Singapore has long been recognized as one of Asia’s top startup hubs, thanks to its pro-business policies, strategic location, and robust legal framework. A key factor contributing to this status is the favorable tax regime, overseen by the Inland Revenue Authority of Singapore (IRAS) and backed by ongoing government initiatives. However, 2025 promises significant changes in international tax regulations—particularly with the OECD’s Pillar Two minimum tax—which may indirectly affect even smaller startups.

This article explores key tax exemptions and upcoming adjustments relevant to startups in Singapore, offering practical strategies to optimize tax savings. We focus on:

Tax Exemption Scheme for New Start-up Companies (SUTE)

The official name used by IRAS (Singapore’s tax authority) is the “Tax Exemption Scheme for New Start-up Companies,” sometimes referred to in full as the “Start-Up Tax Exemption Scheme.” In practice, however, many consultants, auditing firms, and law offices simply abbreviate it to “SUTE” for convenience. This scheme provides substantial corporate tax relief to newly incorporated Singapore companies (that meet specific criteria) during their first three Years of Assessment (YAs). Currently, qualifying startups can receive a 75% exemption on the first S$100,000 of chargeable income and a 50% exemption on the next S$100,000, effectively reducing their tax payable and easing cash flow constraints in the crucial early stages of operation.

Partial Tax Exemption (PTE)

Partial Tax Exemption (PTE) is a scheme designed for companies in Singapore that do not qualify for, or have already exhausted, the Start-Up Tax Exemption (SUTE). Under PTE, a portion of the company’s taxable income is exempted from corporate tax, reducing the overall tax payable. Specifically, companies are granted a 75% exemption on the first S$10,000 of normal chargeable income and a 50% exemption on the next S$190,000. This arrangement ensures that both newer and more established small to medium enterprises (SMEs) can continue to benefit from a lower effective tax rate, provided they meet the relevant eligibility criteria.

Enterprise Innovation Scheme (EIS)

The Enterprise Innovation Scheme (EIS) is a Singapore government initiative aimed at driving innovation, research, and development among local businesses. Under EIS, qualifying expenditures—such as R&D costs, intellectual property (IP) acquisitions, and workforce training—may be eligible for enhanced tax deductions, sometimes as high as 400%. This scheme complements existing incentives like the Start-Up Tax Exemption (SUTE) and Partial Tax Exemption (PTE), enabling companies to further lower their tax liability by actively investing in new technologies, processes, or upskilling programs. By combining EIS with other incentives, businesses can more effectively reduce their chargeable income and channel extra funds into growth-oriented projects.

We also provide actionable recommendations to help founders navigate these changes effectively.

This article explores key tax exemptions and upcoming adjustments relevant to startups in Singapore, offering practical strategies to optimize tax savings. We focus on:

- Start-Up Tax Exemption (SUTE) and its 2025 updates

- Partial Tax Exemption (PTE) for SMEs

- Enterprise Innovation Scheme (EIS) and R&D deductions

- Global Minimum Tax (Pillar Two) and its potential impact on startups

Tax Exemption Scheme for New Start-up Companies (SUTE)

The official name used by IRAS (Singapore’s tax authority) is the “Tax Exemption Scheme for New Start-up Companies,” sometimes referred to in full as the “Start-Up Tax Exemption Scheme.” In practice, however, many consultants, auditing firms, and law offices simply abbreviate it to “SUTE” for convenience. This scheme provides substantial corporate tax relief to newly incorporated Singapore companies (that meet specific criteria) during their first three Years of Assessment (YAs). Currently, qualifying startups can receive a 75% exemption on the first S$100,000 of chargeable income and a 50% exemption on the next S$100,000, effectively reducing their tax payable and easing cash flow constraints in the crucial early stages of operation.

Partial Tax Exemption (PTE)

Partial Tax Exemption (PTE) is a scheme designed for companies in Singapore that do not qualify for, or have already exhausted, the Start-Up Tax Exemption (SUTE). Under PTE, a portion of the company’s taxable income is exempted from corporate tax, reducing the overall tax payable. Specifically, companies are granted a 75% exemption on the first S$10,000 of normal chargeable income and a 50% exemption on the next S$190,000. This arrangement ensures that both newer and more established small to medium enterprises (SMEs) can continue to benefit from a lower effective tax rate, provided they meet the relevant eligibility criteria.

Enterprise Innovation Scheme (EIS)

The Enterprise Innovation Scheme (EIS) is a Singapore government initiative aimed at driving innovation, research, and development among local businesses. Under EIS, qualifying expenditures—such as R&D costs, intellectual property (IP) acquisitions, and workforce training—may be eligible for enhanced tax deductions, sometimes as high as 400%. This scheme complements existing incentives like the Start-Up Tax Exemption (SUTE) and Partial Tax Exemption (PTE), enabling companies to further lower their tax liability by actively investing in new technologies, processes, or upskilling programs. By combining EIS with other incentives, businesses can more effectively reduce their chargeable income and channel extra funds into growth-oriented projects.

We also provide actionable recommendations to help founders navigate these changes effectively.

Scenario Context

Imagine you’re founding a Singapore-based tech startup, “AlphaTech Pte. Ltd.”, in 2025.

You anticipate:

Your aims:

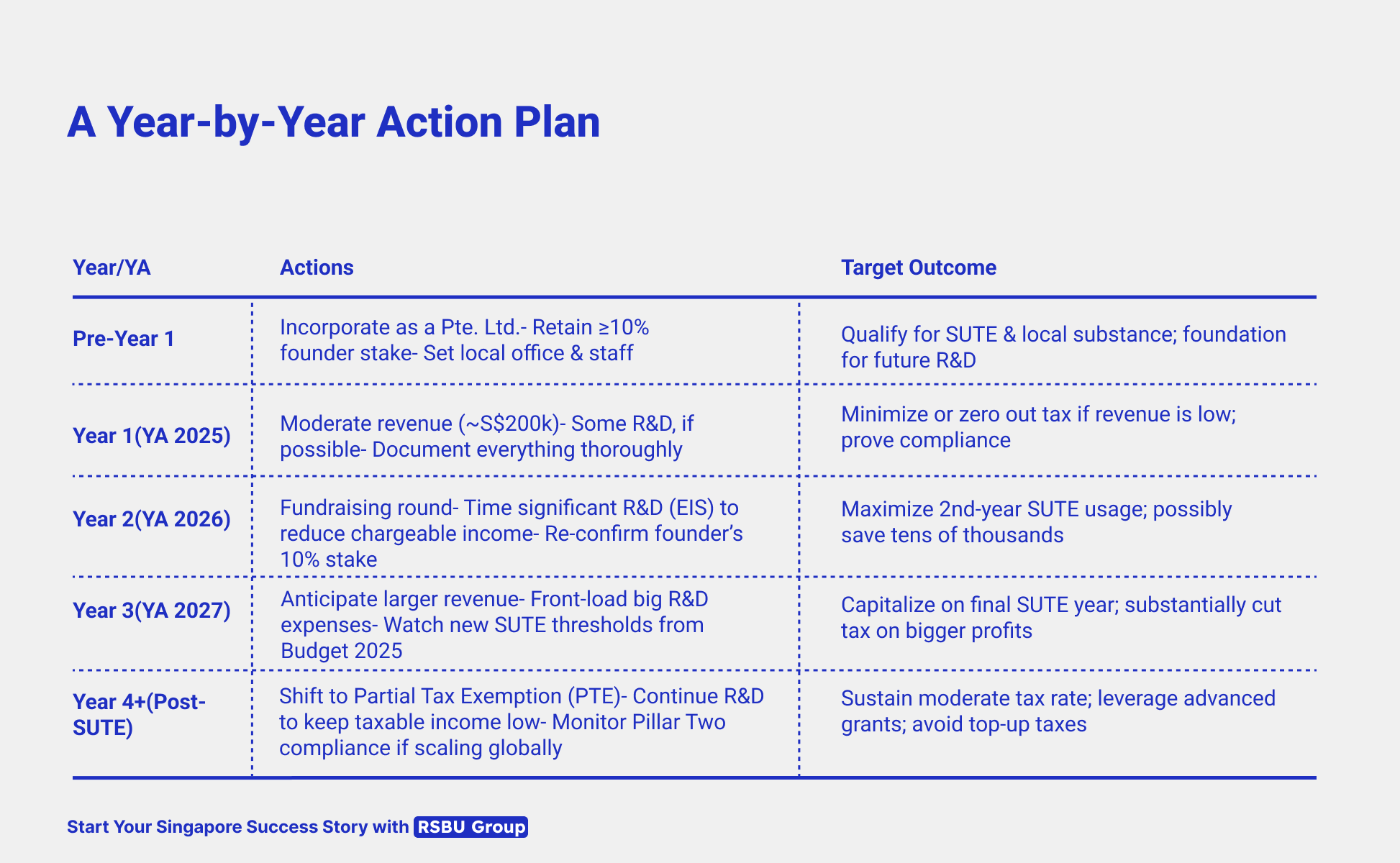

Below, we illustrate a multi-stage plan, showing how you might sequence expenses, maintain shareholding structures, and secure local substance to maximize Singapore’s tax benefits.

Imagine you’re founding a Singapore-based tech startup, “AlphaTech Pte. Ltd.”, in 2025.

You anticipate:

- Year 1 (YA 2025): Modest revenue (~S$200,000) but high initial expenses (product development, small team).

- Year 2 (YA 2026): Rapid revenue growth (~S$600,000) as your MVP gains traction.

- Year 3 (YA 2027): Major funding round; revenues could top S$1.2 million, but also bigger R&D costs.

Your aims:

- Qualify for SUTE during the first three YAs.

- Offset as much chargeable income as possible via R&D incentives and other grants.

- Prepare for any Budget 2025 changes or Pillar Two (if relevant).

Below, we illustrate a multi-stage plan, showing how you might sequence expenses, maintain shareholding structures, and secure local substance to maximize Singapore’s tax benefits.

Foundational Setup (Incorporation through Year 1)

Key Actions Before or Upon Incorporation

1.Ensure SUTE Eligibility:

2.Establish Local Substance:

3.Plan R&D Activities:

Result by End of Year 1 (YA 2025)

Even if the government reduces the top SUTE threshold in Budget 2025 (say from S$100,000 to S$80,000), your first-year profit may still fall under the new cap, so your effective tax rate remains low or near zero.

Key Actions Before or Upon Incorporation

1.Ensure SUTE Eligibility:

- Incorporate as a private limited (tax-resident) company.

- Keep no more than 20 shareholders, with at least one individual (likely you or a co-founder) holding ≥10%.

- Avoid purely investment-holding models if your core business is technology or services; pure holding companies are usually excluded from SUTE.

2.Establish Local Substance:

- Register a local office address and ensure key management decisions happen in Singapore.

- Consider hiring at least 1–2 local employees (if Budget 2025 tightens SUTE criteria for local operations, you’ll already comply).

3.Plan R&D Activities:

- Map out initial R&D costs. If your product dev is significant, you might qualify for Enterprise Innovation Scheme (EIS), offering enhanced deductions (up to 400%).

- The more you reduce your chargeable income via R&D, the smaller your final tax bill after SUTE.

Result by End of Year 1 (YA 2025)

- Expected revenue: S$200,000; let’s assume net chargeable income is ~S$50,000 (after wages, general expenses, and some R&D deduction).

- SUTE impact: 75% exemption on the first S$100,000 → effectively you’re under that threshold, so your tax might be minimal.

Even if the government reduces the top SUTE threshold in Budget 2025 (say from S$100,000 to S$80,000), your first-year profit may still fall under the new cap, so your effective tax rate remains low or near zero.

Scaling Up (Year 2 / YA 2026)

By Year 2, your startup hits meaningful revenue. This is often where SUTE truly matters because your profits may be substantial enough to generate a notable tax liability.

Mid-Year Fundraising & Shareholder Structure

Meet Potential New SUTE Criteria

Financial Management

Forecasting Revenues and Expenses

Apply R&D Deductions

Leverage SUTE

Outcome: You turn what could have been a S$51,000 tax bill (17% × 300,000) into S$8,500, saving over S$42,000.

By Year 2, your startup hits meaningful revenue. This is often where SUTE truly matters because your profits may be substantial enough to generate a notable tax liability.

Mid-Year Fundraising & Shareholder Structure

- Keep Founder’s ≥10% Stake

- If you plan a Series A round, structure it so at least one individual founder retains 10% or more. This maintains SUTE eligibility.

- Use preference shares or convertible notes for investors, ensuring you don’t dilute the founder below 10%.

Meet Potential New SUTE Criteria

- If Budget 2025 mandates local hires or “innovation activity” (R&D/IP) in Singapore, show evidence via payroll records and detailed R&D project logs.

Financial Management

Forecasting Revenues and Expenses

- Suppose you project S$600,000 in net revenue. Expenses are S$300,000, leaving S$300,000 in potential chargeable income.

Apply R&D Deductions

- Let’s assume EIS-qualifying R&D expenses total S$50,000. If the scheme grants a 300% deduction, that’s S$150,000 effectively offset from your chargeable income.

- New chargeable income = S$300,000 – S$150,000 = S$150,000.

Leverage SUTE

- 75% exemption on first S$100,000 → S$75,000 exempt.

- 50% exemption on next S$50,000 → S$25,000 exempt.

- Total exemption = S$100,000.

- Final taxable income = S$50,000; tax at 17% = S$8,500.

Outcome: You turn what could have been a S$51,000 tax bill (17% × 300,000) into S$8,500, saving over S$42,000.

Maturing into Year 3 (YA 2027)

Now your company is in its third SUTE year, which often sees the largest revenue jump. Let’s assume you forecast:

Optimize R&D Timing

Front-Load Big R&D

Remainder of Chargeable Income

Without front-loading R&D or utilizing SUTE effectively, your bill might have been 17% × 700,000 = S$119,000. That’s a S$90,000 difference.

Potential Budget 2025 Adjustments

Now your company is in its third SUTE year, which often sees the largest revenue jump. Let’s assume you forecast:

- Revenue: S$1.2 million

- Operational expenses (including salaries): S$500,000

- Potential chargeable income: S$700,000 (before further deductions)

Optimize R&D Timing

Front-Load Big R&D

- If you have significant product upgrades, time them so that key R&D costs fall into Year 3 while SUTE is still in effect.

- If your R&D qualifies for 400% EIS deductions (best-case scenario), and you invest S$100,000 in such R&D, that’s S$400,000 deducted.

Remainder of Chargeable Income

- S$700,000 – S$400,000 = S$300,000.

- SUTE: 75% of first S$100,000 + 50% of next S$100,000 → Maximum S$125,000 exempt (assuming the original thresholds still apply or remain similar).

- Final taxable income = S$300,000 – S$125,000 = S$175,000.

- Tax at 17% = S$29,750.

Without front-loading R&D or utilizing SUTE effectively, your bill might have been 17% × 700,000 = S$119,000. That’s a S$90,000 difference.

Potential Budget 2025 Adjustments

- If the new Budget 2025 lowers the S$100,000 limit or modifies percentages, you might see a smaller SUTE benefit—say it’s cut by 20–25%. You’d still reduce your taxable income significantly with proper R&D planning and well-documented innovation expenditures.

- Confirm that you continue to meet local hiring or substance criteria, should those be enforced more strictly.

Post-SUTE Phase (Year 4 and Beyond)

After three consecutive YAs, SUTE no longer applies, and you transition to Partial Tax Exemption (PTE). Key steps:

Plan for a Higher Tax Baseline

Seek Sector-Specific Grants

Track Pillar Two

Common Pitfalls and How to Avoid Them

Losing the 10% Founder Stake

Insufficient R&D Documentation

Ignoring Budget Announcements

Late Filing or Non-Compliance

After three consecutive YAs, SUTE no longer applies, and you transition to Partial Tax Exemption (PTE). Key steps:

Plan for a Higher Tax Baseline

- PTE offers 75% exemption on the first S$10,000 and 50% on the next S$190,000. Maximum total exemption ~ S$102,500.

- If your revenue keeps growing, your effective tax might rise. So continuing R&D or IP investments under the EIS can keep your chargeable income in check.

Seek Sector-Specific Grants

- By Year 4, you may qualify for more advanced funding (e.g., EDB incentives) if you’re scaling regionally or engaging in deeper innovation.

Track Pillar Two

- If your startup eventually joins a large global group exceeding 750 million euros in revenue, the Domestic Top-up Tax might come into play, ensuring a 15% minimum. For smaller local startups, direct Pillar Two effects remain minimal, but the government’s push for compliance could still reshape some broad-based incentives.

Common Pitfalls and How to Avoid Them

Losing the 10% Founder Stake

- Dilution below 10% shareholding can disqualify you from SUTE. Use convertible notes or other equity instruments to maintain founder control.

Insufficient R&D Documentation

- EIS and other R&D incentives require detailed paperwork (project scope, technical objectives, cost breakdowns). Without proper documentation, IRAS may disallow your claims.

Ignoring Budget Announcements

- Tax rules can shift quickly if new measures are introduced. Stay up to date with Budget 2025 details to adapt your expense or hiring plan accordingly.

Late Filing or Non-Compliance

- Missing IRAS deadlines for Form C-S/C or failing to submit required forms on time can incur penalties—effectively erasing your tax savings.

Tailoring Your Strategy for 2025 and Beyond

In 2025, Singapore’s Start-Up Tax Exemption (SUTE) and Partial Tax Exemption (PTE) remain critical pillars for reducing a startup’s effective tax rate—if you plan carefully. Yet, pending Budget 2025 changes may tighten thresholds or introduce new operational criteria, making strategic alignment all the more essential. Meanwhile, the Enterprise Innovation Scheme (EIS) can drastically reduce chargeable income through R&D spending, and the global minimum tax (Pillar Two) could become relevant for those connected to larger MNE groups.

By following a stepwise approach—focusing on structuring, timing of expenditures, R&D documentation, and founder shareholding—entrepreneurs can maximize current incentives and pivot quickly if 2025 reforms alter the SUTE or PTE landscape. The key is vigilance, proper record-keeping, and staying informed about any mid-year or annual budget announcements that could shift the playing field.

NB! The information provided in this article is for general informational purposes only and does not constitute legal advice. While we strive to ensure the content is accurate and up-to-date, it should not be relied upon as a substitute for professional consultation. For personalized advice or assistance with legal matters, please contact our specialists directly.

In 2025, Singapore’s Start-Up Tax Exemption (SUTE) and Partial Tax Exemption (PTE) remain critical pillars for reducing a startup’s effective tax rate—if you plan carefully. Yet, pending Budget 2025 changes may tighten thresholds or introduce new operational criteria, making strategic alignment all the more essential. Meanwhile, the Enterprise Innovation Scheme (EIS) can drastically reduce chargeable income through R&D spending, and the global minimum tax (Pillar Two) could become relevant for those connected to larger MNE groups.

By following a stepwise approach—focusing on structuring, timing of expenditures, R&D documentation, and founder shareholding—entrepreneurs can maximize current incentives and pivot quickly if 2025 reforms alter the SUTE or PTE landscape. The key is vigilance, proper record-keeping, and staying informed about any mid-year or annual budget announcements that could shift the playing field.

NB! The information provided in this article is for general informational purposes only and does not constitute legal advice. While we strive to ensure the content is accurate and up-to-date, it should not be relied upon as a substitute for professional consultation. For personalized advice or assistance with legal matters, please contact our specialists directly.

How We Can Help

Our team of experts is here to provide tailored support to help you adapt to the evolving landscape in 2025. Here’s how we can assist:

Our team of experts is here to provide tailored support to help you adapt to the evolving landscape in 2025. Here’s how we can assist:

- Tax Advisory Services: Guidance on BEPS 2.0 compliance, tax optimization, and maximizing benefits from the Refundable Investment Credit (RIC).

- Legal and Employment Consulting: Assistance with adapting to Workplace Fairness Legislation and updated Employment Pass criteria.

- Property Tax Planning: Support in understanding and applying the 2025 Property Tax Rebate and revised Annual Value (AV) bands.

- Custom Solutions: Tailored strategies to address sector-specific challenges and opportunities, from arbitration to sustainability initiatives.