Data centres, renewable energy, and fintech are expected to be key growth areas in Singapore. The year 2025 marks a clear shift from “business‑friendly” to actively “business‑enabling” for Singapore’s technology founders. At the fiscal level, Budget 2025 introduces a one‑off 50 percent Corporate Income Tax rebate—capped at SGD 40,000—alongside an automatic SGD 2,000 cash grant for every active company that employed at least one local worker in 2024. For early‑stage ventures these measures reduce burn‑rate immediately, freeing capital for product development instead of tax outflows.

For tech companies, the city-state’s emphasis on innovation, research, and development makes it an ideal base. However, to fully benefit from Singapore’s pro-business policies, it is critical to understand the specific accounting and tax obligations that apply to tech-oriented enterprises.

1. Regulatory Environment

The Companies Act (Cap. 50) governs the incorporation and ongoing compliance requirements for businesses in Singapore. All companies, including those in technology sectors, must register with the Accounting and Corporate Regulatory Authority (ACRA) and adhere to statutory obligations for record-keeping and reporting.

Tech companies may also need to consider additional regulations if they engage in specialized services such as payment processing, digital lending, or financial technology. In such cases, regulations from the Monetary Authority of Singapore (MAS) may apply, particularly the Payment Services Act for companies operating in the payments and fintech space. Compliance involves proper licensing, data protection measures, and anti-money-laundering controls.

2. Accounting Standards and Financial Reporting

Companies in Singapore are required to prepare financial statements that comply with Singapore Financial Reporting Standards (SFRS), which are closely aligned with International Financial Reporting Standards (IFRS). This high degree of convergence simplifies international expansion and cross-border investments for tech companies.

Tech firms that engage in complex revenue models—such as subscription-based services, multi-element arrangements, or software-as-a-service (SaaS)—often face challenges in revenue recognition. Under SFRS (which mirrors IFRS 15), revenue must be allocated to various performance obligations in a contract and recognized when control of goods or services passes to the customer. Accurate and timely record-keeping of these transactions is essential to meet SFRS disclosure requirements.

In addition to preparing compliant financial statements, most companies must file annual returns with ACRA through its BizFile+ portal. For financial periods beginning on or after January 1, 2025, companies filing with ACRA may also be required to submit financial statements in XBRL (eXtensible Business Reporting Language) format if they do not qualify for certain exemptions.

3. Corporate Taxation

Singapore’s headline corporate income tax (CIT) rate remains at 17% in 2025. While this is a flat rate on taxable income, several exemptions and incentives can reduce the effective tax rate for qualifying tech companies.

3.1 Partial Tax Exemption

Under the partial tax exemption scheme, the first SGD 10,000 of a company’s normal chargeable income can enjoy a 75% exemption, while the next SGD 190,000 can receive a 50% exemption. This scheme benefits startups and smaller tech businesses aiming to conserve cash for reinvestment.

3.2 Start-Up Tax Exemption (SUTE) Scheme

Early-stage tech companies may qualify for the Start-Up Tax Exemption scheme during their first three years of assessment. Although the precise exemptions have been adjusted over time, the scheme generally grants substantial relief on the first SGD 200,000 to SGD 300,000 of chargeable income. To qualify, companies must not have more than 20 individual shareholders, and at least one shareholder must hold a minimum of 10% of the issued shares.

3.3 Research and Development Deductions

The Singapore government continues to support innovation through enhanced deductions or allowances for qualifying R&D expenditures. These can include staff costs, direct R&D expenses, and certain intellectual property (IP) costs. For tech companies developing proprietary software, hardware, or AI-based solutions, these allowances help offset the high costs of innovation.

3.4 Transfer Pricing

For multinational tech companies with cross-border intercompany transactions, Singapore’s transfer pricing guidelines require documentation to prove that transactions between related parties meet the arm’s length principle. Failure to maintain robust transfer pricing documentation can lead to adjustments and penalties by the Inland Revenue Authority of Singapore (IRAS).

4. Goods and Services Tax (GST)

Starting in January 2024, Singapore increased its GST rate from 8% to 9%. By 2025, this 9% GST rate applies to most goods and services, including digital services provided by local and foreign tech firms. Businesses with an annual taxable turnover exceeding SGD 1 million are required to register for GST and file quarterly returns.

Tech companies often operate digital platforms or subscription models that span multiple jurisdictions. In 2025, the Overseas Vendor Registration regime remains in effect, requiring foreign providers of digital services to register and remit GST for supplies to Singapore consumers if their annual global turnover and sales to Singapore exceed specified thresholds. Ensuring proper invoicing and record-keeping is crucial to maintain compliance and avoid penalties.

5. Audit and Compliance Requirements

Under current rules, a Singapore-incorporated company is exempt from statutory audit if it qualifies as a “small company” by meeting any two of the following criteria for the immediate past two financial years:

1. Annual revenue not exceeding SGD 10 million

2. Total assets not exceeding SGD 10 million

3. Number of employees not exceeding 50

Tech startups that remain under these thresholds can often benefit from reduced compliance costs. However, companies part of larger corporate groups or those exceeding these limits will be subject to statutory audits under the Companies Act. Statutory auditors will verify financial statements for accuracy, ensuring that they comply with SFRS and accurately reflect the company’s financial position.

6. Specific Considerations for Tech Companies

In Singapore’s technology ecosystem, certain accounting treatments and government schemes merit special attention:

Licensing and Subscription Revenue

Software-as-a-service (SaaS), platform services, and licensing arrangements all introduce unique revenue recognition challenges under SFRS. Companies must carefully separate different performance obligations and recognize revenue only as each obligation is fulfilled.

Intellectual Property and Intangible Assets

R&D-intensive tech companies often develop valuable intellectual property (IP). Under SFRS, internally generated intangible assets can be capitalized only when certain criteria (technical feasibility, intent to sell or use, availability of resources, etc.) are met. Proper documentation of project costs and feasibility studies is essential to capitalize such expenses legitimately.

Government Grants and Incentives

Singapore offers grants like the Enterprise Development Grant (EDG) and the Productivity Solutions Grant (PSG) to support tech initiatives, process automation, and adoption of digital tools. These grants are subject to eligibility requirements and often demand detailed project planning and documentation to qualify.

7. Best Practices in Bookkeeping and Compliance

With complex revenue streams, cost structures, and rapid expansion, tech companies should prioritize well-designed bookkeeping systems. Timely and accurate financial data not only facilitates compliance but also helps business owners make informed strategic decisions.

Many startups in Singapore leverage cloud-based accounting software to streamline invoicing, expense tracking, and financial reporting. Integration with e-commerce and subscription management platforms further reduces manual workloads and the risk of errors. Because the government strongly encourages digitalization, adopting such solutions can also align a company with ongoing initiatives under the Smart Nation program.

8. Financing and Investment

Singapore’s tech‑funding engine has accelerated sharply in the run‑up to 2025.Statista forecasts that venture‑capital commitments will reach US $10.32 billion this year, more than double the 2020 trough and on track to eclipse the pre‑pandemic peak despite a cautious global environment. Early‑stage rounds still dominate—about US $5.65 billion of the total—but later‑stage cheques are returning as investors regain confidence in Southeast Asia’s exit pipeline.

Investor‑side tax relief remains generous. The Venture Capital Fund Incentive shields approved funds from tax on qualifying income, while the Section 13O and 13U fund‑exemption schemes have been extended until 31 December 2029 and refocused on substance requirements from 1 January 2025—assuring family offices and corporate venture arms that Singapore will stay a long‑term domicile for vehicles investing into local tech.

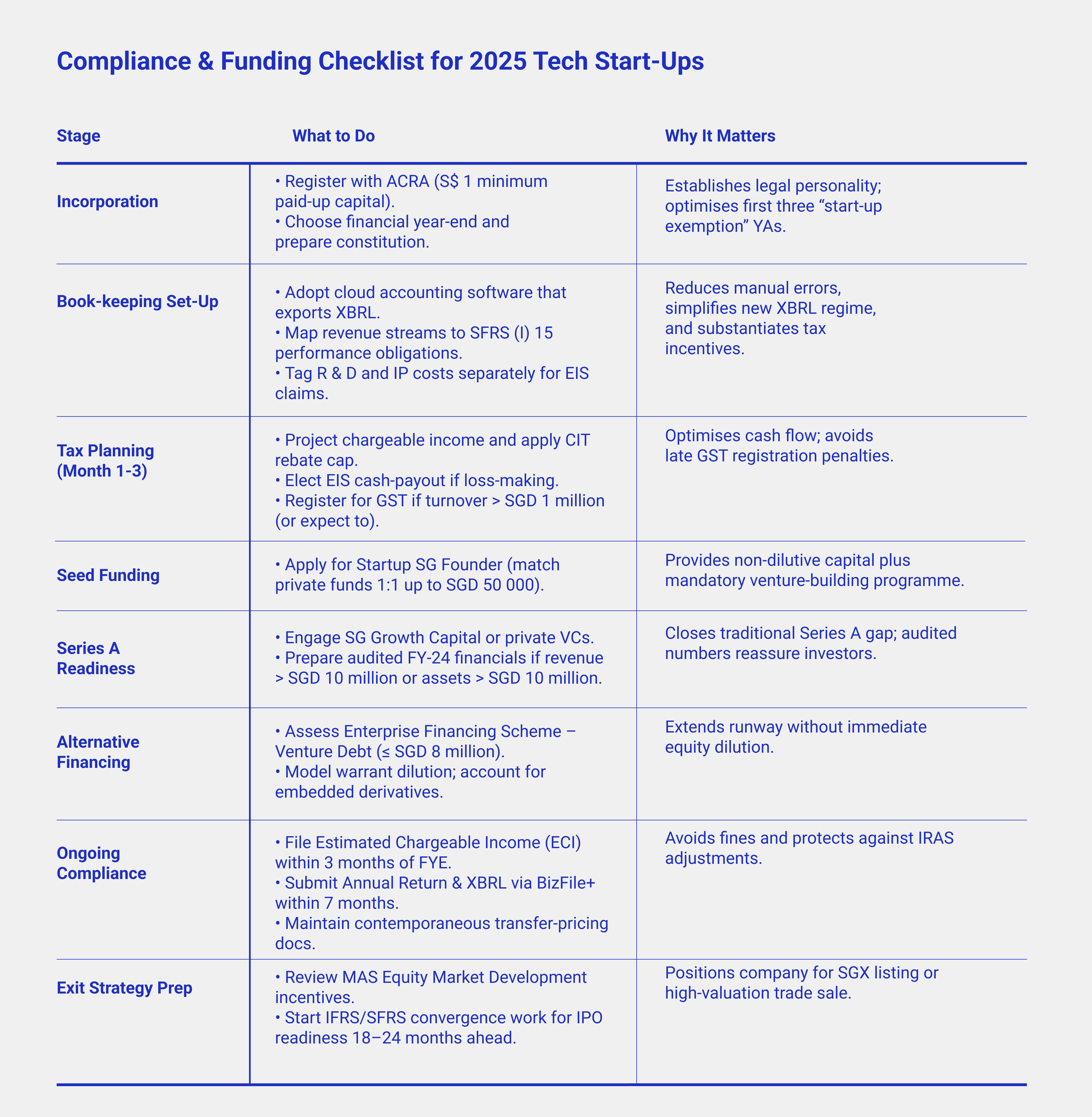

For a tech start‑up forming in 2025, a typical funding pathway now blends:

(1) founders’ S$1 paid‑up capital and personal loans;

(2) a Startup SG Founder grant matched with friends‑and‑family equity;

(3) a seed‑to‑Series A syndicate led or matched by SG Growth Capital;

(4) venture debt under EFS‑VD to extend runway without dilution;

(5) later‑stage private equity or pre‑IPO rounds that may ultimately list under SGX’s rejuvenated framework.

Each step carries distinct accounting treatments—from grant recognition under SFRS 15 to fair‑valuing warrants embedded in venture‑debt deals—so finance teams should map every instrument to the relevant section of the standards before term‑sheets are signed.

For tech companies, the city-state’s emphasis on innovation, research, and development makes it an ideal base. However, to fully benefit from Singapore’s pro-business policies, it is critical to understand the specific accounting and tax obligations that apply to tech-oriented enterprises.

1. Regulatory Environment

The Companies Act (Cap. 50) governs the incorporation and ongoing compliance requirements for businesses in Singapore. All companies, including those in technology sectors, must register with the Accounting and Corporate Regulatory Authority (ACRA) and adhere to statutory obligations for record-keeping and reporting.

Tech companies may also need to consider additional regulations if they engage in specialized services such as payment processing, digital lending, or financial technology. In such cases, regulations from the Monetary Authority of Singapore (MAS) may apply, particularly the Payment Services Act for companies operating in the payments and fintech space. Compliance involves proper licensing, data protection measures, and anti-money-laundering controls.

2. Accounting Standards and Financial Reporting

Companies in Singapore are required to prepare financial statements that comply with Singapore Financial Reporting Standards (SFRS), which are closely aligned with International Financial Reporting Standards (IFRS). This high degree of convergence simplifies international expansion and cross-border investments for tech companies.

Tech firms that engage in complex revenue models—such as subscription-based services, multi-element arrangements, or software-as-a-service (SaaS)—often face challenges in revenue recognition. Under SFRS (which mirrors IFRS 15), revenue must be allocated to various performance obligations in a contract and recognized when control of goods or services passes to the customer. Accurate and timely record-keeping of these transactions is essential to meet SFRS disclosure requirements.

In addition to preparing compliant financial statements, most companies must file annual returns with ACRA through its BizFile+ portal. For financial periods beginning on or after January 1, 2025, companies filing with ACRA may also be required to submit financial statements in XBRL (eXtensible Business Reporting Language) format if they do not qualify for certain exemptions.

3. Corporate Taxation

Singapore’s headline corporate income tax (CIT) rate remains at 17% in 2025. While this is a flat rate on taxable income, several exemptions and incentives can reduce the effective tax rate for qualifying tech companies.

3.1 Partial Tax Exemption

Under the partial tax exemption scheme, the first SGD 10,000 of a company’s normal chargeable income can enjoy a 75% exemption, while the next SGD 190,000 can receive a 50% exemption. This scheme benefits startups and smaller tech businesses aiming to conserve cash for reinvestment.

3.2 Start-Up Tax Exemption (SUTE) Scheme

Early-stage tech companies may qualify for the Start-Up Tax Exemption scheme during their first three years of assessment. Although the precise exemptions have been adjusted over time, the scheme generally grants substantial relief on the first SGD 200,000 to SGD 300,000 of chargeable income. To qualify, companies must not have more than 20 individual shareholders, and at least one shareholder must hold a minimum of 10% of the issued shares.

3.3 Research and Development Deductions

The Singapore government continues to support innovation through enhanced deductions or allowances for qualifying R&D expenditures. These can include staff costs, direct R&D expenses, and certain intellectual property (IP) costs. For tech companies developing proprietary software, hardware, or AI-based solutions, these allowances help offset the high costs of innovation.

3.4 Transfer Pricing

For multinational tech companies with cross-border intercompany transactions, Singapore’s transfer pricing guidelines require documentation to prove that transactions between related parties meet the arm’s length principle. Failure to maintain robust transfer pricing documentation can lead to adjustments and penalties by the Inland Revenue Authority of Singapore (IRAS).

4. Goods and Services Tax (GST)

Starting in January 2024, Singapore increased its GST rate from 8% to 9%. By 2025, this 9% GST rate applies to most goods and services, including digital services provided by local and foreign tech firms. Businesses with an annual taxable turnover exceeding SGD 1 million are required to register for GST and file quarterly returns.

Tech companies often operate digital platforms or subscription models that span multiple jurisdictions. In 2025, the Overseas Vendor Registration regime remains in effect, requiring foreign providers of digital services to register and remit GST for supplies to Singapore consumers if their annual global turnover and sales to Singapore exceed specified thresholds. Ensuring proper invoicing and record-keeping is crucial to maintain compliance and avoid penalties.

5. Audit and Compliance Requirements

Under current rules, a Singapore-incorporated company is exempt from statutory audit if it qualifies as a “small company” by meeting any two of the following criteria for the immediate past two financial years:

1. Annual revenue not exceeding SGD 10 million

2. Total assets not exceeding SGD 10 million

3. Number of employees not exceeding 50

Tech startups that remain under these thresholds can often benefit from reduced compliance costs. However, companies part of larger corporate groups or those exceeding these limits will be subject to statutory audits under the Companies Act. Statutory auditors will verify financial statements for accuracy, ensuring that they comply with SFRS and accurately reflect the company’s financial position.

6. Specific Considerations for Tech Companies

In Singapore’s technology ecosystem, certain accounting treatments and government schemes merit special attention:

Licensing and Subscription Revenue

Software-as-a-service (SaaS), platform services, and licensing arrangements all introduce unique revenue recognition challenges under SFRS. Companies must carefully separate different performance obligations and recognize revenue only as each obligation is fulfilled.

Intellectual Property and Intangible Assets

R&D-intensive tech companies often develop valuable intellectual property (IP). Under SFRS, internally generated intangible assets can be capitalized only when certain criteria (technical feasibility, intent to sell or use, availability of resources, etc.) are met. Proper documentation of project costs and feasibility studies is essential to capitalize such expenses legitimately.

Government Grants and Incentives

Singapore offers grants like the Enterprise Development Grant (EDG) and the Productivity Solutions Grant (PSG) to support tech initiatives, process automation, and adoption of digital tools. These grants are subject to eligibility requirements and often demand detailed project planning and documentation to qualify.

7. Best Practices in Bookkeeping and Compliance

With complex revenue streams, cost structures, and rapid expansion, tech companies should prioritize well-designed bookkeeping systems. Timely and accurate financial data not only facilitates compliance but also helps business owners make informed strategic decisions.

Many startups in Singapore leverage cloud-based accounting software to streamline invoicing, expense tracking, and financial reporting. Integration with e-commerce and subscription management platforms further reduces manual workloads and the risk of errors. Because the government strongly encourages digitalization, adopting such solutions can also align a company with ongoing initiatives under the Smart Nation program.

8. Financing and Investment

Singapore’s tech‑funding engine has accelerated sharply in the run‑up to 2025.Statista forecasts that venture‑capital commitments will reach US $10.32 billion this year, more than double the 2020 trough and on track to eclipse the pre‑pandemic peak despite a cautious global environment. Early‑stage rounds still dominate—about US $5.65 billion of the total—but later‑stage cheques are returning as investors regain confidence in Southeast Asia’s exit pipeline.

Investor‑side tax relief remains generous. The Venture Capital Fund Incentive shields approved funds from tax on qualifying income, while the Section 13O and 13U fund‑exemption schemes have been extended until 31 December 2029 and refocused on substance requirements from 1 January 2025—assuring family offices and corporate venture arms that Singapore will stay a long‑term domicile for vehicles investing into local tech.

For a tech start‑up forming in 2025, a typical funding pathway now blends:

(1) founders’ S$1 paid‑up capital and personal loans;

(2) a Startup SG Founder grant matched with friends‑and‑family equity;

(3) a seed‑to‑Series A syndicate led or matched by SG Growth Capital;

(4) venture debt under EFS‑VD to extend runway without dilution;

(5) later‑stage private equity or pre‑IPO rounds that may ultimately list under SGX’s rejuvenated framework.

Each step carries distinct accounting treatments—from grant recognition under SFRS 15 to fair‑valuing warrants embedded in venture‑debt deals—so finance teams should map every instrument to the relevant section of the standards before term‑sheets are signed.

FAQ

1. What is the new 50 % Corporate Income Tax (CIT) rebate and who gets it?

For Year of Assessment 2025 every company receives a one‑off 50 % rebate on its final CIT bill, capped at SGD 40 000. Loss‑making firms that employed at least one local worker in calendar‑year 2024 receive a separate cash grant of SGD 2 000 so they do not miss out on the benefit. Both the rebate and the cash grant are automatic—no extra form‑filling is required.

2. Does the rebate stack with the Partial Tax Exemption or Start‑Up Tax Exemption?

Yes. First compute chargeable income, then apply the Partial or Start‑Up Tax Exemption, then calculate the 17 % tax on the remaining chargeable income, and only after that apply the 50 % rebate to the resulting tax payable.

3. How do I convert R & D spending into cash under the Enterprise Innovation Scheme (EIS)?

Instead of the 400 % “super‑deduction” on the first SGD 400 000 of qualifying R & D, IP and training costs, loss‑making start‑ups may elect to receive up to SGD 100 000 as a non‑taxable cash‑payout at 20 % of expenditure. The election is irrevocable for that YA and must be lodged with the tax return.

4. What public funding is available at the pre‑seed / seed stage?

Startup SG Founder gives between SGD 20 000 and SGD 50 000 on a one‑for‑one matching basis. Since April 2024 a second, non‑first‑time founder may join the team without disqualifying the grant.

5. Who fills Singapore’s historical “Series A gap”?

From 1 April 2025 EDBI and SEEDS Capital merge into SG Growth Capital, an integrated state investor that can co‑lead Series A through early‑growth rounds—bridging the funding void between seed grants and institutional capital.

6. Can I raise venture debt instead of equity?

Yes. The Enterprise Financing Scheme – Venture Debt lets young tech firms borrow up to SGD 8 million, with Enterprise Singapore sharing up to 70 % of the risk with participating banks. Warrants or preference shares are common sweeteners and must be fair‑valued under SFRS (I) 9.

7. Have XBRL filing requirements changed?

For financial periods beginning on or after 1 January 2025 the Full XBRL template shrinks from ~400 to ~210 data elements, and a Simplified template (~120 elements) is now available for smaller companies—cutting compliance time by roughly half.

8. What exit options are improving?

MAS is launching a SGD 5 billion Equity Market Development Programme and complementary tax incentives to deepen liquidity on the SGX, alongside a separate Temasek‑backed S$4 billion injection. The goal is to make domestic IPOs a realistic end‑game for high‑growth start‑ups.

9. How should SAFEs or convertible notes be presented in the accounts?

Under SFRS (I) 9 most SAFEs are treated as equity (or a compound instrument) rather than pure debt, because settlement is ordinarily in shares—not cash. This classification affects leverage ratios and may influence covenant calculations on venture‑debt lines.

10. Do the new incentives alter my transfer‑pricing or GST obligations?

No. All related‑party transactions must still be documented at arm’s‑length, and the 9 % GST rate introduced in 2024 continues to apply to digital‑service revenue once annual taxable supplies exceed SGD 1 million.

NB! The information provided in this article is for general informational purposes only and does not constitute legal advice. While we strive to ensure the content is accurate and up-to-date, it should not be relied upon as a substitute for professional consultation. For personalized advice or assistance with legal matters, please contact our specialists directly. All fees in the article are indicative and subject to change by regulators. Additional costs for documentation, legal, or advisory services are not included.

How we can help:

Company Incorporation & Business Setup – We assist businesses with company registration, structuring, and licensing in Singapore, ensuring full compliance with ACRA and MAS regulations.

Corporate Tax & Compliance Advisory – We help businesses leverage corporate income tax rebates, deductions, and incentive schemes, ensuring tax efficiency and compliance

Regulatory & Licensing Assistance – We guide businesses through the process of obtaining sector-specific licenses and ensuring compliance with MAS, IRAS, and other regulatory bodies, minimizing operational risks.

Enterprise Financing & Grant Support – We help businesses access Enterprise Financing Scheme (EFS), Private Credit Growth Fund, and SkillsFuture grants, aligning funding opportunities with business growth strategies.

Company Incorporation & Business Setup – We assist businesses with company registration, structuring, and licensing in Singapore, ensuring full compliance with ACRA and MAS regulations.

Corporate Tax & Compliance Advisory – We help businesses leverage corporate income tax rebates, deductions, and incentive schemes, ensuring tax efficiency and compliance

Regulatory & Licensing Assistance – We guide businesses through the process of obtaining sector-specific licenses and ensuring compliance with MAS, IRAS, and other regulatory bodies, minimizing operational risks.

Enterprise Financing & Grant Support – We help businesses access Enterprise Financing Scheme (EFS), Private Credit Growth Fund, and SkillsFuture grants, aligning funding opportunities with business growth strategies.