At the heart of Budget 2025 (SG60 Budget), aptly themed “Onward together for a better tomorrow”, is a strong push for business productivity and innovation. With a significant top-up to the National Productivity Fund and the creation of a Private Credit Growth Fund, the government is providing enterprises with enhanced financial tools to drive competitiveness and scale operations. These measures will empower companies to invest in technological advancements, workforce upskilling, and global expansion—crucial elements for sustained growth.

Tax incentives play a central role in alleviating business costs and fostering a dynamic corporate landscape. The 50% corporate income tax rebate, coupled with cash grants, offers immediate financial relief, while new tax incentives for public listings encourage companies to tap into Singapore’s robust capital markets. The enhanced Enterprise Financing Scheme (EFS) provides expanded access to capital, particularly for SMEs and high-growth sectors.

Beyond direct financial support, targeted measures for key industries—such as R&D, finance, maritime, and infrastructure—reinforce Singapore’s position as a global business hub. The extension of the Land Intensification Allowance (LIA) scheme and refinements to infrastructure finance tax incentives demonstrate a commitment to long-term economic transformation.

With a strategic increase in government spending to reach 20% of GDP by 2030, Singapore is not just supporting businesses today but laying the groundwork for the next wave of economic expansion. These measures provide stability, competitiveness, and opportunity, ensuring that businesses—whether startups, SMEs, or large enterprises—can confidently invest, expand, and innovate in the years ahead.

Tax Incentives

To strengthen Singapore’s equities market, the Equities Market Review Group was established on August 2, 2024, by the Monetary Authority of Singapore (MAS) to develop recommendations for enhancing market growth and increasing corporate and business trust listings on the Singapore Exchange (SGX). The Government has fully adopted its recommendations and is introducing a range of measures, including tax incentives, to enhance the attractiveness of listing in Singapore.

These initiatives include:

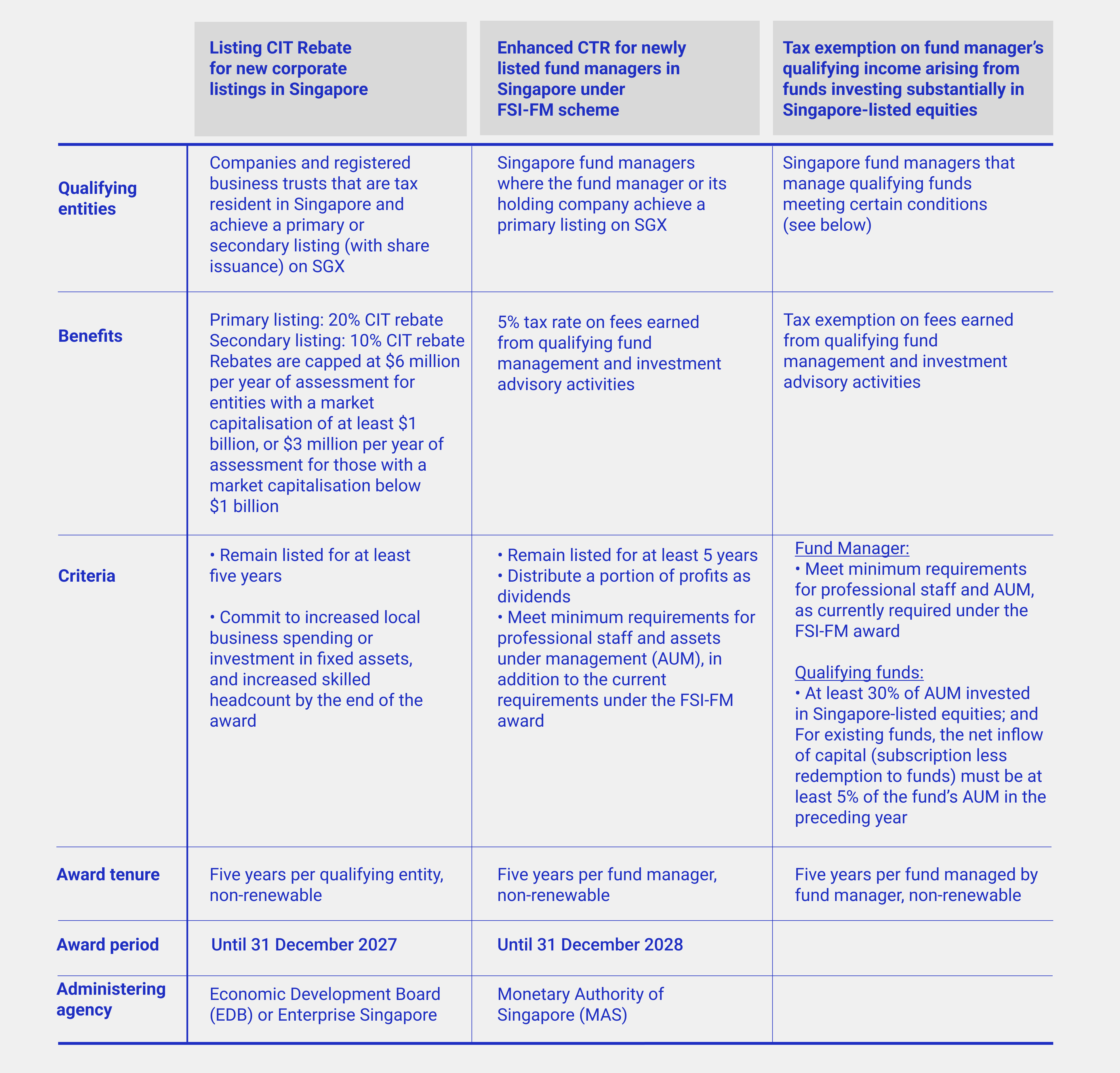

Singapore’s Budget 2025 introduces key incentives to enhance the appeal of listing on the Singapore Exchange (SGX). Companies seeking primary listings can benefit from a 20% corporate tax rebate, while secondary listings qualify for a 10% rebate, both subject to caps. However, REITs are generally ineligible due to their entity structure.

To further support listings, the GEMS grant offers funding to cover up to 70% of listing-related costs, capped at $2 million for companies with a market capitalization of at least $1 billion and $1 million for smaller firms. Combined with the Listing CIT Rebate, eligible companies could secure up to $32 million in support over five years—a significant incentive to list in Singapore.

For fund managers, a 5% tax rate on qualifying income and tax exemptions for investments in SGX-listed equities aim to enhance shareholder returns and market liquidity. However, these incentives are non-renewable after five years, requiring careful financial planning.

Additionally, new tax deductions for equity-based remuneration should attract high-growth companies relying on stock option plans for talent retention. The broader reforms in Budget 2025, alongside upcoming non-tax initiatives, reinforce Singapore’s commitment to strengthening its equities market and positioning itself as a global fund management hub.

Tax incentives play a central role in alleviating business costs and fostering a dynamic corporate landscape. The 50% corporate income tax rebate, coupled with cash grants, offers immediate financial relief, while new tax incentives for public listings encourage companies to tap into Singapore’s robust capital markets. The enhanced Enterprise Financing Scheme (EFS) provides expanded access to capital, particularly for SMEs and high-growth sectors.

Beyond direct financial support, targeted measures for key industries—such as R&D, finance, maritime, and infrastructure—reinforce Singapore’s position as a global business hub. The extension of the Land Intensification Allowance (LIA) scheme and refinements to infrastructure finance tax incentives demonstrate a commitment to long-term economic transformation.

With a strategic increase in government spending to reach 20% of GDP by 2030, Singapore is not just supporting businesses today but laying the groundwork for the next wave of economic expansion. These measures provide stability, competitiveness, and opportunity, ensuring that businesses—whether startups, SMEs, or large enterprises—can confidently invest, expand, and innovate in the years ahead.

Tax Incentives

To strengthen Singapore’s equities market, the Equities Market Review Group was established on August 2, 2024, by the Monetary Authority of Singapore (MAS) to develop recommendations for enhancing market growth and increasing corporate and business trust listings on the Singapore Exchange (SGX). The Government has fully adopted its recommendations and is introducing a range of measures, including tax incentives, to enhance the attractiveness of listing in Singapore.

These initiatives include:

- Corporate Income Tax (CIT) Rebate for newly listed companies in Singapore

- Reduced Concessionary Tax Rate (CTR) for newly listed fund managers under the Financial Sector Incentive – Fund Management (FSI-FM) scheme

- Tax exemption on qualifying income earned by fund managers from investments primarily in Singapore-listed equities, also under the FSI-FM scheme.

Singapore’s Budget 2025 introduces key incentives to enhance the appeal of listing on the Singapore Exchange (SGX). Companies seeking primary listings can benefit from a 20% corporate tax rebate, while secondary listings qualify for a 10% rebate, both subject to caps. However, REITs are generally ineligible due to their entity structure.

To further support listings, the GEMS grant offers funding to cover up to 70% of listing-related costs, capped at $2 million for companies with a market capitalization of at least $1 billion and $1 million for smaller firms. Combined with the Listing CIT Rebate, eligible companies could secure up to $32 million in support over five years—a significant incentive to list in Singapore.

For fund managers, a 5% tax rate on qualifying income and tax exemptions for investments in SGX-listed equities aim to enhance shareholder returns and market liquidity. However, these incentives are non-renewable after five years, requiring careful financial planning.

Additionally, new tax deductions for equity-based remuneration should attract high-growth companies relying on stock option plans for talent retention. The broader reforms in Budget 2025, alongside upcoming non-tax initiatives, reinforce Singapore’s commitment to strengthening its equities market and positioning itself as a global fund management hub.

Tax Deduction Enhancements for Employee Equity-Based Remuneration (EEBR) Schemes

Currently, companies can claim tax deductions on costs incurred when acquiring treasury shares for employee equity-based remuneration (EEBR) schemes. This applies both to a company’s own shares and treasury shares of a holding company transferred through a special purpose vehicle (SPV). However, no deduction has been available when new shares were issued under EEBR schemes.

Budget 2025 introduces a key enhancement—companies will now be able to claim tax deductions even when payments are made to a holding company or SPV for issuing new shares under EEBR schemes. The deductible amount will be the lower of:

This new tax deduction takes effect from Year of Assessment 2026 and aligns Singapore’s policies with jurisdictions like Hong Kong and the UK, where similar deductions are available. However, it remains uncertain whether tax relief will be extended to companies issuing their own shares to employees, which could be crucial for startups and high-growth businesses relying on EEBR schemes.

Further details, including potential valuation requirements for unlisted shares, will be provided by the Inland Revenue Authority of Singapore (IRAS) by Q3 2025.

Enhancements to the Enterprise Financing Scheme (EFS) in Budget 2025

Budget 2025 introduces key enhancements to the Enterprise Financing Scheme (EFS) to support international expansion and mergers & acquisitions (M&As) for Singapore-based businesses:

The updated EFS aims to reduce financial burdens while allowing SMEs to grow and compete on a global scale through strategic acquisitions. Trade Associations and Chambers (TACs) are expected to play a role in supporting businesses by providing advisory services and connecting SMEs with professional guidance on inorganic growth strategies and diverse financing solutions.

Private Credit Growth Fund: A New Financing Alternative

In addition to EFS enhancements, the Government has announced a $1 billion Private Credit Growth Fund to fill financing gaps for high-potential Singapore companies that may not qualify for bank loans. This fund provides a cost-effective and flexible financing alternative, particularly for technology-driven and scalable businesses.

Expanding awareness of private credit options will broaden Singapore’s capital market, attract more private credit funds, and reinforce Singapore’s position as a global financing hub for fast-growing enterprises. These initiatives collectively contribute to a stronger, more dynamic business environment.

New Tax Deduction for Collaborative Innovation in Budget 2025

Budget 2025 introduces a new tax deduction to encourage collaborative innovation, effective from 19 February 2025. Businesses can now claim deductions on payments made under approved cost-sharing agreements for innovation activities.

Unlike traditional R&D tax incentives, which follow a narrow definition under Singapore’s Income Tax Act, this initiative adopts a broader approach, referencing internationally recognized Oslo Manual 2018 guidelines. This could allow a wider range of innovation activities to qualify, fostering partnerships and co-development efforts across industries.

The Economic Development Board (EDB) will release further details on eligibility and approval processes by Q2 2025. Businesses should review their existing and planned innovation projects to identify opportunities to benefit from this expanded tax incentive framework.

Supporting Workforce Transformation Through Skills Development and AI Adoption

Budget 2025 introduces key enhancements to workforce upskilling and job redesign initiatives, making it easier for businesses, especially SMEs, to invest in employee development. The revamped SkillsFuture Enterprise Credit transitions from a reimbursement model to a wallet-based system, simplifying access to funding for skills training. Meanwhile, the new SkillsFuture Workforce Development Grant consolidates multiple schemes, streamlining the application process and reducing administrative friction for employers.

The SkillsFuture Level-Up Programme now covers part-time programmes, and additional funding for company-led training initiatives under the NTUC Company Training Committee (CTC) Grant expands opportunities for customized upskilling. These measures emphasize lifelong learning as a critical driver of both individual career growth and national economic resilience.

Singapore’s proactive approach to job redesign is also evident in efforts to help businesses adapt to technological disruptions. The PwC 2024 Global AI Jobs Barometer ranked Singapore among the top countries impacted by AI-driven changes. To maximize AI’s productivity potential, companies must rethink workflows, job roles, and automation strategies. The Productivity Solutions Grant supports AI adoption, while the new SkillsFuture Workforce Development Grant offers up to 70% funding for job redesign activities, helping businesses integrate AI effectively.

NB! The information provided in this article is for general informational purposes only and does not constitute legal advice. While we strive to ensure the content is accurate and up-to-date, it should not be relied upon as a substitute for professional consultation. For personalized advice or assistance with legal matters, please contact our specialists directly.

Currently, companies can claim tax deductions on costs incurred when acquiring treasury shares for employee equity-based remuneration (EEBR) schemes. This applies both to a company’s own shares and treasury shares of a holding company transferred through a special purpose vehicle (SPV). However, no deduction has been available when new shares were issued under EEBR schemes.

Budget 2025 introduces a key enhancement—companies will now be able to claim tax deductions even when payments are made to a holding company or SPV for issuing new shares under EEBR schemes. The deductible amount will be the lower of:

- The amount paid by the company, or

- The fair market value (or net asset value, if market value is unavailable) of the shares at the time they are allocated to employees, minus any employee contributions.

This new tax deduction takes effect from Year of Assessment 2026 and aligns Singapore’s policies with jurisdictions like Hong Kong and the UK, where similar deductions are available. However, it remains uncertain whether tax relief will be extended to companies issuing their own shares to employees, which could be crucial for startups and high-growth businesses relying on EEBR schemes.

Further details, including potential valuation requirements for unlisted shares, will be provided by the Inland Revenue Authority of Singapore (IRAS) by Q3 2025.

Enhancements to the Enterprise Financing Scheme (EFS) in Budget 2025

Budget 2025 introduces key enhancements to the Enterprise Financing Scheme (EFS) to support international expansion and mergers & acquisitions (M&As) for Singapore-based businesses:

- Higher Loan Limits – The EFS-Trade Loan cap has been permanently raised from $5 million to $10 million, providing businesses with greater access to trade financing amid rising costs and larger deal opportunities.

- Expanded Scope – The EFS now includes targeted asset acquisitions, recognizing that businesses may opt for asset purchases as an alternative to equity acquisitions. This provides greater flexibility for SMEs looking to expand internationally while managing financial risks more effectively.

The updated EFS aims to reduce financial burdens while allowing SMEs to grow and compete on a global scale through strategic acquisitions. Trade Associations and Chambers (TACs) are expected to play a role in supporting businesses by providing advisory services and connecting SMEs with professional guidance on inorganic growth strategies and diverse financing solutions.

Private Credit Growth Fund: A New Financing Alternative

In addition to EFS enhancements, the Government has announced a $1 billion Private Credit Growth Fund to fill financing gaps for high-potential Singapore companies that may not qualify for bank loans. This fund provides a cost-effective and flexible financing alternative, particularly for technology-driven and scalable businesses.

Expanding awareness of private credit options will broaden Singapore’s capital market, attract more private credit funds, and reinforce Singapore’s position as a global financing hub for fast-growing enterprises. These initiatives collectively contribute to a stronger, more dynamic business environment.

New Tax Deduction for Collaborative Innovation in Budget 2025

Budget 2025 introduces a new tax deduction to encourage collaborative innovation, effective from 19 February 2025. Businesses can now claim deductions on payments made under approved cost-sharing agreements for innovation activities.

Unlike traditional R&D tax incentives, which follow a narrow definition under Singapore’s Income Tax Act, this initiative adopts a broader approach, referencing internationally recognized Oslo Manual 2018 guidelines. This could allow a wider range of innovation activities to qualify, fostering partnerships and co-development efforts across industries.

The Economic Development Board (EDB) will release further details on eligibility and approval processes by Q2 2025. Businesses should review their existing and planned innovation projects to identify opportunities to benefit from this expanded tax incentive framework.

Supporting Workforce Transformation Through Skills Development and AI Adoption

Budget 2025 introduces key enhancements to workforce upskilling and job redesign initiatives, making it easier for businesses, especially SMEs, to invest in employee development. The revamped SkillsFuture Enterprise Credit transitions from a reimbursement model to a wallet-based system, simplifying access to funding for skills training. Meanwhile, the new SkillsFuture Workforce Development Grant consolidates multiple schemes, streamlining the application process and reducing administrative friction for employers.

The SkillsFuture Level-Up Programme now covers part-time programmes, and additional funding for company-led training initiatives under the NTUC Company Training Committee (CTC) Grant expands opportunities for customized upskilling. These measures emphasize lifelong learning as a critical driver of both individual career growth and national economic resilience.

Singapore’s proactive approach to job redesign is also evident in efforts to help businesses adapt to technological disruptions. The PwC 2024 Global AI Jobs Barometer ranked Singapore among the top countries impacted by AI-driven changes. To maximize AI’s productivity potential, companies must rethink workflows, job roles, and automation strategies. The Productivity Solutions Grant supports AI adoption, while the new SkillsFuture Workforce Development Grant offers up to 70% funding for job redesign activities, helping businesses integrate AI effectively.

NB! The information provided in this article is for general informational purposes only and does not constitute legal advice. While we strive to ensure the content is accurate and up-to-date, it should not be relied upon as a substitute for professional consultation. For personalized advice or assistance with legal matters, please contact our specialists directly.

How we can help:

Company Incorporation & Business Setup – We assist businesses with company registration, structuring, and licensing in Singapore, ensuring full compliance with ACRA and MAS regulations.

Corporate Tax & Compliance Advisory – We help businesses leverage corporate income tax rebates, deductions, and incentive schemes, ensuring tax efficiency and compliance

Regulatory & Licensing Assistance – We guide businesses through the process of obtaining sector-specific licenses and ensuring compliance with MAS, IRAS, and other regulatory bodies, minimizing operational risks.

Enterprise Financing & Grant Support – We help businesses access Enterprise Financing Scheme (EFS), Private Credit Growth Fund, and SkillsFuture grants, aligning funding opportunities with business growth strategies.

Company Incorporation & Business Setup – We assist businesses with company registration, structuring, and licensing in Singapore, ensuring full compliance with ACRA and MAS regulations.

Corporate Tax & Compliance Advisory – We help businesses leverage corporate income tax rebates, deductions, and incentive schemes, ensuring tax efficiency and compliance

Regulatory & Licensing Assistance – We guide businesses through the process of obtaining sector-specific licenses and ensuring compliance with MAS, IRAS, and other regulatory bodies, minimizing operational risks.

Enterprise Financing & Grant Support – We help businesses access Enterprise Financing Scheme (EFS), Private Credit Growth Fund, and SkillsFuture grants, aligning funding opportunities with business growth strategies.