. Foreign trusts, for example, which are set up by non-resident settlors for non-resident beneficiaries, are exempt from tax on foreign-sourced income. Similarly, locally administered trusts managed by a licensed Singapore trust company can benefit from tax exemptions on non-trading income. Singapore also has no estate duty, capital gains tax, or inheritance tax, making it highly attractive for wealth structuring and succession planning.

Key Benefits of Setting Up a Trust in Singapore

- Strong Legal Framework: Trusts are governed by well-defined laws and regulations, ensuring transparency and compliance.

- Asset Protection: Trust assets are shielded from lawsuits, creditors, and matrimonial disputes.

- Tax Efficiency: Certain Singapore trusts enjoy exemptions from capital gains tax, estate duty, and inheritance tax.

- Privacy: Trusts in Singapore do not require public disclosure, making them an attractive option for discreet wealth management.

Types of Trusts in Singapore and Their Uses

Trusts are widely used in Singapore for wealth protection, estate planning, tax efficiency, and corporate structuring. However, with multiple types of trusts available, choosing the right one depends on your specific financial goals, level of control, tax considerations, and legal flexibility.

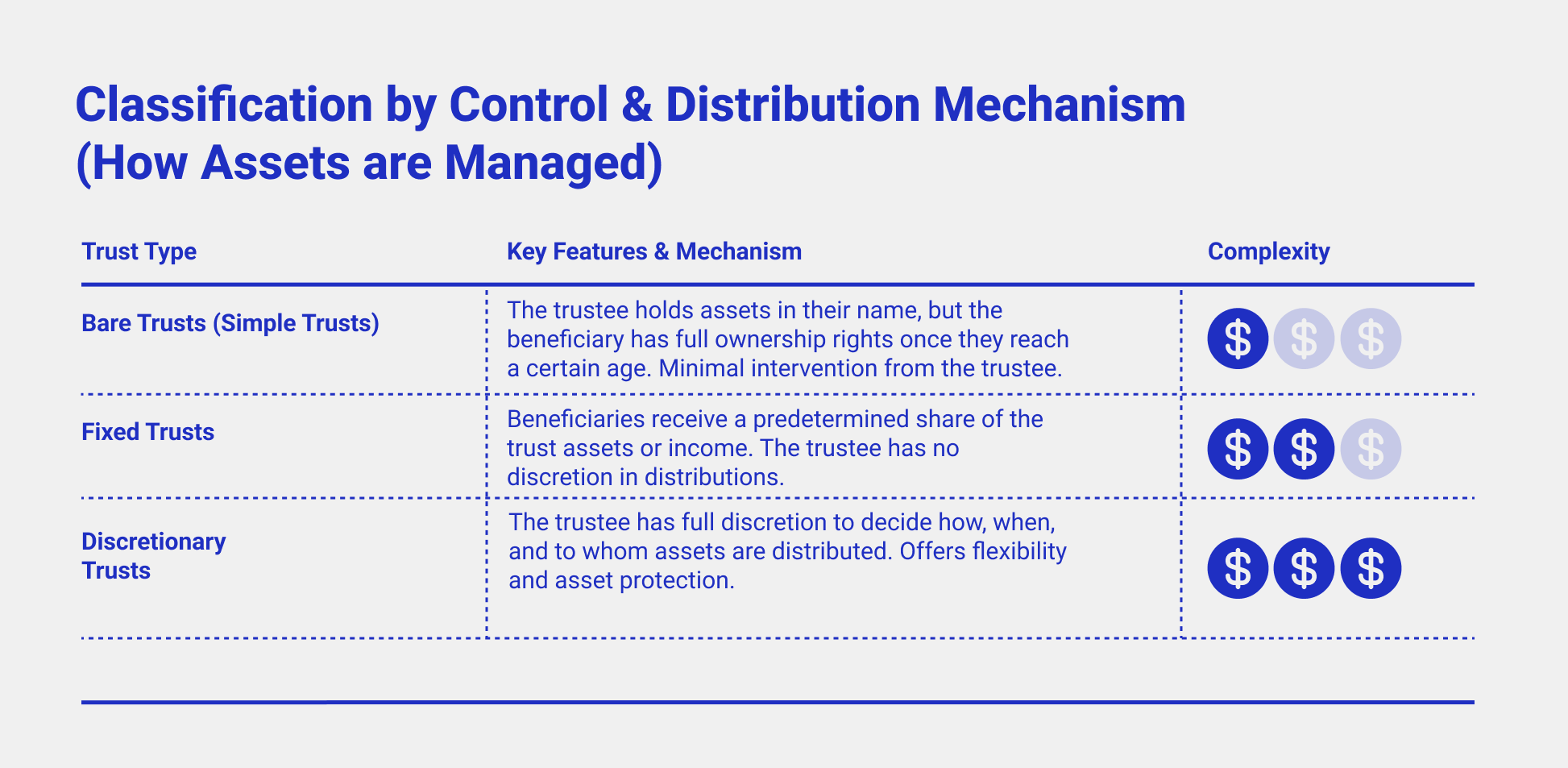

In Singapore, trusts are categorized based on their purpose, distribution mechanisms, tax treatment, and the level of control retained by the settlor. These classifications often overlap, making it important to understand how each type functions.

Setting Up a Trust in Singapore: What You Need to Know

Establishing a trust in Singapore involves careful planning and legal structuring. The process begins with defining the objectives of the trust, selecting the right type of trust, and appointing a trustee. The trustee plays a crucial role in managing the trust assets and ensuring compliance with legal and fiduciary responsibilities. In Singapore, trust companies must be licensed by MAS, which enforces strict capital requirements and governance standards to maintain investor confidence.

Establishing a trust in Singapore requires careful planning and legal structuring. The process includes:

Why Trusts in Singapore Offer a Smart Wealth Planning Strategy

Singapore’s reputation as a secure and well-regulated financial hub makes it one of the best places in the world to set up a trust. Whether for asset protection, estate planning, corporate structuring, or philanthropy, trusts provide a flexible and highly effective means of managing wealth.

With strong legal protections, favorable tax policies, and a stable economic environment, Singapore continues to attract individuals and businesses seeking to secure their financial future. Those considering setting up a trust should consult with licensed professionals to tailor a trust structure that aligns with their long-term goals and financial planning needs.

Frequently Asked Questions (FAQs)

1. How much does it cost to set up a trust in Singapore?

The cost varies depending on the complexity of the trust and the trustee’s fees. Expect to pay from SGD 15,000 for initial setup, with annual maintenance fees.

2. Can foreigners set up a trust in Singapore?

Yes. Non-residents can establish foreign trusts, benefiting from Singapore's tax exemptions on foreign-sourced income.

3. How long does the process take?

Setting up a trust typically takes at least 2-4 weeks and longer, depending on the legal complexity of the case and assets.

Take control of your financial future today! Whether you're looking to protect your wealth, ensure smooth succession planning, or maximize tax efficiency, a trust in Singapore is a smart and strategic solution. Contact our specialists now for a free consultation and start planning for a secure tomorrow!

NB! The information provided in this article is for general informational purposes only and does not constitute legal advice. While we strive to ensure the content is accurate and up-to-date, it should not be relied upon as a substitute for professional consultation. For personalized advice or assistance with legal matters, please contact our specialists directly.

Establishing a trust in Singapore involves careful planning and legal structuring. The process begins with defining the objectives of the trust, selecting the right type of trust, and appointing a trustee. The trustee plays a crucial role in managing the trust assets and ensuring compliance with legal and fiduciary responsibilities. In Singapore, trust companies must be licensed by MAS, which enforces strict capital requirements and governance standards to maintain investor confidence.

Establishing a trust in Singapore requires careful planning and legal structuring. The process includes:

- Define Your Objectives: Identify the purpose of setting up the trust (asset protection, wealth management, tax efficiency, etc.).

- Choose the Right Type of Trust: Select a structure that aligns with your goals.

- Appoint a Trustee: Choose between a licensed trust company or a private individual.

- Draft the Trust Deed: Clearly outline how the trust should be managed, including rules for asset distribution.

- Ensure Compliance: Trust companies in Singapore must be licensed by the Monetary Authority of Singapore (MAS).

- Fund the Trust: Transfer assets into the trust to activate its provisions.

- Establish Governance Rules: Define trustee responsibilities, investment policies, and mechanisms for conflict resolution.

- Review and Update Regularly: Periodically assess the trust structure to align with changing legal, financial, or family circumstances.

Why Trusts in Singapore Offer a Smart Wealth Planning Strategy

Singapore’s reputation as a secure and well-regulated financial hub makes it one of the best places in the world to set up a trust. Whether for asset protection, estate planning, corporate structuring, or philanthropy, trusts provide a flexible and highly effective means of managing wealth.

With strong legal protections, favorable tax policies, and a stable economic environment, Singapore continues to attract individuals and businesses seeking to secure their financial future. Those considering setting up a trust should consult with licensed professionals to tailor a trust structure that aligns with their long-term goals and financial planning needs.

Frequently Asked Questions (FAQs)

1. How much does it cost to set up a trust in Singapore?

The cost varies depending on the complexity of the trust and the trustee’s fees. Expect to pay from SGD 15,000 for initial setup, with annual maintenance fees.

2. Can foreigners set up a trust in Singapore?

Yes. Non-residents can establish foreign trusts, benefiting from Singapore's tax exemptions on foreign-sourced income.

3. How long does the process take?

Setting up a trust typically takes at least 2-4 weeks and longer, depending on the legal complexity of the case and assets.

Take control of your financial future today! Whether you're looking to protect your wealth, ensure smooth succession planning, or maximize tax efficiency, a trust in Singapore is a smart and strategic solution. Contact our specialists now for a free consultation and start planning for a secure tomorrow!

NB! The information provided in this article is for general informational purposes only and does not constitute legal advice. While we strive to ensure the content is accurate and up-to-date, it should not be relied upon as a substitute for professional consultation. For personalized advice or assistance with legal matters, please contact our specialists directly.

How We Can Help

- Relocation and Residency Assistance: Our relocation specialists guide you through the Global Investor Program (GIP) application process, helping secure permanent residency for you and your family, along with support for educational and healthcare arrangements.

- Investment and Market Insights: We connect you with opportunities in Singapore’s high-growth sectors, from tech to biotech, and provide insights on investment strategies to maximize returns in Singapore’s favorable tax environment.

- Wealth Transfer and Estate Planning: We assist in establishing trusts and foundations, ensuring seamless intergenerational wealth transfer without estate taxes, safeguarding your legacy.